by

Elizabeth Moran | Nov 07, 2012

Barclays has had a tough couple of months; the Bank acknowledged its involvement in a LIBOR scandal and was fined US$450m by US and UK regulators. The Bank also revealed the US Federal Energy Regulatory Commission could be close to fining it over the manipulation of power prices in the west US between 2006 and 2008. Moreover, Barclays is under investigation by UK’s financial regulator over the payments to Qatari investors after it raised billions from the country five years ago and Barclays’ profits were hit by the ongoing provisions for mis-selling payment protection insurance (PPI). It might take a lot of effort from the new CEO Anthony Jenkins to return the Bank its former credibility with stakeholders and the market.

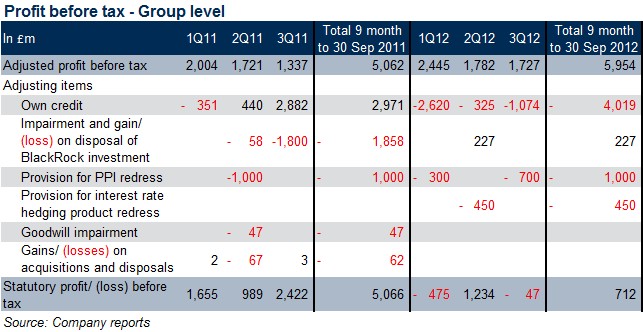

Like the other UK banks, Barclays’ reports its results in two formats: statutory and adjusted. Adjusted profit before tax incorporates a number of one-off adjusting items. Therefore, the statutory result is achieved after stripping all those items from adjusted results (Table 1). Adjusted profit before tax was up 30% to £1.7bn from £1.3bn in 3Q11, and up 18% to almost £6.0bn for the nine month from £5.1bn a year earlier. At the same time, due to two major extraordinary items (provisions for PPIs and loss on fair value of own debt due to tightening spreads), statutory loss before tax for 3Q12 was £47m, significantly down, compared to £1.2bn in 2Q12 and £2.4bn in 3Q11. For nine months to 30 September, statutory profit was also down 86% to £712m compared to £5.0bn in September 2011.

Table 1

Key points to note from the results:

- The Core Tier 1 ratio increased 0.3% to 11.2% from 10.9% in 2Q12. The estimated transitional Basel III Common Equity Tier 1 ratio as at 1 January 2013 will stand at 9.1% and fully loaded ratio will be 8.2%

- Credit impairment charges were down 22% to £825m in 3Q12 versus £1.1bn in 2Q12 and down 19% versus £1.0bn in 3Q11. In 9M12, charges were also down 7% to £2.7bn, compared to £2.9bn in 9M11, reflecting improvements in UK RBB (Retail and Business Banking), Barclaycard and Corporate Banking, but offset by high charges in Investment Banking over 2Q12 as well as Europe and Africa RBB. However, management indicated that while short term volatility may persist in Africa, they continue being optimistic about the region going forward. For European RBB, management indicated that the main strategy at this point is mitigation of both redenomination risk and credit risk. Looking forward they are reviewing 80 different lines of business in the region and will be able to give more detail in February

- The liquidity pool stood £160bn, down from £170bn in 2Q12. The liquidity portfolio was also realigned, moving funds from deposits with central banks into government bonds (75% in high quality European and US securities)

- Wholesale funding outstanding stood at £253bn with £113bn maturing within 12 months and £39bn within one month, however Barclays met its term funding needs for 2012

- On the balance sheet, the loan to deposit ratio was 104%, gradually improving from 106% in 2Q12 and 111% in 4Q11

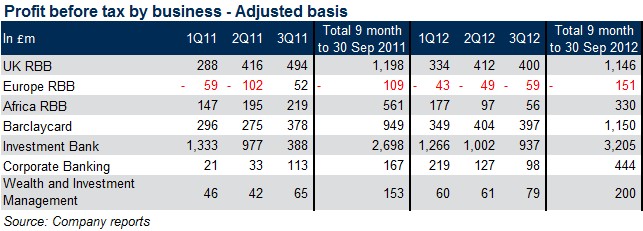

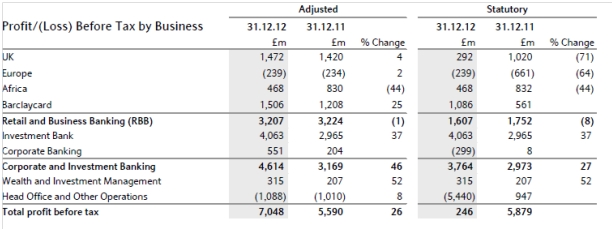

- Trends in most business divisions were somewhat stable (see Table 2 summary results), with the exception of struggling European (a large part is mortgage lending in Spain and Italy) and African operations

- At the start of October, Barclays agreed to buy the mortgage book (£5.6bn as at 31 August 2012) and deposit book (£10.9bn) from ING Direct UK, ING’s online and internet bank. The mortgage book was acquired at 3% discount and deposit book was acquired at par. Completion is expected to occur in 2Q13

- Sovereign exposures to PIIGS reduced by 15% to £4.8bn, compared to £5.6bn at the end of 2Q12. In addition, Barclays continued to mitigate its funding mismatches through attracting corporate deposits in Spain and reducing corporate lending in Spain and Portugal. Mismatches in Spain had been greatly reduced to £0.1bn from £2.5bn

- Adjusted return on equity was 8.8% ( 5.8% 2H11)

- Although statutory pre tax profit fell steeply, revenues have held up well, while costs have been falling and impairments have been steady or falling

Table 2

Barclays announced that it may soon sell contingent capital securities (CoCos) - bonds that convert to equity if capital falls to a predefined level. The Bank said it has made progress with Financial Services Authority (FSA) over regulatory treatment of the instrument, and indicated that one of the reasons they find CoCos attractive is the ability to retire or exchange out of some legacy hybrids. Existing issuers of CoCos include Credit Suisse, three Irish banks, Lloyds TSB Bank, Newcastle Building Society and Rabobank.

Finally, management indicated that the Investment Banking arm may be significantly cut back, with investors seeking an improved return on equity above the cost of capital. In addition, ring-fencing, bail-ins and further regulatory investigations pose longer term uncertainty.

Barclays bonds

Prices are accurate as at 6 November 2012, are a guide only and subject to market availability. FIIG does not make a market in these securities.