by

Justin McCarthy | Feb 11, 2014

Key points:

- 4Q13 net operating earnings of US$66m, compared with US$61m in the previous quarter and US$62m in the corresponding 4Q12. FY13 net operating earnings were US$228m, a 61% increase from US$142m in FY12

- Property, unemployment and interest rate/affordability conditions for Genworth Australia are relatively supportive for the foreseeable future

- Genworth June 2021 (callable June 2016) subordinated FRN is “fairly priced”. Investors looking to increase yield could consider the new Bendigo and Adelaide January 2024 (callable January 2019) subordinated FRN that has a yield to first call of almost 1% more

Last week Genworth Australia reported their 4Q13 results, headlined by an increase in quarterly net operating earnings to US$66m (compared with US$61m in the previous quarter and US$62m in the corresponding 4Q12). On a full year basis net operating earnings were US$228m, a significant 61% increase from US$142m in FY12.

The solid results were not unexpected with Australian house prices up around 10% over the past year. The improving property cycle has resulted in a significant reduction in the loss ratio (i.e. claims paid/premiums received). The company reported that the loss ratio was 21% in 4Q13, down from 47% in 1Q13 and 31% in 3Q13. On an annual basis the loss ratio for FY13 was 36%, almost half that of the previous year 70% reading. Over the same period, expenses remained essentially flat.

New business levels rose 3% over the year.

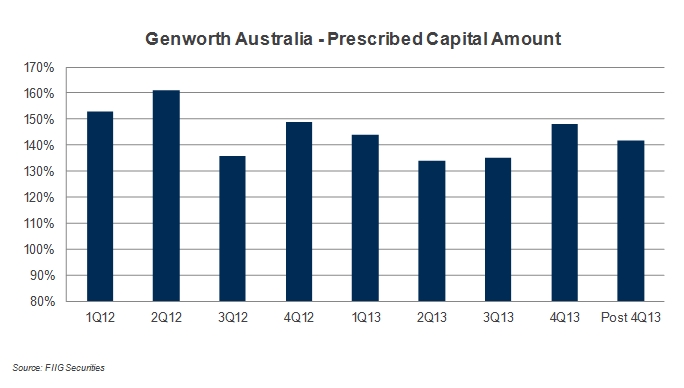

The all important regulatory capital ratio or prescribed capital amount (PCA) improved to 148% as at 31 December 2013, however, the company rescinded a reinsurance contract post-balance date which will see the PCA go back to around 142%. As a comparison the Canadian division has a regulatory capital ratio of 222%. As written in the past, the PCA is still below the levels we would like to see it. Management also confirmed the target PCA is “in Excess Of 135%”, again considered relatively low by peer comparison.

The following chart shows the recent PCA history:

The level of dividends paid to the parent continues to be high. Genworth don’t separate the details in the preliminary report but the combined international lenders mortgage insurance (LMI) division, which is essentially half Canadian and half Australian, paid dividends of US$67m to the US parent in 4Q13 and US$240m for the full year, a relatively high payout ratio. A lower payout ratio would see the PCA improve but we don’t expect this to change anytime soon. That said, the parent is rapidly improving with respect to both profitability and credit quality as the US recovers. This does reduce the risk of the strong Australian operation being called upon to “prop up” the US parent.

The IPO is still on the cards for 2014 but management again downplayed expectations saying there are a number of steps that still have to be undertaken before the IPO can proceed, suggesting that it may be in the latter half of the year if it is to proceed.

Notwithstanding the discussion above, the Genworth subordinated bond risk can always be simplified as a function of three things:

- House prices - very strong, up circa 10%

- Unemployment – slightly elevated but well short of concerning levels

- Mortgage affordability/interest rates – interest rates are as low as they have been for fifty years and affordability is at recent highs

As such, conditions for Genworth and the lenders mortgage insurers in Australia are relatively supportive for the foreseeable future.

From a relative value perspective, the Genworth June 2021 (callable June 2016) subordinated floating rate note (FRN) is offered at a yield to first call date of 5.09% and has a very healthy running yield of 6.98%, amongst the highest in the market for a FRN. While the results and outlook appear favourable, compared to other subordinated and property related bonds, the Genworth FRN looks to be “fairly priced”.

For any investors looking to take profits or reduce property risk, there is one switch that does appeal on a yield to call basis if the investor is happy to extend the expected maturity. This would be to sell the Genworth subordinated FRN and move into the new Bendigo and Adelaide January 2024 (callable January 2019) subordinated FRN issued a few weeks back, that is currently offered at a yield of 6.08% to first call date.

Please speak to your FIIG representative if you are interested in either the Genworth or Bendigo and Adelaide subordinated FRNs.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. Genworth bonds are only available to wholesale investors. The Bendigo and Adelaide subordinated FRN is available to retail and wholesale investors.