by

Justin McCarthy | Nov 07, 2012

In this week’s edition of our call risk series we look at a real life example of what can happen when an issuer does not call their subordinated debt or Tier 1 hybrids.

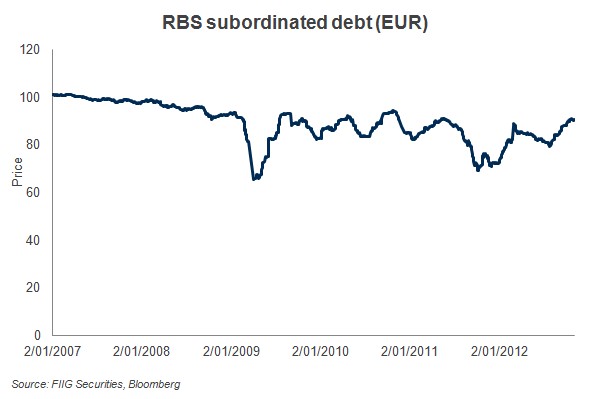

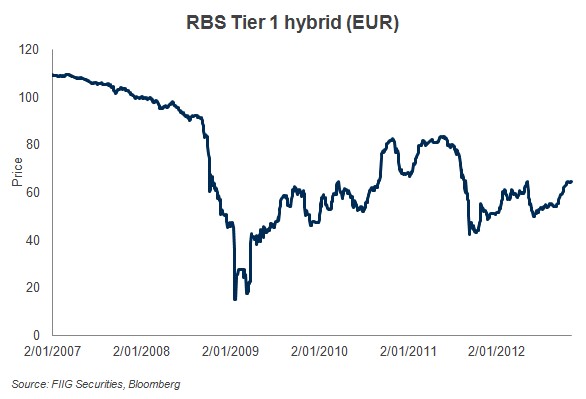

The two charts below plot the price of Royal Bank of Scotland Plc (RBS) securities that have not been called.

Figure 1 shows a subordinated debt issue that was first issued in November 2003 with a first call date in January 2011 and a final maturity five years later of January 2016.

Notice the price drop in March 2009. The bond had been trading at €90 but declined 28% to €65. There has been considerable volatility since. We anticipate it will move towards par as it nears final maturity. However, with past exchange offers investors may be concerned that they may be forced to receive less than par via a coercive exchange.

Figure 1

Figure 2 shows a Tier 1 hybrid that was first issued in June 2002 with a first call date in June 2012 and no final maturity date (i.e. perpetual). Note that this security also had interest payments suspended for two years between April 2010 and April 2012. Being further down the capital structure and with a greater impact if not called (given the potential for the security to be perpetual), the price fall is significantly more, in this case falling from close to €100 to just €20 (a fall of 80%) in the space of just a few months from late 2008 to March 2009.

Both securities were not called on first call date and still have not been called. However, as Figure 1 and 2 demonstrate, the market started pricing in significant call risk and credit risk in 2008 and early 2009 as the GFC gathered steam and the risk of a UK banking/RBS banking collapse was at its highest.

Figure 2

Unlike our hypothetical examples last week, in practice it is very difficult to separate the impact of non-call from the perceived increase in credit risk. In addition, the Tier 1 hybrids also have the impact of two years of coupons being cancelled. All three of these features had a negative impact on price.

However, as the charts above clearly demonstrate, when the market expects that a security will not be called (which typically coincides with elevated credit risk), the impact on price can be dramatic. And the further down the capital structure, the greater the impact.

Conclusion

The conclusion this week is almost exactly the same as last week.

The point of the examples above is not to calculate the exact dollar value of the price fall that could occur if a certain security was not called, because the answer really depends on the circumstance. Rather, investors need to be aware of the significant price falls that can occur in the event subordinated debt and moreover Tier 1 hybrids if they are not called.

As the charts demonstrate, investors should expect the price fall for Tier 1 hybrids to be significantly more than that seen for dated subordinated debt, given their perpetual nature, the fact Tier 1 hybrids are further down the capital structure and the added likelihood of suspended interest payments increases volatility.

When assessing call risk, investors must consider both the probability of non-call and the likely implications of non-call. As Tier 1 hybrids rank lower in the capital structure, have the potential to become perpetual and have interest suspended, when they become stressed they tend to act more like the underlying equity.