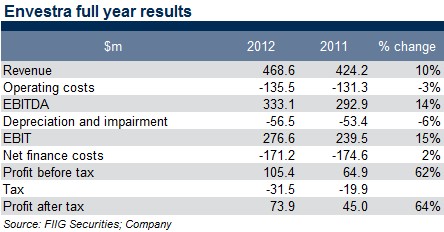

Envestra Limited delivered an impressive set of numbers last week delivering solid revenue growth on lower volumes and a significant increase in profits.

Revenue for the year increased 10% on the back of positive regulatory outcomes in South Australian and Queensland (17% and 11% tariff increases respectively). The upcoming Victorian regulatory review (due early 2013) is the last piece of the regulatory puzzle, and a positive outcome here should be seen as a catalyst for a credit rating upgrade.

Irrespective of the Victorian regulatory decision, credit metrics continued to improve over the 2012 financial year with Debt-to-Regulated Asset Base coming in at 79%, ahead of budget (80%) with interest coverage similarly improving. A similar performance in the 2013 financial year should meet agency hurdles for an upgrade.

Revenue for the year increased to $468.6m up from $424.2m with the aforementioned South Australian and Queensland tariff increases driving 17% increases in revenue from each of these territories. Revenue also benefited from 25,800 new connections which should contribute circa $8m annually. In contrast, operating costs only rose 3% to $135.5m with the majority of the increase a result of marketing costs in new territories.

Finance costs for the year actually decreased despite an increase in the level of debt reflecting tight controls around cost of debt over the portfolio as a whole. The balance sheet was also improved by the $70m of equity raised through the company’s dividend reinvestment plan and share purchase plan. This is viewed as a positive for debt holders displaying the company’s commitment to solid balance sheet management as is the decision to leave the October 2012 dividend flat as the board seeks to meet the requirements for a rating upgrade.

The equity raisings (in addition to internally generated cash flows) helped fund capital expenditure during the year with replacement of old network assets and capital expenditure related to adding new customers the two largest areas of capital investment during the year. Going forward management forecast new capex will be 25% debt funded.

Funding

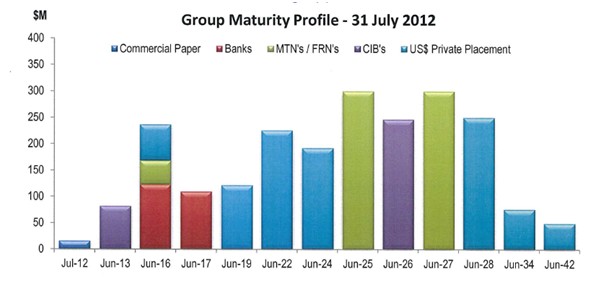

Envestra maintains a well diversified (by maturity and type) funding profile and enjoys one of the longest average maturities in the sector at ~11yrs, see Figure 1 below. Envestra management have a good history of managing its debt profile and all debt with 2013-14 maturities are covered by existing facilities.

Figure 1

Envestra’s inflation linked bond maturing in 2025 is currently providing strong returns to investors and with management publicly targeting a rating upgrade in the next 12 months investors have the potential to benefit from repricing at some point in the future.