by

Justin McCarthy | Feb 13, 2013

Genworth Australia reported their 4Q12 results on 5 February 2013 as part of the parent’s (Genworth Inc) results release in the USA.

The company provided the following summary for the 4Q12 with respect to the Australian mortgage insurance business (i.e. Genworth Australia):

“Australia reported net operating earnings of $62m versus reported operating earnings of $57m in the prior quarter and $54m in the prior year as claims development in the quarter was in line with the first quarter reserve strengthening expectations. The loss ratio in the quarter was 36%, down 11 points sequentially and 10 points from the prior year. Overall, delinquencies were down 14% from the prior quarter and new delinquencies were lower in all major states...At quarter end, the Australia mortgage insurance business had a regulatory capital ratio of approximately 149%, as the business continued to expand its reinsurance program as part of risk and capital management strategies. The GAAP book value was $2.3bn as of the end of the quarter.”

As highlighted in our last results update on 5 November 2012, we were looking for two specific aspects of the 4Q12 results – the trend in lenders mortgage insurance (LMI) claims and delinquencies and whether the company would reinstate the rescinded reinsurance contracts. On both fronts the news was positive as detailed below.

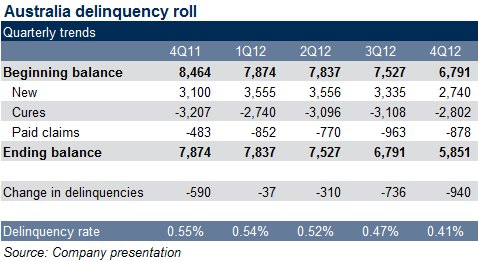

1. Improvement in trend of LMI claims – as highlighted in the statement above, delinquencies were down 14% QoQ and lower in all major states. The chart below looks at the delinquency numbers over the last five quarters and it is clear that there is an improving trend, albeit still at elevated levels on a historic basis. 4Q12 was a material improvement on the previous four quarters which means at least for the time being, things are looking a little better.

In addition, the number and average payout per claim fell from the previous quarters so the trend with respect to delinquencies, claims and payouts are improving and also in line with the “reserve hardening” (i.e. provision assumptions) taken in 1Q12 according to management. However, we do note that the level of reserves has also been declining since extra provisions were taken in 1Q12 providing slightly less buffer should something unexpected occur.

2. Replacement of the reinsurance contract Genworth Australia rescinded in the June 2012 quarter – in the 2Q12, Genworth Australia rescinded a reinsurance contract (which was with a related group entity) that resulted in the APRA minimum capital ratio (MCR) falling from 161% to 136%. This has been highlighted in our recent results updates and research reports (particularly the report dated 5 November 2012) as a significant credit concern if not addressed.

Confirmation in the results release that reinsurance contracts have now been entered into and this has returned the MCR to approximately 149% is viewed as the most significant aspect of the results update. A level of 149% is within the range we are comfortable with, albeit at the lower end.

Reinsurance is a major protection for the key risk of this business which is an Australian residential property crash.

IPO

One negative was the announcement that management now plan to conduct the much discussed partial IPO of the Australian operation in the second half or possibly even the last quarter of 2013. Previously they had announced an already delayed date of 1H13.

The main issue we have with this is it just delays a little longer the extra disclosure requirements an ASX listing will bring and continues the reliance on the cash strained US parent for equity capital injections in the unlikely event they are needed. Once the listing proceeds, it will provide Genworth Australia with better access to equity capital in times of stress. Base on previous statements by Standard and Poor’s this could also result in a downgrade if the company miss a 1H13 IPO deadline. As long as the IPO does occur this year, we are relatively comfortable with the longer time frame.

Conclusion

The 4Q12 results were positive in that the key trends of delinquencies and payouts appear to be improving. However, the reinstatement of reinsurance protection is the largest single credit improvement which gives us greater comfort. The delay in the IPO is a small negative.

However, each discussion or assessment of Genworth always comes down to the investor’s view on property prices, unemployment and to a lesser extent mortgage affordability/interest rates. We remain of the view that a property crash per se is very unlikely. Unemployment is also unlikely to spike significantly. Mortgage affordability is very supportive with low interest rates reducing monthly repayments and this is likely to remain for some time.

From a relative value perspective, our renewed comfort with the credit would suggest Genworth June 2016 subordinated bond with a 6.10% yield to first call looks attractive given the tight spreads on other existing bank and insurance subordinated debt issues in the market.

Full research report dated 8 August 2012 is available to wholesale clients through the link.