by

Justin McCarthy | Feb 13, 2013

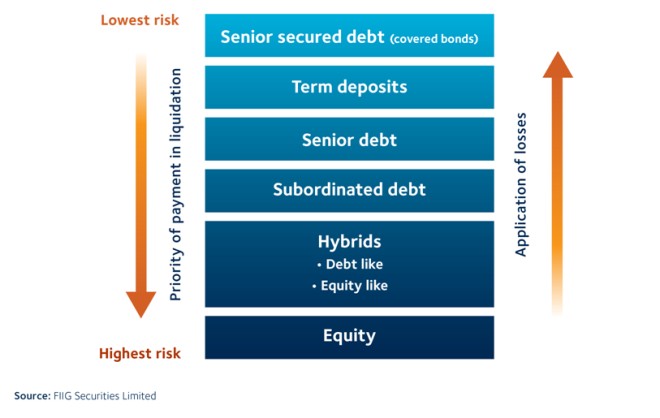

It is important to remind ourselves of the capital structure (see Figure 1 below) before we discuss call risk. The risk and return dynamics of callable bonds is typically driven by three main factors:

- Credit worthiness

- The level of subordination

- Call risk

In the case of call risk, the vast majority of bonds tend to be at the subordinated debt or Tier 1 hybrid level.

Figure 1

Banks and insurance companies issue subordinated debt (also known as lower Tier 2 debt) and Tier 1 hybrids as regulatory capital instruments. Their primary purpose is not as a source of funding but rather to add to the capital position of a bank or insurance company which can be used to absorb losses in a crisis scenario. These securities add to capital ratios that are monitored by regulators, credit rating agencies and the market in general as an indication of risk.

As investors move down the capital structure the risk of loss increases in a liquidation scenario. However, there are some additional risks that are present with subordinated debt and Tier 1 hybrid securities as detailed below:

- Extension of maturity date (or call risk) – senior secured/covered bonds, term deposits and senior unsecured bonds all have defined maturity dates. If the issuer does not pay the investor the full face value back upon that maturity date it is an event of default. These securities do not have call risk. However, subordinated debt can be extended if not called. Tier 1 hybrids (like equities) are perpetual if not called and investors must make the decision to sell to recoup their investment

- Deferral/cancellation of interest payments – for banks, a non-payment of any scheduled interest payment on senior secured/covered bonds, term deposits, senior unsecured bonds or lower Tier 2 subordinated debt is an event of default. Typically it is the same for insurers with the exception that interest on subordinated debt can be deferred but capitalised to be paid later for a period of up to five years (i.e. cumulative). Both bank and insurance Tier 1 hybrids can have interest suspended or cancelled indefinitely, but if this occurs the issuer cannot pay dividends on its ordinary shares (called a “dividend stopper”). If a bank or insurer does not pay interest on it’s Tier 1 hybrids, then there is no requirement for it to be made up at a later date (known as non-cumulative coupons or distributions)

- Coercive exchange and coercive rollover – there have been a number of examples overseas of financial institutions as well as corporations such as Goodman in Australia that have essentially forced investors into selling out at less than face value (coercive exchange) or switching into a new security at below market interest rates (coercive rollover)

- Rule changes by the sovereign if the institution is nationalised

While much of the discussion that follows will centre on call risk, it is also important to remember that non-payment of coupons on Tier 1 hybrids can occur, most likely in combination with non-call, and would more than likely result in a significant reduction in Tier 1 hybrid prices.

Call/extension of maturity risk

The term call risk refers to the risk that an issuer will decide not to call or redeem a security at the first possible call date. In doing so the issuer has extended the term of the maturity. In the vast majority of subordinated bonds and Tier 1 hybrids that trade in the over the counter (OTC) and listed market, the investor has no say in the call decision. Rather, the power is with the issuer.

Call risk essentially means that the time until redemption where the investor gets back the face value is extended.

In the case of bank subordinated debt which is typically structured as a ten year legal maturity with a non-call period of five years (or “10 year non-call 5”), this means the maturity can be extended up to a further five years at which time the subordinated bond reaches its legal final maturity date (with the issuer maintaining the discretion or choice to redeem at any quarterly interest payment date between the first call date after five years and the legal final maturity date of ten years).

Insurance company issued subordinated debt is typically “20 year non-call 10”, meaning that the extension period can be up to an additional ten years. However, some of the more recent insurance subordinated debt issues have seen even longer legal final maturity dates of 20, 30 and even 50 years.

Another difference between bank subordinated debt and insurance subordinated debt is that the former requires all interest payments to be met, otherwise it is an event of default (with some minor timing exceptions allowed in the more recent ASX listed subordinated issues), whereas many insurance subordinated debt issues allow for interest deferrals for a period of up to five years but with missed interest payments “cumulative” and as such must eventually be made up.

However, it is the Tier 1 hybrid securities of both banks and insurers which typically have the greatest call risk in that if not called they are perpetual (have no defined maturity date), but again the issuer has the discretion to call on any subsequent interest payment date. In addition, interest payments on Tier 1 hybrids are discretionary. The issuer can decide not to pay them indefinitely; however, as detailed above they will then be prevented from paying a dividend on ordinary shares which is often classified as a “dividend stopper”.

The main consequence of call risk is that if not called at first opportunity the market will reprice these securities downward due to a longer term to maturity, uncertainty over when investors will receive their money and a perceived or actual increase in call risk. If interest payments are delayed/ cancelled, this will also have a strong negative impact on the price of the hybrid.

The other call risk articles in this special edition of The WIRE cover:

- The decision process to call or not, both at the first possible call date and any subsequent call date as allowed under the issue documentation

- Possible price implications if the security is not called

- Financial institutions call risk by jurisdiction

- SNS bank, an example of recent bank failure