Interest rates

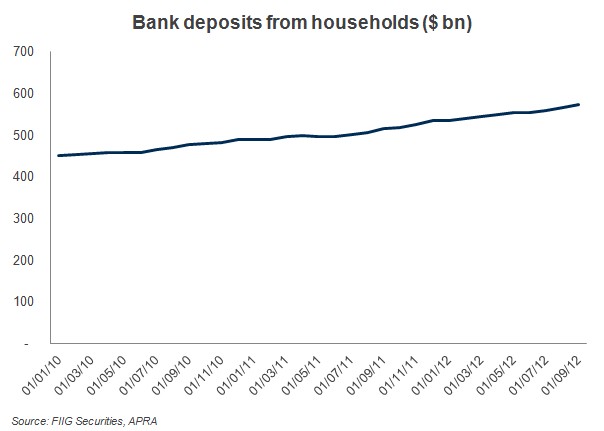

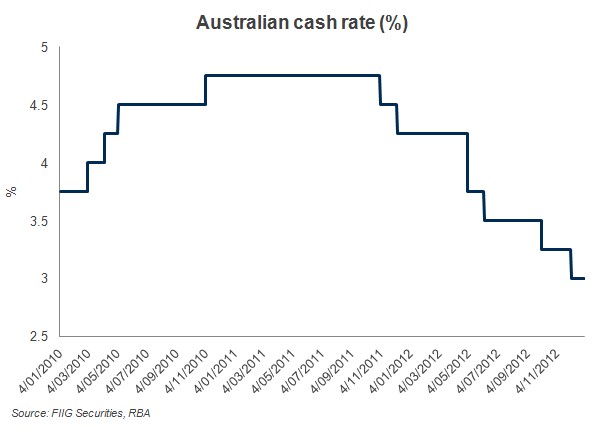

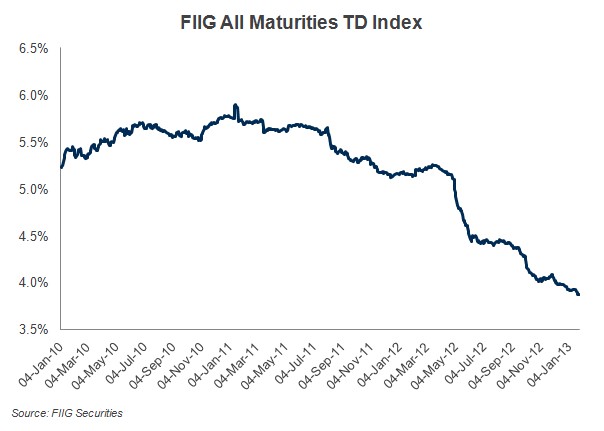

Monetary policy has become more accommodative with the RBA reducing interest rates since November 2011. Interest rates for borrowers are clearly below their medium term averages. As cautious investors seek some relief from the volatile share market, banks have also been flooded by cash deposits. Over the past year, the Australian Prudential and Regulation Authority (APRA) reports that the value of deposits from households held by Australian banks reached $572bn as of 30 September compared to $515bn a year earlier (Figure 1). Yet despite the flight to cash, interest rates have dropped (Figure 2) and the FIIG All maturities TD Index (Figure 3, which is composed from average term deposit rates across all maturities from 75 Australian ADIs calculated daily) shows TD rates being driven down over this period.

Figure 1

Figure 2

Figure 3

FIIG has seen most clients investing deposit funds for six months or one year. There seems to be less interest in longer term maturities with banks offering more attractive shorter maturities to coincide with the expectation of further rate cuts.

So what’s the market’s view of interest rates over the medium term?

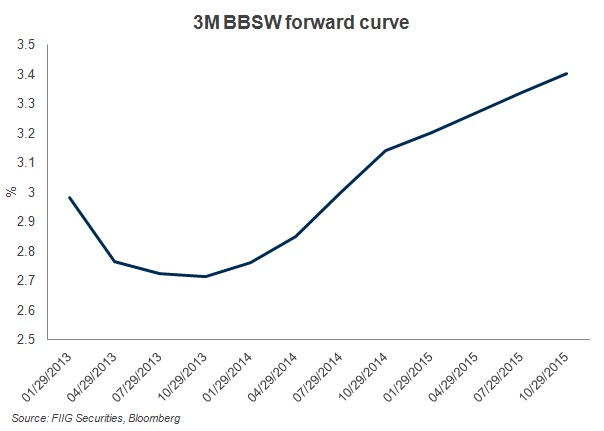

The market’s expectations will already be factored into the bank bill swap rate, this is the benchmark rate used to calculate coupon or interest payments on floating rate notes (see Figure 4 below). The forward expectations of 3 month BBSW, shows rates are expected to continue to fall into 2013, and only returning to the current low level in about 2015. It may therefore be a good idea to lock in longer term deposit rates, or indeed consider fixed rate bonds if you agree with the interest rate expectations of the market. It is also FIIG’s view that rates will continue to fall and remain low for some time.

Figure 4

At call accounts

FIIG has seen a lot of interest in high yielding at call accounts as they are generally offering higher rates than term deposits. It is however important for clients to be aware of both the positive and negative aspects of such products:

Positives

- Can offer higher yields

- Immediate access to funds

- Part of a balanced portfolio

- Monthly income which can be compounded

- FIIG has also negotiated a special arrangement with RaboDirect which simplifies bond transactions. Benefits include:

- Access to a high interest at-call savings account with one of the world’s most highly regarded banks

- A seamless process for transacting FIIG products with settlement directly through the RaboDirect account

- Coupon and maturity payments are credited to the account

- An effective transaction management and cashflow tool

Negatives

- The rate is not fixed. If rates continue to decline and stay low, so will the rate on the at call account

- Usually involves a headline rate including a bonus amount, with the rate reverting to the standard rate after a few months

- Some come with complicated tiering structures which can confuse the client and may lead to the actual rate being less than what they are expecting

Conclusion

In this environment it is necessary to have access to the full market in order to find the best cash or term deposit rate. FIIG’s Term Deposit Service has access to over 60 banks and financial institutions, with over $7.5bn of term deposits under investment. FIIG offers an opportunity to access some of the most competitive term deposit and at-call rates.

For more information please contact your FIIG representative.