Deutsche Bank (DB) reported solid results across its businesses.

UBS’ decision to exit much of its fixed income business may provide an opportunity for Deutsche to improve market share, rather than follow a similar path. While global investment banks are seeking to deleverage away from capital intensive and volatile businesses, DB still aims to be a global investment bank (albeit with more diversity). DB already has a much larger scale fixed income business than UBS and will likely seek to leverage this capability.

DB has also embarked on a significant cost cutting programme planning to reduce expenses by €4.5bn by 2015 (or 17% of its annualised 1H12 operating costs). DB's headcount is still over 100,000.

Key events during the quarter

In September, DB published strategic and financial aspirations for 2015 and beyond. These include:

- A post tax return on average active equity of at least 12% (5.2% 3Q12)

- A cost/income ratio of below 65% (80.6% 3Q12)

- Annual cost savings of €4.5bn

These aspirations are based on a number of major assumptions including stabilisation of asset valuations, revenue growth in line with the market and global GDP growth in the range of 2% to 4% per annum over the period.

In its total, the new strategy represents a significant change of direction for DB. Such change can be seen across the banking sector and goes much further than the usual cyclical reposes to a banking crisis. The background of low economic growth, ongoing deleveraging, increasing competition and more regulation is driving change. The strategy is broadly credit positive and if followed will mark the start of fundamental change for the bank.

Income

Income before income taxes for 3Q12 increased 20% YoY to €1.1bn driven by improvement in most businesses especially Corporate Banking & Securities (CB&S) but was offset by restructuring expenses of €276m in CB&S and Asset and Wealth Management (AWM). Net income decreased slightly by 3% to €755m due to a lower effective tax rate the previous year.

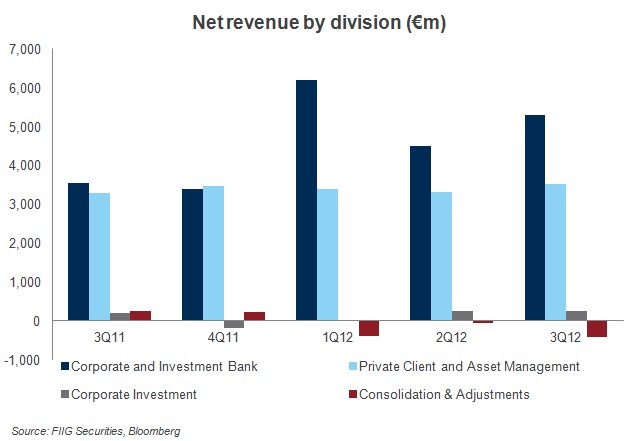

Net revenues increased 18% to €8.7bn. Revenues in Corporate Banking & Securities (CB&S) increased 65% to €4.3bn reflecting improved market conditions and increased market activity. Revenues in Global Transaction Banking (GTB) increased 6% to €1.0bn reflecting continued growth and business volumes. Asset and Wealth Management (AWM) revenues increased 11% to €95m mainly reflecting a gain on sale of an investment and higher revenues driven by market appreciation and higher performance fees. Private & Business Clients (PBC) revenues increased 5% to €2.6bn.

Noninterest expenses increased 18% to €7.0bn relating primarily to items including higher compensation-related expenses, restructuring activities, increased policyholder benefits and claims in Abbey Life as well as higher litigation related expenses.

Provision for credit losses was €555m compared to €463m in 3Q11 with the increase attributable to CB&S due to IAS 39 reclassified portfolio including €61m triggered through de-risking.

Capital, funding and liquidity

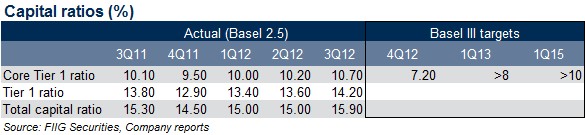

The Tier 1 ratio increased 5bps compared to the second quarter of 10.7% due to de-risking (resulting in lower capital deduction items as well as lower risk weighted assets(RWA)) and retained earnings. The bank targets a fully implemented Basel III target of 7.2% by the end of the year, greater than 8% the following quarter and greater than 10% by 1Q15. The bank acknowledges that compared to peers its capital position is weak. However unlike other banks it will seek to build capital and meet these targets organically (through retained earnings and RWA reduction), rather than through an equity raising.

In September, the Bank completed its full-year funding plan of €15bn. Liquidity reserves were in excess of €210bn with the composition broadly the same versus 2Q12 with over 60% being in cash and cash equivalents.

DB currently has an A$ subordinated FRN with final maturity of April 2014 in the market. This bond was one DB failed to call at the first opportunity, so its coupon has stepped-up. New Basel III rules mean that from the 1 January 2013, the bond will not qualify towards capital, so is more likely to be called around this date.