by

Justin McCarthy | Nov 05, 2012

Genworth Australia reported a reasonable set of 3Q12 results last week but the focus was on a further delay in the IPO and the level of capital as measured by APRA via the minimum capital requirement ratio (MCR).

3Q12 results summary

Net profit for the quarter was $57m versus $44m 2Q12 and $36m in 3Q11 “as claims development in the quarter was in line with the first quarter reserve strengthening expectations”. It is important to note that the profit results since 1Q12 have been boosted by the significant increase in provisions (or “reserve strengthening”) taken in 1Q12 when the company realised the number and severity of claims were rising faster than expected.

The loss ratio in the quarter was 47%, down seven percentage points on 2Q12 and one percentage point from 3Q11.

Delinquencies were down 10% from 2Q12 and new delinquencies were lower in all major states.

New business was up 9% on last quarter and 30% year over year. The strong growth in new business was due to improved affordability from lower mortgage rates according to the company.

At quarter end, the Australia mortgage insurance business had a regulatory capital ratio (MCR) of 136%, as the company terminated a reinsurance agreement (with a Genworth group reinsurer) during the quarter. At 30 June 2012 the MCR was significantly higher at 161%.

While the current quarter profit results were reasonable, the key focus was on two aspects of the release:

- Further delay in the proposed IPO of the Australian operation to late 2013

- Regulatory capital pressures from APRA on Genworth Australia as a result of the fall in the minimum capital requirement level (MCR)

IPO delayed until late 2013

On the investor conference call last week, management stated that they were still committed to a “partial sale” of Australian mortgage insurance business but the timing is impacted by regulatory capital expectations (read APRA want Genworth Australia to increase their MCR as a priority, before they consider an IPO) and market conditions.

The IPO of the Australian operation originally set down for 2012 and then 1H13 has now been put back again to “late 2013”. We expect that 40% of the company will be sold when the IPO does occur.

As previously written, one of the key benefits of the IPO will be increased disclosure on the Australian operation once it is listed on the ASX, so a further delay in that respect is disappointing. From a longer term view point, the listing will increase Genworth Australia’s financial flexibility via improved access to equity funding given the stressed state of its current owner/US based parent.

However, the IPO also carries a risk of excess capital being repatriated to the parent (albeit APRA will be keeping a close watch on this). From that viewpoint a delay is a mild credit positive.

Weighing up the pros and cons of this further delay is considered a mild negative to the credit.

Reduction in capital/MCR

The bigger issue surrounds Genworth Australia’s capital/MCR levels.

Before discussing the latest developments some background information is provided below. The following is an excerpt from our recent full research report dated 8 August 2012 on Genworth Australia’s capital levels:

Genworth Australia is subject to APRA regulation, which sets prudential standards requiring specific minimum capital requirements (MCR) for all insurers that are incorporated in Australia. The fact that Genworth Australia is separately regulated in Australia by APRA, despite being a wholly owned subsidiary of the much weaker USA-based parent GFI, is of key comfort.

The MCR regime utilises a risk based approach to capital adequacy, which approximates APRA’s derivation of the required capital to meet a 1 in 250 year risk of absolute ruin.

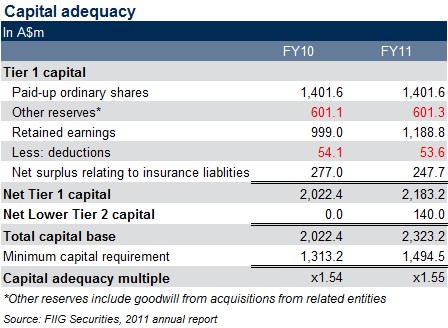

As at year end 2011, Genworth Australia held 1.55x its regulatory MCR (as shown in Table 1 below). This excess partly reflects GFMI holding high capital levels to improve the assessed financial strength ratings from the ratings agencies.

Table 1

In the company’s 2Q12 results release they stated that:

“the Australia mortgage insurance business had a regulatory capital ratio of 161 percent [1.61x], well in excess of regulatory requirements. Consistent with the company's capital management plan of obtaining external reinsurance to replace internal reinsurance, effective in July 2012, the company terminated a reinsurance agreement with an affiliate, which will lower the capital ratio by approximately 25 to 28 points [to 1.33x – 1.35x] but remain in compliance with regulatory requirements.”

While the reduction in MCR is a concern, the reinsurance agreement which was terminated was with a high risk, sub-investment grade US-based associate that was already given little or no value by both the rating agencies (and most likely APRA). It is expected that GFMI will replace this terminated contract with an independent third party re-insurance provider in the near future, in accordance with their statement above.

With over A$2.3bn in capital available to absorb losses, plus a further A$1.0bn in unearned (future) premiums, Genworth Australia is considered to be well capitalised.

The company is yet to replace the terminated reinsurance contract and as a result it appears that APRA have now pressured management to do that as a priority. Moreover, the need to increase the MCR appears to be a condition required by APRA before any IPO can take place.

Martin Klein, Acting CEO, covered this issue above in last week’s investor call:

“Executing a partial sale of our Australia MI [mortgage insurance] platform remains a key goal in reducing our exposure to mortgage insurance risk and generating capital. While the performance of the business is recovering, the increasing regulatory capital expectations and uncertain market conditions in Australia financial public offerings can impact both valuation and timing...Execution of an IPO is subject to market valuation and regulatory considerations and we do not now expect an IPO to occur prior to late 2013.”

“It's not really a regulator pushback on the IPO. I mean, if you just think about our regulatory capital levels that we're holding to, as you saw in the quarter, our MCR levels came down a bit from where they were in the previous quarter. We had told you that that was going to happen after our second quarter call, largely as the result of the elimination of some reinsurance – affiliate reinsurance that we had in the system that was being provided by the U.S. MI business. So one of the things we're working through is rebuilding and building that MCR backup into a level that we think will be more appropriate in that regulatory environment. So think of that in the low 140%s to high – a high maybe 150% MCR type level. So we're doing that through the continued improvement in our business performance. We're doing it through looking at other ways of managing the capital, perhaps by the usage of some reinsurance.”

From a credit perspective, we are comfortable with the Acting CEO’s statements above as long as management see them through. In particular, we will be looking for an increase in the MCR from the current 136% towards 150% in the full year results, due out in February 2013 (ideally via a replacement reinsurance contract with a strong, third party insurer or the build up of equity capital below the subordinated debt holders).

If no progress has been made towards improving the MCR by the time of the full year results we will most likely downgrade our credit worthiness assessment of Genworth Australia (and hence increase the credit margin required to adequately compensate for the risk)..

From a positive standpoint, the above highlights a key strength of investing in (APRA) regulated entities. The regulator keeps a close eye on the operations, strategies and moreover capital levels of all banks and insurers. Reading between the lines of what the acting CEO said on the investor call, APRA have firmly told management of Genworth Australia that they need to get their MCR up (following the recent fall from 161% to 136%) before they even think about doing an IPO.

APRA regulation is possibly the strongest safeguard investors have when holding the subordinated bonds of Genworth Australia, given the stressed state of the US-based parent and the temptations of repatriating capital back to the parent.

Relative value

Despite the concerns above, we believe the Genworth Australia subordinated bonds offer reasonable value on the assumption the capital levels are boosted as stated.

As always the credit risk on Genworth Australia comes down to the macroeconomic picture and whether you believe Australian property will crash circa 20-40% and unemployment will spike. We believe this is unlikely to occur and hence are relatively comfortable with the credit risk. However, if you do believe this could happen, you don’t want to be invested in Genworth Australia.

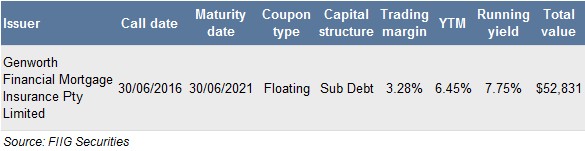

The following table highlights the key features and the current trading margin and yield to call date of the one available A$ subordinated bond.

Possible alternative – Mortgage insured RMBS

While not for everyone there is one interesting alternative investment which has similar risks, being Australian property, unemployment and lenders mortgage insurance. Residential mortgage backed securities (RMBS) or more particularly the B notes of prime RMBS transactions that are mortgage insured by Genworth (or QBE).

The investor has the security of underlying mortgages PLUS a guarantee or insurance contract from the lenders mortgage insurer such as Genworth or QBE. While there is the issue of willingness to pay from the mortgage insurers, the credit risk to Genworth or QBE is right at the top of the capital structure, above senior and subordinated debt. Like deposits for banks, insurance contracts rank right at the top.

Now there are many differences between risks and cashflows of subordinated bonds and RMBS but investors may consider selling Genworth subordinated debt risk and switch into mortgage insured B notes with Genworth (or QBE) insurance/guarantee at the top of the capital structure and even increase the trading margin and/or yield to maturity. However, please note that access to class B RMBS notes can be difficult at times.

Conclusion

The results for the quarter were reasonable but the key issues were the delay of the IPO and reduction in capital/MCR. We will continue to monitor developments with the respect to the increase in MCR towards 150%, particularly around the release of the full year results in February next year.

In the meantime, both the subordinated Genworth Australia bond and class B notes of mortgage insured RMBS are possible property investment options for clients who do not think there will be an Australian property crash and/or spike in unemployment in the coming years.

Prices are accurate as at 5 November 2012 and are a guide only. FIIG does not make a market in these securities.