Bank of Queensland (BoQ) has become the first Australian bank to opt not to redeem an issue of preference shares on the first optional call date. PEPS holders have been given the option of reinvesting in a new issue of convertible preference shares (CPS) or continuing to hold the PEPS. The CPS are “new style” Basel III compliant securities of similar structure to the recently issued listed hybrids from other Australian banks (i.e. BENPD, SUNPC and CBAPC).

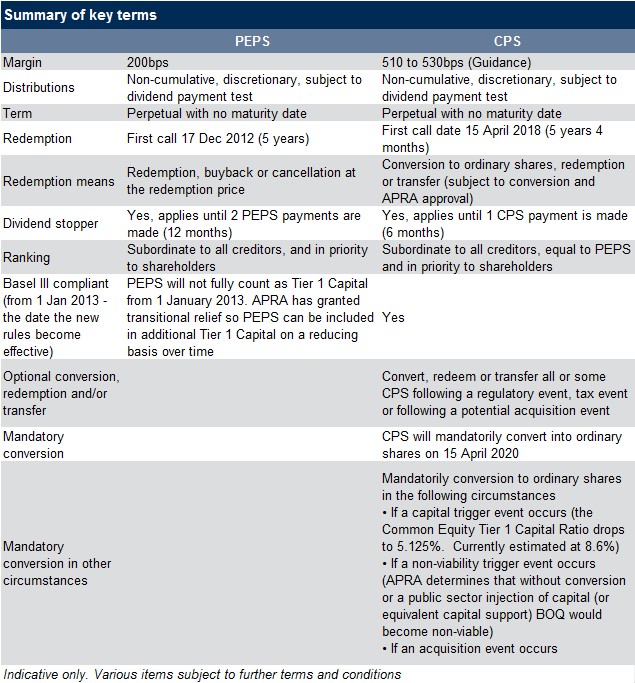

As predicted in our previous commentary, BoQ has followed a similar path to Goodman offering to roll PEPS holders into a new security – and giving them little choice; known as a “coercive” rollover. While they will not be forced to take the new security, the alternative is to continue to hold the PEPS as a perpetual security which the bank may never call. The PEPS pay 200bps over the 6 month BBSW while the CPS offer an estimated minimum of 510 bps over 6 month BBSW. We note that these rates are “unfranked” in that the cash amount you receive being 30% less – with the balance claimed in the year-end tax return.

While the PEPS are the first bank preference shares not to be redeemed, there have been bank “income securities” which were not redeemed at first call date. For example the 1999 issued NABHAs. These however were sold explicitly as perpetual with no step up - while NAB has the option to call these at each payment date it has no obligation. The following is taken from the original prospectus:

“The income securities...have no maturity date, and will not be repayable by the National. To realise your investment you will need to sell your National Income Securities on the ASX at the prevailing market price, or privately. There can be no assurance as to what that price will be.”

We note that PEPS does stand for Perpetual Equity Preference Shares, and have no coupon step up. The name alone alludes to the very equity/perpetual like nature of these securities.

Source: FIIG Securities, BoQ

Key points

- Like the other Basel III compliant hybrids, capital and non-viability conversion triggers are included which converts the CPS to ordinary shares - along with the possibility of having the CPS completely written off if conversion into equity is not possible at the time

- CPS will mandatorily convert to ordinary shares on the earlier of:

- 15 April 2020 if the conversion conditions are satisfied, or otherwise on the first dividend payment date after 15 April 2020 on which the conversion conditions are satisfied

- A capital trigger event occurring at any time

- A non-viability Trigger event occurring at any time

- Following an acquisition event occurring and subject to the conversion conditions being satisfied

- Subject to APRA’s prior written approval, BOQ may elect to:

- Convert to ordinary shares (subject to the conversion conditions being satisfied), redeem or transfer CPS following the occurrence of a tax event or regulatory event

- Convert to ordinary shares (subject to the conversion conditions being satisfied), redeem, transfer or do nothing at its option on the optional conversion/redemption date of 15 April 2018

- Convert to ordinary shares (subject to the conversion conditions being satisfied), following the occurrence of a potential acquisition event

- The CPS dividend stopper applies only until the next distribution payment (within 6 months) which offers less protection compared the PEPS which applies to the next two distribution payments (12 months)

- Those who do not participate in the swap to CPS face the prospect of the PEPS being delisted from the ASX, if the remaining volume outstanding falls below a certain threshold (noting PEPS holders outside Australia and New Zealand are excluded from the offer). It is expected the PEPS will become extremely illiquid

- In the absence of significant new investor demand for the CPS the chances of PEPS holders selling the CPS on the market after they list at face value are not good. But investors may be able to achieve a better price than the $94.00 the PEPS closed at before the announcement

- To participate in the CPS offer as a PEPS holder you had to hold the PEPS at 9 November. Buying PEPS after this date will likely leave you in an illiquid, possibly delisted security whose value will likely fall. The PEPS closed at $87.00 on 8 November

- Relative to where other listed hybrids have priced, pricing on the CPS makes them look moderately less attractive given other offerings are more highly rated (ie. BENPD @ 500bps, SUNCP @ 465bps and CBAPC @ 380bps)

- Generally a reasonable outcome for existing PEPS holders. While not redeemed for cash the offer could have been much worse

Investors need to consider the additional risks associated with owning new style hybrid Tier 1 securities. They have increased loss absorption features and are one rung above equity in the capital structure, but importantly will convert to equity with potential capital losses if the capital trigger is breached, or if the entity is deemed “non-viable” again with significant capital loss possible, or if BoQ decides to do so on the call date in April 2018 or mandatorily (subject to conditions) in April 2020.

These new style securities are extremely equity like with investors taking a lot of downside risk, without upside benefits of equity or the benefits and additional security of more traditional fixed income securities.

The next question investors should ask is “Am I being paid enough for the risk?” These issues are targeted at retail investors for a reason – professional investment firms and funds would probably demand a greater return for the risk taken.

FIIG has over the counter (OTC) more protective “old style” subordinated and hybrid securities available offering better credit quality and higher ratings. Please contact your dealer for more information.