by

Justin McCarthy | Oct 31, 2012

In this week’s instalment on our call risk series we looks at what can happen when an issuer does not call their subordinated debt or Tier 1 hybrids.

At the onset, let me please emphasise once again we are not changing our credit or call risk assessment on the securities below. Rather the following is an estimate of the fall in price that may be seen in the unlikely (but possible) event these securities are not called. (Please see last week’s article “Everything you want to know about call risk – Part 2” which covers the decision making process by the institution).

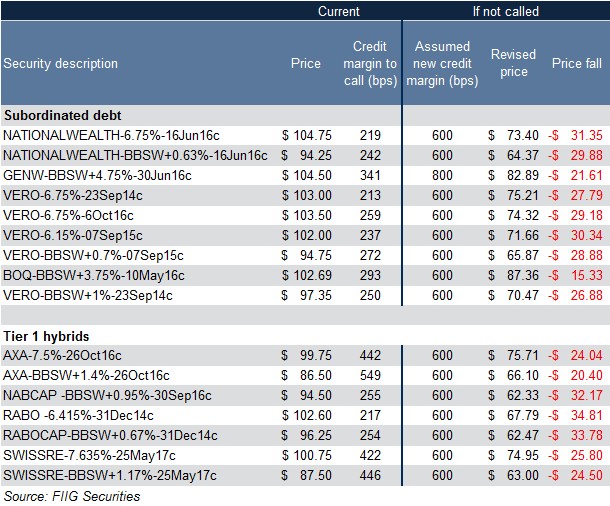

Table 1 lists 16 of the most commonly traded over the counter Tier 1 hybrids and subordinated debt issues in the market and applies the following assumptions to come up with an expected price fall (figures in red) in the case the securities are not called.

Assumptions – Subordinated debt

- The bond will not be called and will run to legal final maturity. For GENW (i.e. Genworth) and BOQ (Bank of Queensland), that is five years past the call date. For all others that is ten years past the call date. The call date is identified in the bond description in the first column.

- The majority of callable securities if not called revert to floating. All of the securities listed below will become floating if not called. Further, all of the subordinated bonds other than Genworth and BOQ have a stepped-up credit margin if not called and this has been applied to future cashflows post the call date.

- To compensate for a longer term to expected maturity and market perception of higher credit risk due to non-call, a trading margin of 600bps is assumed to be required by the market (however, a higher margin of 800bps is assumed for Genworth as non-call places investors at higher risk of capital losses with a mortgage insurer).

Assumptions – Tier 1 hybrids

- The security will not be called and will run for a further 15 years past the first call date. This is just an arbitrary date. It is likely if/when the institution can raise cheaper replacement funding, it would do so and call the existing securities at that time. In theory, these securities could be perpetual which would have an even greater negative impact on price.

- As with the subordinated debt, all of the Tier 1 hybrid securities listed below will become floating. In addition, all are the “old-style” step-up securities and as such the stepped-up credit margin has been applied to future cashflows post the call date. (Note that the probability of interest deferrals or cancellations increases exponentially if a security is not called. For the purpose of this exercise it is assumed all future interest payments are made. However, if the market anticipated that interest payments may be missed, this would have a further negative impact on price and possibly a very material impact).

- To compensate for a longer term to expected maturity and market perception of higher credit risk due to non-call, a trading margin of 600bps is assumed to be required by the market.

Table 1

It is important to note that there is no “right or wrong” answer to this analysis. In fact, the extent of any price fall depends on a large number of variables such as prevailing interest rates, direction of rates, credit spreads, regulatory and sovereign risks, market expectation of call and interest deferral/cancelation risk, credit risk, management commentary, what other institutions are doing, etc.

Further, there is an argument that the assumed credit margin if not called should be higher for Tier 1 hybrids than subordinated debt (as well as differences between the entities and industries that make up each of the subordinated debt and Tier 1 hybrid lists). However, for the ease of calculation and comparison a simple approach of applying 600bps was used.

Conclusion

The key point of the exercise above is not to calculate the exact dollar value of the price fall that could occur. The output of our model will change significantly depending on the assumptions used.

Rather, the point is that in the unlikely event any or all of these securities are not called the price fall is expected to be material - anything from $15 to $35 using the above assumptions but this could be even greater depending on the circumstances.

While we still believe that all securities listed above will more than likely be called based on current circumstances (mainly market conventions, reputation risk and regulation), it is possible that this may change.

When assessing call risk, investors must consider both the probability of non-call and the likely implications of non-call.

Next week we will look at some real life examples/case studies of European financial institutions that didn’t call as a result of the GFC.