Deutsche Bank (DB) reported a larger than expected 4Q12 loss after several one-off charges, including goodwill impairments and litigation provisions. Its underlying performance was reasonably solid, although sales and trading revenues were down, with the bank blaming seasonal factors. The restructuring programme is progressing well so far, with asset reduction and cost savings ahead of target. However this is a long term project and there are a few hurdles on the horizon. In regard capital (one of the bank’s main relative weaknesses) performance was good with improvements being made much faster than expected.

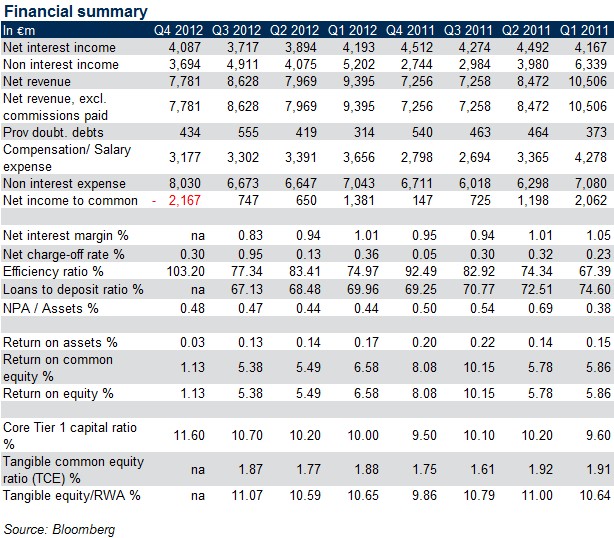

The Bank reported a loss before taxes for 4Q12 of EUR2.6bn (4Q11: loss before taxes of EUR0.4bn) and a net loss of EUR2.2bn (4Q11: net income of EUR0.2bn). DB's underlying performance was solid in 2012, but its reported earnings were and will continue to be depressed by one-off charges relating to the implementation of the Strategy 2015+ programme. This programme seeks to accelerate de-risking of non-core activities, implement a cost saving plan and it also introduced of a new divisional structure including the creation of a dedicated non-core division. This drove the 4Q12 impairment charges on goodwill and other intangible assets of EUR1.9bn, primarily relating to businesses acquired by Corporate Banking & Securities and Asset and Wealth Management prior to 2003 and to businesses assigned to the non-core unit.

4Q12 revenues were a little down on previous quarters, although they were higher year-on-year, as trading income came under pressure. The main effect was on the expenses line. Stripping out the one-offs, underlying costs were actually broadly unchanged compared with 3Q12. DB is on track to cut annual costs by EUR4.5bn by 2015, around 17% of the group's 1H12 annualised costs of EUR27bn. This should reduce its cost/income ratio to around 65%. Management has also talked about the need to change the compensation culture, and there was some sign of this in the 2012 results, with bonuses falling to 9% of revenues, the lowest ratio for many years. Another encouraging trend for DB was the fall in loan impairments in 4Q12.

DB's capital ratios (which are a weakness for the bank) are improving faster than expected. Its Basel II Core Tier 1 ratio at end-2012 was 11.6%, compared with 9.5% at end-2011. This translates to a Basel III Common Equity Tier 1 (CET1) ratio of 12.5% and a fully loaded CET1 ratio (looking through the transitional arrangements to the 2019 rules) of 8.0%. While this still trails the fully loaded ratios reported by some European banks, it is starting to look less out of line, and is better than the 7.2% target set at its September 2012 Investor Day. DB has raised its 1Q13 target from 8.0% to 8.5%.

FIIG has Deutsche bank Lower Tier 2 AUD securities on offer to wholesale clients. Please speak to your FIIG dealer.