Last week, Bank of Queensland (BoQ) released profit guidance stating it will miss its projected net profit for the second half of 2012 by between $20-25m due to an increase in loan provisions, higher refunds to customers (relating to incorrect interest charges) and increasing legal bills. This result is likely to lead BoQ to a second half NPAT of approximately $70-75m (compared to a loss of $90.6m in the first half), and therefore a loss of about $15-20m for the full financial year.

The bank was able to raise $450m in the first half (after expenses more than doubled) and has sold a portfolio of four of its largest commercial property loans worth a face value of $156m to Goldman Sachs for a price of 38 cents in the dollar. In this context and given the significant loan provisioning in the first half, this increase is not overly significant. It is highly likely provisioning has peaked and looking forward, performance should continue to improve as provisions decrease. The significant provisioning over FY12 is in itself positive for bondholders in that more capital is kept within the bank. The main question is whether the bank should have recorded these earlier – and what that suggests about their credit management.

Results for the full year are due 18 October at which time we will conduct a full credit review of BoQ.

Loan loss provisions

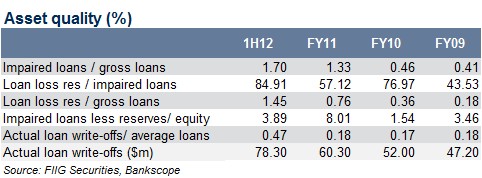

BoQ posted significant provisioning in the first half of the year ($327.7m compared $134.4m 1H11) following a review of its portfolios. BoQ has further reviewed provisioning levels and has increased provisions by a further $15m, which will lead to total loan provisions of $70-75m for 2H12. The bank states that the majority of this relates to loans which were not included in the review in the first half and range from $1-5m.

This action reflects BoQ’s geographic concentration in South East Queensland, which has been one of the hardest hit in terms of property values. BoQ is now increasing its provisions as they quantify the effects of this on their loan portfolios. The bank’s new CEO, Stuart Grimshaw stated that "It's taken us a while to catch up" on the required loan book credit quality reviews.

At 1H12, impaired loans to gross loans increased to 1.70%, however this will fall over 2H12 given the $156m portfolio sale. Arguably, the ultimate arbiter of credit quality is actual loan write-offs, which increased significantly to 0.47% of loans in 1H12 compared to circa 0.18% over the prior full years. Looking forward, the market will expect improvement in all these measures as the worst should have already past – assuming property prices remain stable in SEQ.

Additional operational costs

The bank has also undertaken an operational review which has identified “legacy issues” which will require an additional $10m. This includes:

- Operational loss provisions for refunds relating to incorrect interest charges

- Legal expenses associated with owner-manager and Storm Financial litigation

- Government guarantee break fees

- Restructuring and other related expenses, including redundancies and consultant costs

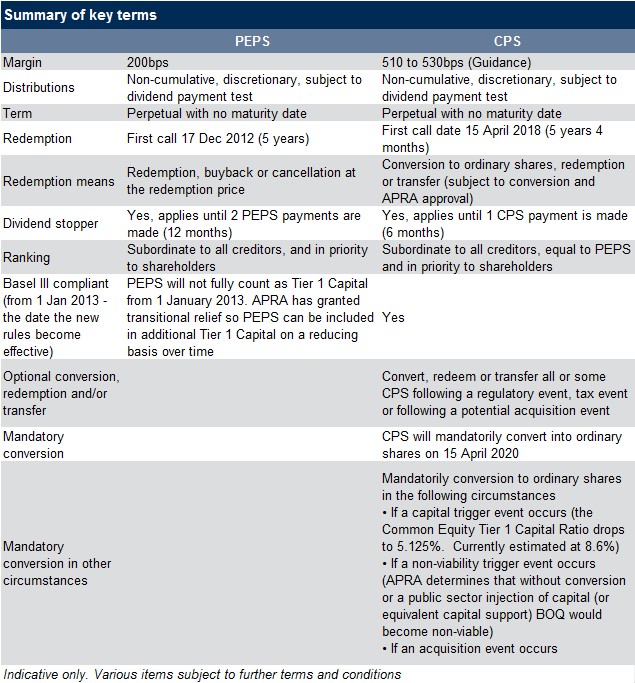

BoQ hybrids

There has been rumours in the market that BoQ may not redeem its Tier 1 hybrid notes (PEPS), which have a first call date of 17 December 2012. If not redeemed, BoQ would become the first Aussie bank not to redeem a Tier 1 hybrid note when expected.

In order to redeem the PEPS and issue a new Basel III compliant Tier 1 hybrid note, BoQ would have to pay significantly more than the 200bps over BBSW if it was left in place as perpetual notes. The recent Bendigo and Adelaide bank hybrid for example (which is better credit quality more highly rated than BoQ) issued at 500bps over BBSW.

The options for the bank are to:

- Call and repay the Tier 1 at the first opportunity

- Not call and leave the note outstanding, meaning it then becomes a perpetual security

- Offer investors an exchange for new notes. The current margin BoQ are paying on the hybrids is low and we think they would want to avoid paying market rates. So they could offer a “coercive” exchange where the terms are usually only marginally better than the existing securities, but remain cheaper than paying market rates. For example, Goodman, did not give investors a repayment option.

Full results for BoQ are due 18 October 2012.