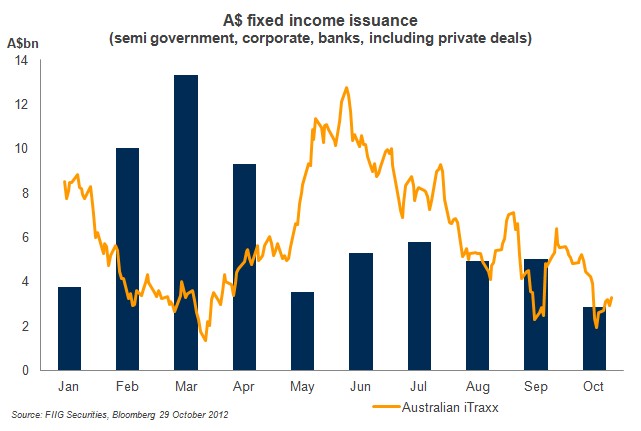

With the majority of issuance in the 1H12, the start of the 2H12 and 3Q12 was slow. According to Bloomberg data, a total of A$64bn of debt was issued domestically, excluding Australian government placements. July recorded the highest issuance in 3Q12, with August and September just marginally lower (see Figure 1).

Figure 1

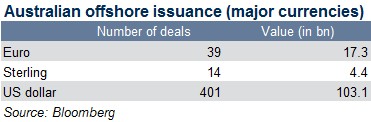

While the domestic A$ issuance was somewhat subdued, Australian financial institutions and corporations continued to be active in offshore markets. The US$ issuance of Australian institutions was impressive, with around 401 deals placed this year worth US$103bn and US$48bn since July 2012 alone (see Table 1).

Table 1

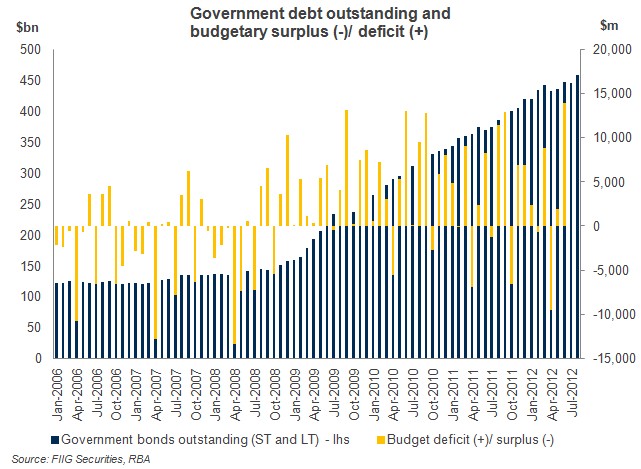

Australian government issuance

Figure 2 below shows Australian government issuance. The dark blue columns depict government bond issuance since the onset of the GFC, while the orange columns illustrate budget surplus (-) and deficit (+) for the same period. Interestingly, government debt issuance saw a dramatic increase since around mid-2009. As RBA data from January 2006 to April 2009 shows the debt outstanding increased by 59% from A$122bn to A$194bn, while from May 2009 to July 2012 it surged by a whopping 123% from A$206bn to A$458bn. This can be characterised by a sustained period of budget surpluses in the years prior to 2009, which enabled government to keep debt at lower levels but maintain a liquid and efficient government bond market. However, at the onset of the GFC, the task has shifted from one of supporting the market to funding budgetary deficits, thus issuance increased dramatically.

However, in future years, the structure of the Australian government bond market is set to shift again, as the government forecasts to move aggressively to a budget surplus. While, the current Budget indicates that net government debt is forecast to peak in 2011-12, net debt is then expected to reduce by 5.8% of GDP in 2014-15. This would require Commonwealth government securities (CGS) on issue to reduce to “around 12 to 14% of GDP over time”.

Figure 2

Government issuance is set to shrink over the coming years and coupled with overall slow domestic corporate issuance, means we anticipate Australia’s bond market will remain small by global standards (for example according to The Securities Industry and Financial Markets Association in eight months to August, the US bond market sold US$856bn of new corporate debt). This issue was addressed last week during the Australian Securitisation Forum and published in Deloitte’s “Domestic fixed income assets” report. The paper suggested that the Australian bond market is currently in “low equilibrium”, meaning that the value of corporate debt relative to GDP is low and the allocation by pension funds to fixed income assets is also very low (see also Dr Nash’s article “Can Australia’s love affair with risk last?”)

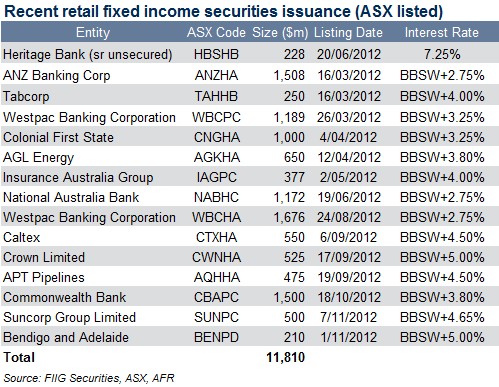

Finally, 3Q12 can be characterised by the flurry of ASX listed, hybrid issuance, highlighted by increased demand from borrowers for higher yielding securities as cash rates declined, despite ASIC warning about the complexity of those issues (see “ASIC warning on dangerous hybrid offers”). For the four months till October 2012 the ASX listed hybrid market issued 46% (A$5.4bn) of the total A$11bn issued since the start of the year (see Table 2).

Table 2

Over the past seven days there were five A$ issues. Inter-American Development Bank priced a new three year Kangaroo on 24 October; Bendigo and Adelaide bank also priced a three year domestic senior unsecured line; JP Morgan issued a five year dual tranche Kangaroo; Investa Office Fund placed its debut issue in the domestic market on 26 October and Asian Development Bank launched a new four year Kangaroo. For full details, please click on the New issues section on the right of the WIRE email.