by

Ekaterina Skulskaya | Apr 08, 2014

Last week UBS sold its Composite Bond Index to Bloomberg. The decision by UBS to divest a range of index and benchmarking activities marked the end of a 25 year period of control of the Australian bond market’s main performance index. The UBS Composite Bond Index has been the main benchmark for Australian fixed income investors with in excess of 90 per cent market coverage, tracking 500 bonds. According to the UBS head of fixed income sales, Duncan Haig, there is an evolution within fixed income indices and it makes sense for the indices to be run by a global specialist and the dominant provider of market data like Bloomberg.

New features will be added to the Bloomberg AusBond Index, such as breaking up sectors of credit markets by index and by ratings and providing the ability to tailor custom indices for investors where no “off the shelf” indices exist. For example, bond indices without tobacco and gaming bonds will be added.

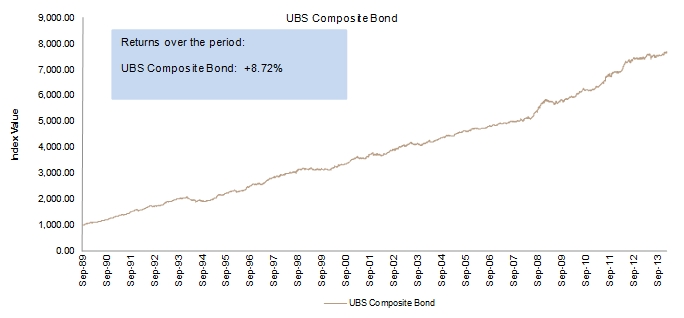

The Composite Bond index since September 1989 is reproduced below.

Source: UBS estimates, Bloomberg