FIIG Research started publishing its view on the relative value of owning USD denominated corporate bonds back in August 2014. At that time, the AUD/USD exchange rate was 94c and we wrote to clients suggesting 75c was fair value. All the major banks had 85-90c as forecasts.

A lot has changed in that time. The US has continued on its recovery path, with business investment in particular driving strong economic results.The recovery is still fragile, but certainly compared to the rest of the world, relatively solid and reliable.

At the same time, Australia’s economic outlook has weakened considerably. Commodity prices have fallen further, business and consumer confidence is down and while retail and construction data has shown brief signs of life, activity needs to be sustained to bring confidence back.

With the US economy strengthening further and the Australian economy weakening, we revise our outlook for the AUD/USD exchange rate to 65-70c.

It’s now 78c and even the majors have forecasts down to 70c. With many of our clients having bought USD corporate bonds well above 85c, the most common question we are getting these days is “What level does it make sense to consider selling?”

In this article we take a look at the reasons why investors should hold foreign currency corporate bonds. We show that there are three major investment strategies, only one of which suggests you “should” sell simply based on currency movement.

3 key investment strategies for investing in foreign currency corporate bonds

Investing in fixed income in a foreign currency requires a similar plan to investing in fixed income in your own currency. You need to understand why you are investing and therefore at what point it no longer makes sense to stay invested.

Aside from the normal benefits of investing in bonds (regular, secure income and lower capital risk than shares), there are broadly three reasons to own foreign currency bonds:

- Credit diversity: A different economy or exposure to different sectors than Australia offers means investing in offshore bonds can provide diversification, lowering portfolio risk.

- Relative income: Sometimes one market will offer a higher “spread” (better returns) than another.

- Relative capital value: Warren Buffett’s favourite strategy – buy good companies for good value. If buying in a foreign currency, this holds just as true but you need to consider both the relative value of the bond AND the currency. If the bond rises in value but the currency wipes out the gain, you’ve not bought for good value in hindsight.

These strategies are not mutually exclusive. That is, you should be considering relative income and capital value even when investing offshore for credit diversity. But it’s about the main reason for holding a bond. If someone has invested in USD corporate bonds, for example, to get exposure to the healthier US economy, they would be more likely to hold that investment until the economic advantages fade, not selling just because of a move in the currency. Similarly, if they are investing for better income, the currency level is less relevant. But if investing because the currency itself makes the bond great value, there must be a level at which it no longer makes as much sense to hold that bond.

Relative value when considering currency values

So let’s consider the “Relative Capital Value” investment strategy in more detail to answer that question we are currently getting from clients that have made big gains on their USD investments.

Relative value requires an assessment of return and risk. For an investment to be good value, it means it offers good return prospects relative to the level of risk of the investment. Risk is not the same as volatility as many investment specialists will suggest, but also includes overpaying for an investment; overestimating that investment’s earning potential; liquidity risk, that is, not being able to sell when you want to; and investment-specific risks (called “idiosyncratic risks”).

So when looking at currency levels and considering relative value, the assessment is highly subjective. There are a host of historic data points and quantitative analyses that can be done, but past performance only gives us an idea of what happened last time we were here, not next time.

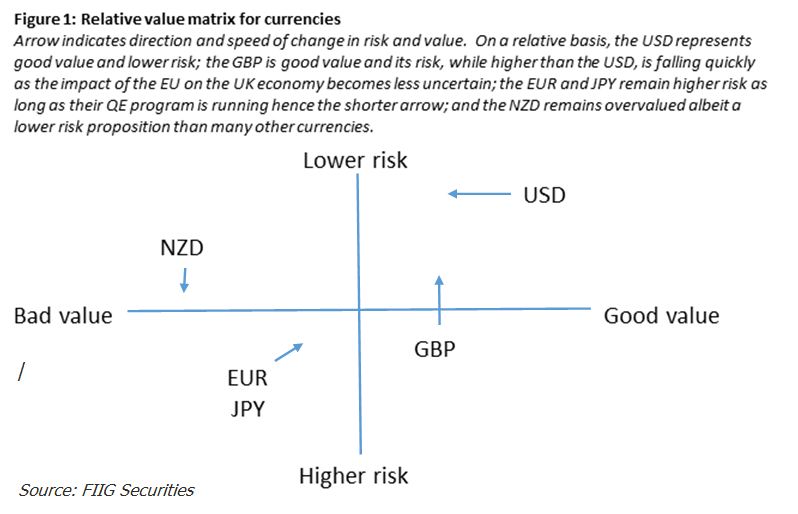

To have a plan, however, one has to form a view. Based on our view of global markets, as outlined in our 2015 Smart Income Report, the below gives a framework of relative value of the world’s major currencies and a sense of whether the relative risks and value are rising or falling (as shown by the arrows).

Same old boring message

At FIIG we believe that regardless of whether you use a financial planner or not, you are the only one ultimately responsible for whether you succeed or fail when planning your future investment income. So that means you need to draw on reliable independent sources to form that view, and then build a plan. We repeat this call to action: “have a plan” over and over, and it is no doubt boring, but the old adage is undeniable true: “if you don’t have a plan, you guarantee that you won’t achieve your goals”. So, what is your plan for including foreign currency bonds in your portfolio?

For more information, please call your local dealer.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.