by

Elizabeth Moran | Apr 08, 2014

Key points:

- High yield bonds are those that are unrated or rated below investment grade and thus offer higher returns.

- Sub-investment grade rated companies Fortescue Metals, Nufarm and Bluescope Steel have all issued into the US market and investors in those US dollar bonds can earn up to 5.5 per cent yield to maturity, a much higher rate than current US deposit rates

- Like other bonds, high yield bonds also have an equity buffer. So, even if a company goes into liquidation or wind-up, share holders are in the “first loss” position and must lose all of their investment before bond holders incur a loss.

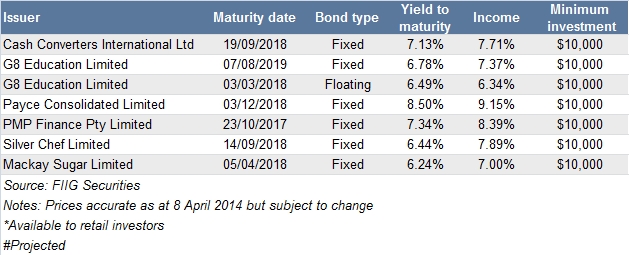

- The most recent bond from G8 Education is floating rate and the projected yield to maturity for this bond is 6.50 per cent. The highest yielding bond is Payce Consolidated, currently offering 8.50 per cent if held until maturity, but income is running at over 9 per cent.

Australia’s bond market is under developed compared to other OECD nations. One of the markets in its infancy here is a high yield market.

High yield bonds are those that are unrated or rated below investment grade and thus offer higher returns.

In the US, which has the largest global bond market worth USD39.9 trillion dollars at year end 2013 (Securities Industry and Financial Markets Association), approximately 15 per cent of total corporate bonds (worth USD9.8 trillion) are high yield bonds, equating to a significant USD1.5 trillion high yield market; more than the total value of the Australian debt market.

In Australia it has been difficult for companies to access debt markets if they do not have a rating or have a sub-investment grade rating. Traditionally they have had to raise funds in US markets, where investors better understand and appreciate the risk and return trade off. Risk is fine as long as investors understand and are being paid enough to compensate for those risks. For example, sub-investment grade rated companies Fortescue Metals, Nufarm and Bluescope Steel have all issued into the US market and investors in those US dollar bonds can earn up to 5.5 per cent yield to maturity, a much higher rate than current US deposit rates.

High yield bonds have the same legal obligations as other bonds in that failure to make an interest or principal repayment when due would see the company go into wind-up or liquidation. Investors know the projected return until maturity upfront and as long as the company survives, investors will be paid interest and principal.

Like other bonds, high yield bonds also have an equity buffer. So, even if a company goes into liquidation or wind-up, share holders are in the “first loss” position and must lose all of their investment before bond holders incur a loss. This buffer provides comfort and explains why, theoretically, bonds should have lower returns than shares in the same company. High yield bonds usually have other in-built protections designed to minimise risk and maximise their “survivability”. These are known as covenants. Typical covenants restrict dividend payments to specific percentages, say 50 per cent of net profit after tax or state minimum performance ratios like interest cover. These clauses are much the same restrictions banks use when lending to businesses.

The company I work for, FIIG Securities has been working to develop a high yield market in Australia. FIIG has brought seven high yield bonds to the wholesale, over the counter market, worth a total $360 million. Six bonds are from ASX listed companies and the other is from Mackay Sugar, a company that is over 100 years old. Six of the bonds are fixed rate, meaning investors know the return they will earn upfront, assuming the company continues to operate. These bonds are attractive to investors seeking a regular, high income. The most recent bond from G8 Education is floating rate and the projected yield to maturity for this bond is 6.50 per cent. The highest yielding bond is Payce Consolidated, currently offering 8.50 per cent if held until maturity, but income is running at over 9 per cent. The minimum face value investment for most of the bonds is $10,000 per bond ($50,000 in total) giving individual investors’ access to the high yield market.

Investors should only invest small amounts in the highest risk investments (like fund managers and professional investors) as a way of boosting overall return in a portfolio. Bonds offer a very wide range of risk and return options.