With real yields of between 2% to 3% on offer, inflation indexed annuity bonds (IABs) continue to represent a compelling investment proposition given the strong underlying credit quality.

This article provides a comparison of the relative value of (IABs as well as a short summary of the underlying business and risk of each one.

IABs fully amortise over the life of the bond, with payments comprising both a principal and an interest component which are indexed to CPI. As such, IABs offer a relatively high cash flow for a product that offers inflation protection.

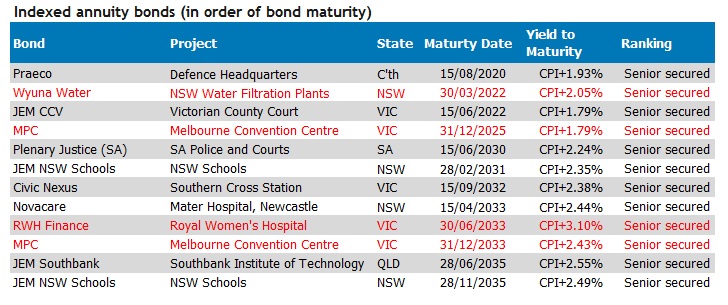

As listed in the table below, FIIG has a number of IABs available across a variety of maturities. Each of the IABs are currently rated investment grade and were originally issued as a source of financing for various infrastructure public-private partnership (PPPs). Generally speaking, these PPP projects receive availability-based service payments from their respective government counterparty, based on the availability of completed buildings and the provision of services.

The availability payments are contractually pre-agreed for the full project term and are generally sufficient to cover operating expenses, service debt and pay a return to equity holders. The availability revenues have a CPI-linked component which is directly matched to the CPI-linked outgoings of the project, which include servicing of the IABs. The bonds are senior secured, and as such a high level of recovery is expected in the unlikely event of default or project termination.

Despite the recent low reading for the CPI, we continue to see strong demand in the market for inflation protection. This was highlighted when the Australian government recently issued inflation linked bonds at negative real yields. Recent gains in crude oil prices and the depreciation in the Australian dollar underscore the importance of having a level of inflation protection incorporated into an overall investment portfolio. In an environment where Australian government inflation linked bonds are being issued at negative real yields, we believe the real yields of 2% to 3% on offer with these highly rated IABs continue to represent a compelling investment proposition. Each of the bonds listed below are available in initial investment parcels based on a $10,000 face value.

Source: FIIG Securities

Source: FIIG Securities

Please note that bonds marked in red above are available to wholesale investors only.

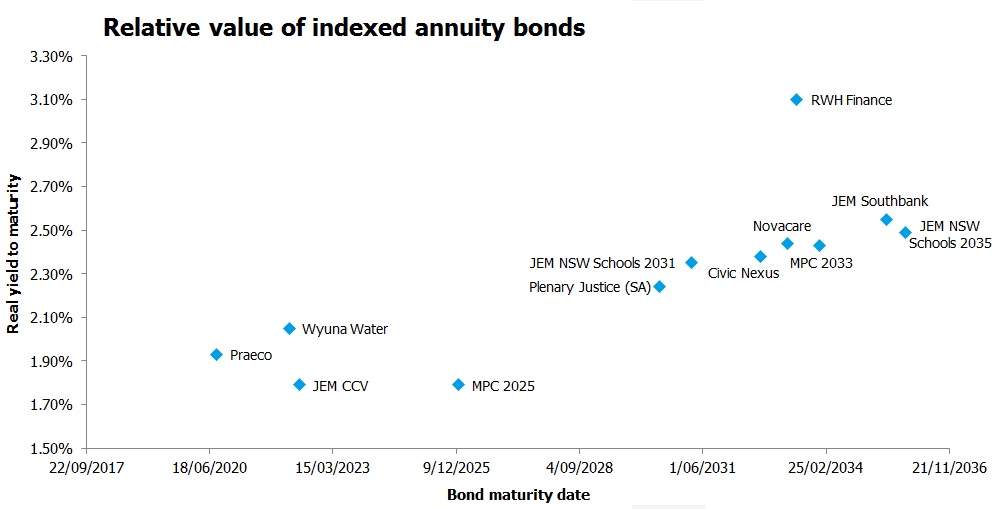

The chart below also provides a useful comparison of the relative value of each IAB based on their respective real yield to maturity. Over the life of a bond, an investor is expected to earn a total yield to maturity based on the real yield plus the actual CPI rate of inflation over the period of holding the bond.

Source: FIIG Securities

Wholesale investors can request the above table and chart with credit rating details from their FIIG representative.

Below we provide a brief outline of each of the projects and commentary on the relative value of the IABs related to each of them.

Praeco is a special purpose company that financed, designed, built and now maintains the Australian Defence Headquarters Joint Operations Command Facility under a PPP arrangement with the Commonwealth Government. Praeco is the only PPP project where the Commonwealth Government is the project counterparty, which is a relative advantage to the other IABs where the counterparty to the PPP is a state government. While the project’s credit is subject to refinancing risk, this relates to the nominal bullet bonds which have a call date one month prior to the maturity date on the IABs. We therefore expect the IABs will be fully repaid to maturity. We believe the Praeco IAB offers good relative value for investors seeking inflation protection with a shorter duration, noting the strength of the Australian Commonwealth government counterparty.

Wyuna Water is a special purpose company which has entered into an agreement with the Sydney Water Corporation to design, build, and operate two water filtration plants in Illawarra and Woronora in Sydney for 25 years until 2021. The payment obligations from the Sydney Water Corporation are guaranteed by the NSW state government. We understand the contract is likely to be extended a further 15 years until 2036 which would be a credit positive. There could be a potential rating upgrade for Wyuna rating when the contract extension is finalised and if there is evidence of an improved financial profile for the remaining term of the extended PPP contract. With the potential for a credit rating upgrade, we consider the Wyuna Water 2021 as good relative value for a shorter duration IAB.

MPC is the funding vehicle for the Melbourne Convention Centre PPP project. The IABs have a relatively high credit rating reflecting the benefit of a guarantee of scheduled principal and interest repayments on the bonds by insurer Assured Guaranty Municipal Corp. While the 2025 IAB looks fully priced, we see good relative value in the longer dated 2033 IAB given the relatively strong credit rating.

Plenary Justice SA is the special purpose company which entered into a PPP arrangement with the South Australian government in respect of the redevelopment of five police stations and four court houses in six different locations across South Australia. Plenary Justice acquired the freehold rights to all of the six sites which enhances the recoverability on the bonds in an unlikely default scenario. Unlike other PPP projects, the operating phase obligations have been retained in-house by Plenary Justice rather than subcontracted out to third-party service providers, which means Plenary Justice has higher exposure to volatility in operating costs than other PPP assets. We consider the 2030 IAB to be fully priced given the higher operational risk and relatively weaker South Australian government counterparty.

Civic Nexus is the financing vehicle for Civic Nexus Pty Ltd as trustee of the Civic Nexus Unit Trust (“Civic Nexus”), which entered into a PPP arrangement with the Southern Cross Station Authority to finance, design, build and maintain the Southern Cross Station (formerly known as Spencer Street Station), in Melbourne. Civic Nexus has the right to operate the Station for the balance of the project term, which expires in 2036. Major subcontractors are Honeywell Limited for facilities maintenance, Wilson Parking for security and parking, as well as other subcontractors including for cleaning. Unlike the other PPPs, Civic Nexus also earns a considerable portion of its revenue (around 30%) from commercial revenues including rental from retail properties, car parking, bus terminal rentals, locker hire, advertising and other sources. The Civic Nexus 2032 IAB appears fully priced at current levels.

Novacare is the special purpose vehicle which entered into a PPP arrangement with the NSW state government to redevelop the Newcastle Mater Hospital. Construction was fully completed in mid-2009. Operating phase responsibilities have been subcontracted to Medirest (Australia) Pty Ltd and Honeywell Limited, for the entire project term through to 2033. Novacare is offering good relative value at current levels.

RWH Finance is the financing vehicle for RW Health Partnership, a special purpose entity established to design, construct, operate and maintain the new Royal Women’s Hospital in Melbourne under a PPP arrangement with the Victorian state government. The hospital was completed in 2008 and comprises a 5 level car park, 9 floor hospital facility, 60 bed private hospital and private consulting suites. While this is the highest yielding IAB on offer, we note the refinancing risk prevalent in the structure relating to the nominal bullet bonds issued by RWH Finance (see New Direct Bond – Royal Women’s Hospital for further information). For investors who would prefer not to have exposure to refinancing risk, there are other IABs such as MPC 2033 and JEM NSW Schools 2031 which are currently offering comparatively good value for taking a lower credit risk.

JEM NSW Schools is the financing vehicle for Axiom Education NSW No. 2 Pty Ltd (“Axiom NSW”), which maintains facilities at 11 schools across NSW under a PPP agreement with the NSW state government which expires in 2035. Axiom NSW has subcontracted the bulk of its services obligations to Spotless. Axiom NSW benefits however from the absence of refinance risk in its capital structure. FIIG has both a 2031 and 2035 IAB available, with both offering good relative value.

JEM Southbank is the financing vehicle for Axiom Education Queensland Pty Ltd (“Axiom Qld”), which maintains facilities at the Southbank Institute of Technology, Brisbane under a PPP agreement with the Queensland state government. Axiom Qld provides facilities management services, which are to be provided for the balance of the PPP term, expiring in 2039. It has subcontracted the majority of its operations phase obligations to Spotless, a highly experienced PPP subcontractor. The project is subject to refinancing risk, with the nominal bullet bonds which mature in June 2018 needing to be refinanced. However, unlike Praeco and RWH, Moody’s considers JEM Southbank’s refinancing risk more manageable and as such has kept its rating on a stable outlook.

For details on a potential inflation linked bond portfolio, including IABs, please see the article in this weeks’ WIRE, RBA drops rates again - Where can I invest my cash?

Please note pricing is indicative only and subject to change. Please contact your FIIG representative for more information or if you are interested in investing in any of the above listed IABs.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.