by

Dr Stephen J Nash | Nov 07, 2012

Over the last few weeks, the reporting season for US equities has proven disappointing, and we have been suggesting that clients consider increasing asset allocation to bonds for some time. In this context, we review some recent developments in the US equity market, which point to continued concerns and risk. Accordingly, we then propose a portfolio that suits the current environment.

US reporting season

It has been a tough few weeks in US equities, with the reporting season generally failing to meet expectations. While this tendency has been evident in the US and Australian markets broadly, the change in momentum that is emanating from lower than expected earnings, is evident in the glamour stock of US equities, Apple (AAPL). As the enclosed chart shows, AAPL has now closed under the generally accepted momentum indicator, the 200 day moving average of its share price, meaning the average share price for the last 200 trading days. While there have been some dramatic recoveries in the AAPL share price in prior occasions, the move below the 200 Day moving average is generally seen as a negative indicator of share price momentum. If the bull market continues, then APPL may recover, yet the current position is somewhat difficult, and the direction of recent trading is quite negative.

Figure 1

Apart from earnings, the US equity market is also concerned about the forthcoming “fiscal cliff”, which refers to a large cut in US government spending, which might push the US back into recession. Some estimates of the effects of the fiscal cliff are large, in the order of a $103bn cut to spending and a $399bn increase to government revenue (1). As the Congressional Budget Office indicate, the fiscal cliff has the potential to slow the emerging US recovery;

To keep deficits and debt from climbing to unsustainable levels, policymakers will need to increase revenues substantially as a percentage of GDP, decrease spending significantly from projected levels, or adopt some combination of those two approaches. Making such changes while economic activity and employment remain well below their potential levels would probably slow the economic recovery (CBO’s 2011 Long-Term Budget Outlook, Congressional Budget Office, p.XII).

Still another risk is the possible reaction of US equity markets to a re-election of President Obama, where the US equity market may react negatively to another Democratic president, and the dismal prospect of another gridlocked senate and house. While a resolution of the fiscal cliff, or avoidance of the forthcoming fiscal contraction is likely, the market will become increasingly concerned at the issue as we approach year end. Also, the ever-present issue of European economic contraction is bearing down on earnings expectations. In other words, the following is a concern to US equities, and, as a result Australian equities:

- European recession reducing global growth expectations, with sovereign debt concerns and possible restructurings continually on the agenda

- Earnings coming under optimistic expectations

- US fiscal cliff and the possible recessionary impact of a large cut in US government spending

- Another deadlocked house-senate with another “lame duck” President

A smarter asset allocation

Given these risks, we think it’s better to have a higher bond allocation at this point.

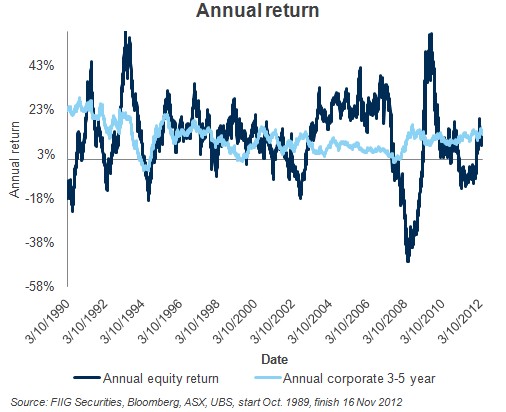

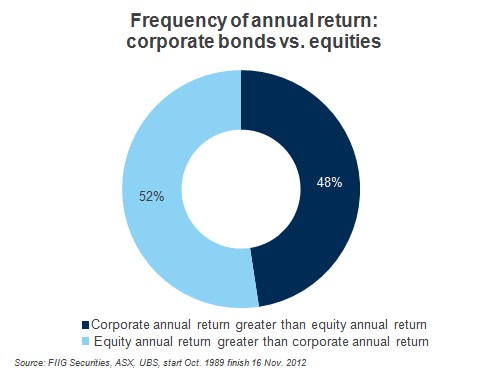

We would suggest a 75% allocation to bonds and 25% to equities as the volatility in returns of bonds is much lower than equities as shown in Figure 2. Crucially, one does not have to forego substantial return, when switching from an equity biased allocation to a bond biased allocation (2). We would argue that an alternative allocation, where substantially more bonds are allocated, can cut portfolio risk in half, while taking only a few basis points from return.

Figure 2 shows the average return and the possible range of portfolio returns, where one standard deviation is added and subtracted from the average return for the portfolio. Generally, a range of one standard deviation, either side of the average will describe the majority of occurrences that can be expected in the distribution of possible outcomes assuming a normal distribution of outcomes. More extreme occurrences can occur, yet the below analysis tells us where most occurrences exist, and Figure 2 gives us a guide of what to expect in terms of portfolio return.

Figure 2

Notice the range of possible outcomes with the 75% equity portfolio is double that of the 75% bond portfolio. Also notice how the 75% equity portfolio can enter the negative return area even in the normal course of events, while that is not the case with the 75% bond portfolio. Logically, one would find such a portfolio not acceptable in the current context, where so many risks can ignite a savage “risk-off” response by equity markets. Hence, we would argue that the 75% bond portfolio is “smarter” as it has a positive return without taking too much risk, and allows investors to allocate back to equities when they are oversold. In the current highly risky context, such an approach makes a lot of sense.

Conclusion

There are many risks that are of a concern regarding US financial market pricing, especially US equity markets, and the good news is that a bond biased portfolio will increase the certainty of return while cutting risk, and allow you to sleep at night. Bonds like Sydney Airport 2030 inflation linked bond offers returns around 7% if you assume an inflation rate of around 2.50%.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.