by

Dr Stephen J Nash | Sep 12, 2012

Last week, we looked at how bonds do much better than cash in most cases and how bonds really help to mitigate portfolio volatility in a fashion that cash cannot match. This leads us to assess the impact of a possible further easing of monetary policy by the US Federal Reserve (the Fed) this week. Generally, US equity prices have already reflected expectations of further monetary easing by the Fed, and the delivery of further easing will probably be met with disappointment. In other words, the markets tend to “buy the rumour and sell the fact”.

This article looks at the recent speech by Bernanke, and we assess whether that speech suggests that growth is approaching “normal” conditions. Afterwards, we look at recent bond and equity performance and we show how different asset allocations have performed in the recent past, where growth has been weaker than normal. Finally, we consider what might happen even if growth were to revert to more “normal” levels, before making some concluding comments, with specific mention of current valuations of equities.

Bernanke and an outlook for growth far from “normal”

In Bernanke’s speech “Monetary Policy since the Onset of the Crisis” he assessed three important issues (1):

- He reviewed the past performance of quantitative easing (QE), where he concluded that it has worked in the past, leading to lower 10 yr government bond yields. So, the implication is that it will work in the future. As Bernanke indicated

Overall, however, a balanced reading of the evidence supports the conclusion that central bank securities purchases have provided meaningful support to the economic recovery while mitigating deflationary risks (p.8).

- He reviewed forward guidance of monetary policy, where he indicated that the intention of the policy is working. Extending the interest rate tightening date (increasing interest rates) should be part of the forthcoming QE package, and Bernanke indicated that the costs of a non-traditional policy are manageable

- Bernanke reviewed the forthcoming economic prospects, which was the most important part of the speech. Here, Bernanke observed that unemployment is too high

In fact, growth in recent quarters has been tepid, and so, not surprisingly, we have seen no net improvement in the unemployment rate since January. Unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum employment for some time ... following every previous U.S. recession since World War II, the unemployment rate has returned close to its pre-recession level, and, although the recent recession was unusually deep, I see little evidence of substantial structural change in recent years. Rather than attributing the slow recovery to longer-term structural factors, I see growth being held back currently by a number of headwinds” [emphasis added] (pp. 15-6).

The following headwinds were outlined:

- Housing still slow

- Fiscal contraction

- Credit stresses, tightening of lending standards, and European uncertainty (pp. 16-7).

This outlook has underpinned a depreciation of the capital stock embedded in the labour market, as recently mentioned by Charles Evans, from the Chicago Federal reserve.

In conclusion, this speech by Bernanke was quite, to very, dovish, probably the best that we could have expected. In particular, the speech ended with the following important statement

The Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability (pp.19-20).

As indicated previously, the equity and bond markets will probably sell the rumour, yet they are still buying the fact. Given that the Fed has lowered 10 year yields to almost 1.5% and lifted the S&P to almost the old highs, the Fed has done everything they could have to make debt and equity financing cheap. One of the most potent policies that could emerge would be one that enables all borrowers to “roll down”, and given New York Federal Reserve, President and Chief Executive Officer, William Dudley mentioned a “housing intervention” back in January, something for the mortgage market may be the biggest surprise (2).

This means that the “package” of measures in September could be as follows:

- Extension of the tightening date to 2015, possibly even 2016

- Measures to allow easier “roll-down” for underwater mortgage holders to lower rates

- Some mortgage-backed purchases

While the equity rally may continue to roll on possibly a little more, expectations of earnings growth, as currently built into the S&P over 2013 remain far too high, relative to a reasonable expectation. In other words, current earnings growth expectations remain a possibility, yet only in an optimistic scenario. In the central scenario, earnings growth remains much more subdued, even without any negative scenarios playing out, from Europe or elsewhere. Earnings growth will, most likely, not achieve the current levels because, as Bernanke has pointed out, we are not in a situation that could be described as “normal”, as unemployment is still way above acceptable levels and growth is constrained by the “headwinds”.

Upcoming events and current pricing

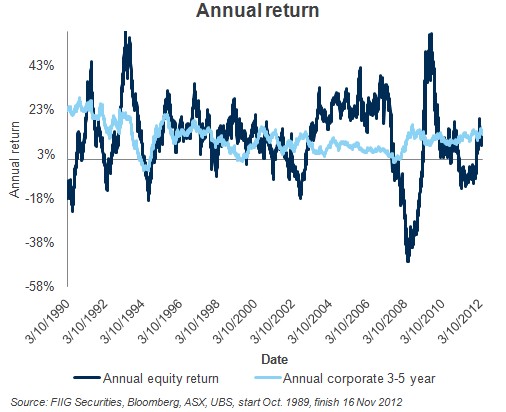

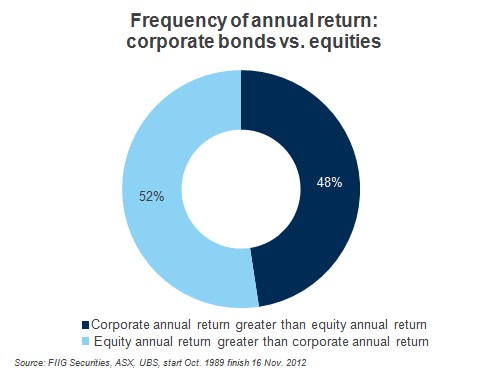

Given that growth will remain weak, according to Bernanke, it could be expected that, at some point, the market is going to revert back to a more realistic evaluation of growth prospects. This means, apart from other things, that it may be a good time to consider trimming equity allocations and adding bonds (3). More specifically, one can review the performance of Australian equities, as well as US equities in local currency terms, since the GFC, as shown in Figure 1 below.

Figure 1

Here, we had the large relief rally that started in February of 2009, followed by a period of constrained equity return, from July 2010, as detailed in Figure 2 below.

Figure 2

Notice how, in the period from July 2010 to now, the All Ordinaries annual return has essentially moved around zero, both positively and negatively, where the market has difficulty justifying annual return of greater than 15%, or under 15%, while US equities have been achieving consistently better returns, when compared to Australia. As we have indicated for some time, this kind of situation is consistent with the thesis that the market is coming to grips with a completely new world order of lower global growth, which means that equities will add substantial risk to portfolios, without adding equivalent return.

This is because earnings growth has been, is currently, and will be in future, much lower than it has been in the past. Hence, underlying equity market earnings growth will not lift back to what it was under “normal” conditions. Rather, global economic growth will continue to only justify relatively low annual equity returns; possibly in the 3-5% region, not the 10%-12% region, as we had grown used to. Over time, this situation could change, and recent moves by the ECB, combined with the anticipated third round of quantitative easing by the Fed (QE3), will help. However, expecting everything to occur, for economic growth to revert to “normality”, remains overly optimistic right now.

Importantly, as we approach QE3 this week, we would suggest that the market has already built most of the good news in, as annual returns are running around 10% yet further upside in equity return essentially means a change in the fundamental framework of global growth. While QE3 will help US growth, expecting a change in global growth, from close to zero to something more substantial remains optimistic in our view. Not that we are negative on equities at all times, as equities provide excellent longer term growth under normal conditions. Rather, all we are saying is the following:

- That in the short term, we agree with Bernanke, that we do not have “normal conditions”

- That the market has already factored in the optimistic scenario

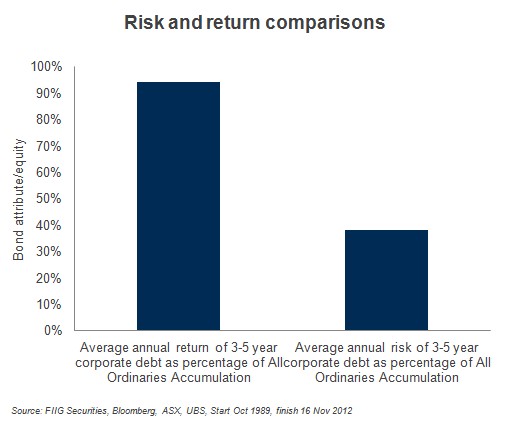

Allocating to equities, in this abnormal environment, therefore, takes patience and needs to be done very, very carefully. As Figure 3 shows, bonds, the light blue line, outperformed and protected portfolios when equity return was negative from July 2011 to July 2012. It’s worth noting that the scale for bond returns on the right hand side differs from the equity scale on the left hand side. Bond returns remain positive throughout the period under review, reaching a low point of around 4.50%, whereas the equity low point is negative 13%.

Figure 3

Portfolio asset allocation

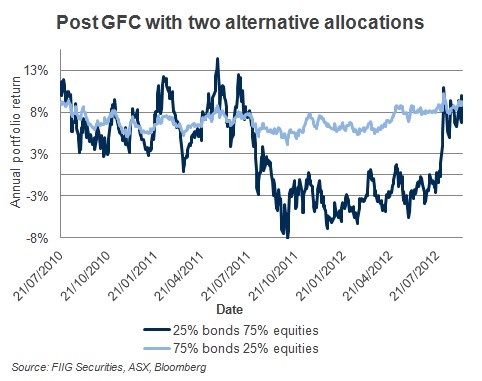

Given these asset class returns, we now compare two asset allocations:

- 75% bonds and 25% equities, or the “bond allocation”, which is represented in the light blue line in Figure 4

- 25% bonds and 75% bonds, or the “equity allocation”, which is represented in the dark blue line in Figure 4

Figure 4

Note how the bond allocation does the job of obtaining return with little fuss; with low volatility of annual return. In comparison, the equity allocation is, essentially, just a watered down version of the equity (ASX All Ordinaries) performance, being very volatile.

Conclusion

If we gain nothing else from the recent Bernanke speech, the message that growth is nowhere near “normal”, either now, or in the medium term, needs to be emphasized. If we are not near “normality” regarding underlying economic performance, then we should not expect the investment performance that is derived from economic performance to approach normality either.

Since the GFC and excluding the large relief rally, we have reviewed equity and bond performance, where we saw that recent data suggests that equities will continue to add risk to the portfolio, not return, because underlying growth remains below the historical average. More of the same is expected over the medium term, supporting a higher allocation to bonds which would cut risk and volatility without materially impacting return. Even over the longer term, when markets revert to normality, a higher bond allocation cuts risk dramatically, improving consistency of returns especially for those reliant on income. Accordingly, using the recent rally to trim equity allocations seems both prudent and justifiable at this time.

(1) “Monetary Policy since the Onset of the Crisis”, Remarks by Ben S. Bernanke, Chairman, Board of Governors of the Federal Reserve System, at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, August 31, 2012.

(2) “Housing and the Economic Recovery”, January 6, 2012, Printer version, William C. Dudley, President and Chief Executive Officer, Remarks at the New Jersey Bankers Association Economic Forum, Iselin, New Jersey.

(3) Asset class returns are estimated using the following data:

Equities: All ordinaries accumulation, 3 October 1989 to 7 September 2012, daily

Fixed rate bonds: UBS Composite 0+yrs, 3 October 1989 to 7 September 2012, daily

Cash: UBS Bank Bill, 3 October 1989 to 7 September 2012, daily