The company result for FY13 was strong given the difficult environment they operated in, in particular in the second half of the financial year with a slowdown in the mining sector affecting all services companies with exposure to the sector. The FY13 result would have benefited from the term contracts which Downer is party to, helping to protect its top line, however a prolonged softening in the Australian mining sector would be expected to eventually flow through to Downer’s revenues.

Total revenue of all three of Downer’s groups; infrastructure, mining and rail grew during the 2013 financial year – up 13.1%, 3.7% and 4.0% respectively. Total revenue for the group increased 7.1% for the year to $9.1bn.

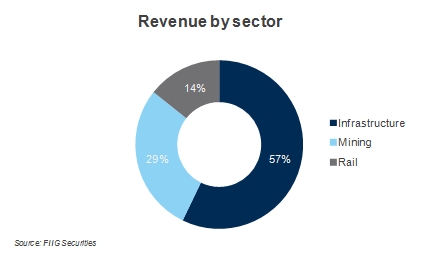

Infrastructure contributed $5.2bn in revenue, representing more than half of the group’s total revenue with mining contributing $2.6bn and Rail $1.3bn. In general the infrastructure group provides a more stable level of performance than can be expected from the mining group which by its nature is linked to the cyclical nature of that sector. Rail continues its transformation from a focus on building locomotives to being a provider of ‘whole of life’ engineering solutions. Whilst this should provide a smoother revenue stream, margins on the servicing of trains is lower than that of constructing them – though so is the operational risk.

With regards to the rail group, the Waratah Train Project is running to schedule with 47 trains available for passenger service with the 78th train due for delivery in the middle of 2014. The trains have been performing well operationally, a positive given their troubled past.

Operating cash flows were also impressive, growing 24.1% to $452.4m at the same time as decreasing gearing and maintaining a high level of liquidity ($1.1bn including $473m in cash). Gearing was down to 20.8% (including operating leases) from 29.2% at FY12 with the company also refinancing during the year, neutralising the refinance risk in the near term. Work-in-hand remains very strong at $19.0bn, up $0.1bn on the $18.9bn 2012 balance.

Looking forward, Downer highlighted the headwinds they face in their key sectors. The slowing mining sector which affected results in the second half of FY13 is expected to continue through 2014. We have seen this to date in the negative results of the pure mining services firms and Downer’s mining group will not remain immune.

Further, with federal and state governments proving financially cautious, infrastructure revenues are expected to come under pressure as governments choose to defer major road and rail expenditures.

Notwithstanding these headwinds, the company provided advice of a flat FY14 result, noting that they had already achieved their five year cost saving programme (in three years) and would be targeting a further $250m in savings in the FY14 and FY15 years.