What may seem like a loss on a high coupon fixed rate bond needs further investigation, as it’s more than likely a positive return and may even be a profit. This article explains Holding Period Return (HPR) and why investors need to understand this concept in order to fully evaluate how their investment has performed.

We often hear the comment from clients, “I don’t want to sell right now because the price is lower than when I bought it, and I would be locking in a loss”. While this may occasionally be true, more often than not it is a misconception as a result of not taking into account the income earned on the investment. To some investors this is obvious, but others overlook the income side of the investment and focus purely on the capital gain or loss.

This misconception is most common when dealing with bonds that have high coupon rates. The reason for this is that a bond that has a higher coupon than yield will trade at a premium (a price over $100). At maturity, the bond will redeem at $100, so the price naturally decreases as time passes, giving the investor the impression that the investment is loss-making. However, the decline in price is offset by the higher income received, so both of these factors must be considered when evaluating the performance of an investment.

HPR is used to combine the capital gain/loss with the income earned to calculate the annualised rate of return on the investment. It incorporates three components:

- Capital gain/loss

- Income

- Annualising the return to incorporate the time value of that investment

The interesting effect of correctly using HPR, as we will demonstrate, is that what may on the surface appear to be a loss, is in reality an even bigger gain (HPR) than originally targeted (yield to maturity).

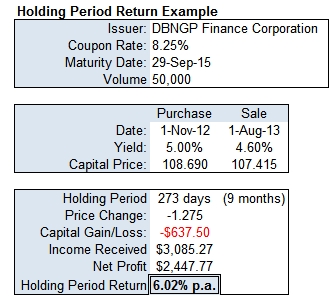

To illustrate this point, we use a theoretical investment in Dampier Bunbury Natural Gas Pipeline (DBNGP) Finance Corporation Pty Ltd fixed rate bonds, paying an 8.25% coupon and maturing 29 September 2015. Investors who bought this bond last year have been reluctant to sell the bond because they appear to be crystallising a loss (see Figure 1). In reality, the opposite is true.

Assuming the investor purchased $50,000 face value on 1 November 2012 at a yield to maturity of 5.00%, at a capital price of $108.690. If they were to sell this on 1 August 2013, the yield would have been lower at 4.60%; as would the price of $107.415, which implies a capital loss of $1.275 per $100 face value or $637.50.

What is being ignored in this case is the fact that during the holding period, the investor earned 8.25% on the $50,000 face value for nine months, or $3,085.27. When income is added to determine the total return a net profit of $2,447.77 has been made on the investment in the nine months it was held. This equates to an annualised return of 6.02%, which is in fact a better return than the expected 5.00% yield, when the bond was acquired.

Investors need to make informed decisions and just looking at a declining bond price does not reflect the annualised holding period return, which may be better than initial expectations.