Two regional banks have announced new hybrid securities this week following in the footsteps of the CBA Perls VI. These securities are “new” style hybrids that are equity-like and meet the Basel III regulatory requirements and are similar in structure to the Perls VI. Bendigo and Adelaide Bank announced on Monday that they are looking to raise $125m+ of convertible preference shares (CPS) that will include a rollover offer to reset preference share holders (BENPA) and a general offer. Suncorp followed on Tuesday announcing plans to raise $350m+ via a convertible preference share (CPS2). Investors need to be aware that both these securities contain regulatory trigger events that increase the equity-like nature of these hybrids and assess whether the return is adequate for the risk involved. Investors should expect the Bendigo and Suncorp to upsize if the volume is there.

For a discussion on the new regulatory regime that APRA is implementing as part of the Basel III please refer to our recent article on the CBA Perls VI (click here to read “Perls VI – The newest regulatory hybrid”).

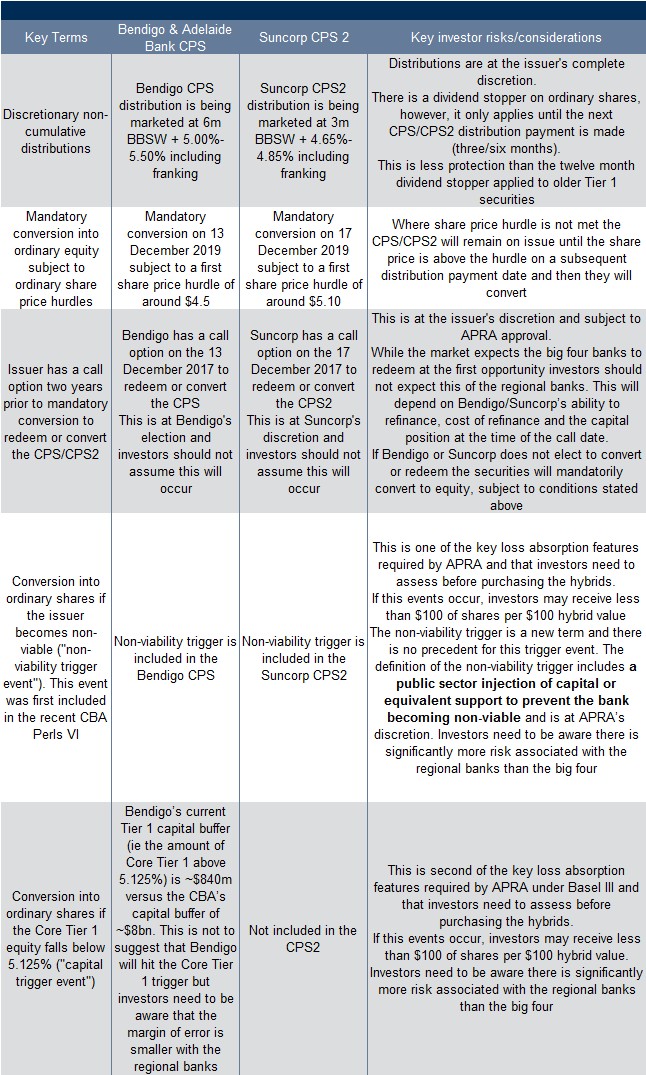

The table below outlines the key terms of the Bendigo and Suncorp offers:

Source: Bendigo and Adelaide prospectus and Suncorp prospectus

Investors need to consider the additional risks associated with owning these new hybrid Tier 1 securities as they have increased loss absorption features and are one rung above equity in the capital structure, but importantly will convert to equity if the capital trigger is breached or the entity deemed “non-viable”. Investors take all the downside risk without the upside of growing dividend payments and higher share prices, so need to be comfortable with the underlying credit and the strength of the capital base of the issuer. There is a difference between the regional banks and insurers and the big four and while there may be no current expectation of Bendigo or Suncorp experiencing financial difficulties investors need to be comfortable with the equity-like structure of the hybrid.

The next question investors should ask is “Am I being paid enough for the risk?” In FIIG’s opinion the answer is that both of these issues look skinny. The over-the-counter (OTC) market has several securities that provide significantly better value in terms of risk reward for investors. Suncorp has a £ Lower Tier 2 (LT2) issue with 6.2% coupon and a call date on 13 June 2017 that is currently trading at the equivalent of A$ swap + 7.5%. That is an additional 2.8% for a superior security as the LT2 ranks above T1 in the capital structure and provides investors with cumulative coupons and fixed final maturity. While investors may not be able to invest in £ it provides an indication of the where the institutional and wholesale market would price the Suncorp credit. In contrast, the 6.75% Vero LT2 securities with a call on the 6 October 2016 are trading at swap + 2.60%, however, these have a higher credit rating that Suncorp (retail report, wholesale report). For A$ investors, the more debt-like old-style Tier 1 step-up security, the NAB Caps, that are trading in the secondary market at swap + 3.7% are offering a better risk return.

For more information about Suncorp £ LT2 or NAB Caps, please call your local dealer.