GE Capital Corp (GECC) yet again recorded strong earnings growth despite lower revenues compared to 3Q11 reflecting the planned reduction in its investment balances. GE also reaffirmed its 2012 operating outlook of double-digit YoY earnings growth at both GECC and the industrial businesses. Against the backdrop of slowing global growth environment, GE's strong 3Q12 results and its reaffirmed full year forecasts reflect the strength of its well diversified portfolio of businesses that continue to deliver.

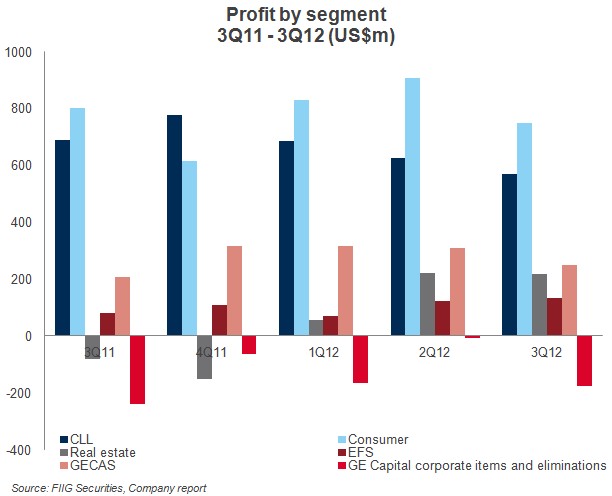

Figure 1

For the 3Q12 quarter, revenues were down 5% YoY, in line with the 7% reduction in assets. Pre-tax earnings of US$1.8bn were up 10% from 3Q11, driven by improvements in the Real Estate segment, strong retail volumes supported by better overall margin, and lower impairments, which were partially offset by higher credit costs and lower assets from the non-core portfolio run-off.

Profits in the Commercial Leasing and Lending (CLL) and Consumer segments were down marginally compared with the same period last year. Performance at CLL declined the most (down 17%) due to low loan demand (commercial volumes were down 5%), continued reduction of non-core assets and the drag from Europe. Profit at the Consumer division declined by 7%, largely because of lower assets and an increase in reserves.

Overall segment performances reflected a combination of ongoing run-off of noncore assets, overall stable asset quality performance and a healthy net interest margin (up 50bps to 4.9%).

Asset quality metrics stabilised with improvements in 30+ days mortgage delinquencies. Delinquencies were close to flat in both Real Estate and CLL.

GECC has almost completed its planned long term debt issuance target for the year. GECC’s total capital improved 10bps to 10.2% over the quarter. The benefits of earnings, issuances of preferred shares and reductions in risk weighted asset were offset by the resumption of dividend payments.

GE bonds

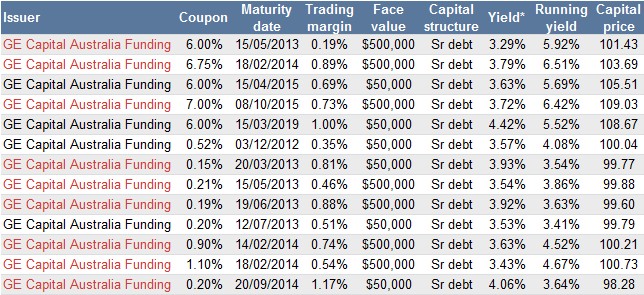

GECC has a range of A$ bonds in both fixed and floating offering attractive yields, various maturities and the security of senior debt (Figure 2). These securities are issues by Australian domiciled GE Capital Australia Funding, which is fully guaranteed by GECC.

*Yield for Floating Rate Notes is the swap rate to Maturity/Call plus the trading margin

Red = wholesale, black = retail

Figure 2

For more information please call your local dealer. All prices and yields are accurate as at 30 October 2012 and are a guide only and subject to market availability. FIIG does not make a market in these securities.