by

Elizabeth Moran | Aug 20, 2013

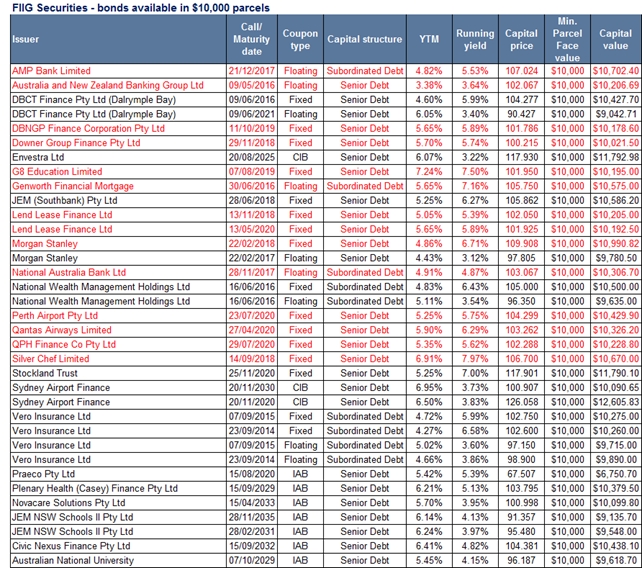

In an effort to allow greater access to the wholesale over-the-counter bond market FIIG has made 35 bonds available in $10,000 parcels. A total of 21 bonds are available to both retail and wholesale investors, while there’s an additional 14 bonds available to wholesale investors only (see Table 1). New investors will need to invest a minimum $50,000 which could be made up of five $10,000 bonds, or split in other configurations, for example one $30,000 bond and one $20,000 bond as long as the minimum $10,000 per investment is satisfied.

The availability of these bonds in smaller parcels also provides liquidity to existing holders of the bonds. For example, if you own $50,000 of the Dalrymple Bay Coal Terminal 2016 fixed rate bond and needed some liquidity, you could now sell down the bond in $10,000 parcels instead of selling the complete holding.

For more information, please contact your local FIIG Representative on 1800 01 01 81

Notes:

Prices are as at 19 August 2013 in A$ and subject to change. The prices of these securities are provided by FIIG based upon available prices sourced from leading market makers and data services as well as any available market information. Prices are indicative only and there is no guarantee as to their accuracy and may not necessarily represent the market price or a price at which FIIG or any other party will buy or sell the securities.

Black = retail and wholesale investors, red = wholesale only

CIB - Capital indexed bond these are linked to inflation. FIIG assumes CPI of 2.5% per annum (the mid point of the RBA inflation target)

IAB - Indexed annuity bond, also indexed to inflation. FIIG assumes CPI of 2.5% per annum (the mid point of the RBA inflation target)

YTM - Yield to maturity incorporates any capital gain or loss at maturity or first call plus interest payments, using the pricing provided

Running yield - estimated interest income for the bond based on the above prices

Source: FIIG Securities Limited