by

Alen Golubovic | Oct 07, 2014

Over the past year, owners of some unhedged foreign currency bonds have received substantially higher returns than owners of equivalent domestic bonds due to the appreciation of the US dollar and British pound against the Australian dollar. This has resulted in the bonds delivering a higher income stream, because their foreign currency coupons are now worth more in Australian dollars, and a potential capital gain.

This week, we look at how three different foreign currency bonds have performed over the last 12 months on a total return basis. For an Australian investor taking an unhedged foreign currency exposure, the total returns on foreign currency bonds are made up of the following three components:

- Income return – the return received from the regular coupon income

- Capital price movements

- Movements in foreign currency

Please note that the past performance of these bonds is not a reliable indication of future performance, and foreign currency bonds are currently only available to wholesale investors.

If you expect continued strengthening in these foreign currencies, then now is a good opportunity to invest in foreign currency bonds.

1. Ausdrill - 6.875% November 2019 US dollar bond

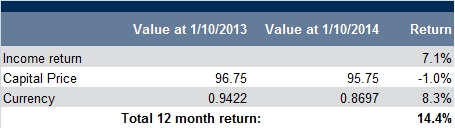

The table below provides a breakdown on the returns of the Ausdrill 2019 bond over the past 12 months:

Ausdrill, a high yielding US dollar bond, delivered an overall 14.4% return to Australian investors (unhedged) over the past 12 months. Ausdrill’s capital price fell over the period however most of the capital losses have been subsequently recouped. Being a high yielding bond, Ausdrill delivered a high coupon return and combining this with the foreign currency gains has resulted in strong total investor returns. Please note that Ausdrill is a sub investment grade bond with exposure to the commodity sector, and as such suits investors with a higher risk/return appetite.

2. Newcrest – 4.2% October 2022 US dollar bond

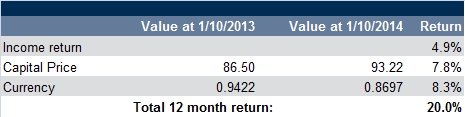

The table below provides a breakdown on the returns of the Newcrest 2022 bond over the past 12 months:

Newcrest, an investment grade US dollar bond, delivered a very healthy 20.0% return to Australian investors (unhedged) over the past 12 months. These returns were achieved through a combination of income, price growth and the strengthening of the US dollar. Note that, being a gold mining company, Newcrest is heavily exposed to the commodities sector.

3. IAG – 5.625% December 2016 GBP Bond

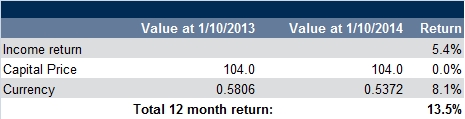

The table below provides a breakdown on the returns of the IAG 2016 British pound bond over the past 12 months:

IAG, a British pound bond, has delivered a solid 13.5% total return to Australian investors (unhedged) over the last 12 months. The returns reflect a combination of both income return and a strong pound relative to the Australian dollar, while capital price has remained reasonably steady. Please note that the IAG bonds are subordinated debt instruments which rank below the senior debt obligations of IAG.

FIIG currently has a range of foreign currency bonds available to wholesale investors, across the US dollar, Euro and pound currencies. Please contact your FIIG representative if you are interested in investing in foreign currency bonds.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

FIIG Securities Limited (‘FIIG’) provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.