by

Elizabeth Moran | Oct 13, 2014

ANGLO-SWISS miner Glencore has been in the news recently courting Rio Tinto but it made bond market headlines last month for different reasons.

The behemoth producer and marketer of more than 90 commodities launched its first Australian dollar bond, a five-year, fixed-rate bond with an issue yield of 4.75 per cent.

The BBB-rated corporate sought $500 million, although there was demand for $700m.

Financial institutions are the main issuers of bonds so when non-financial corporations come to the market and the terms are right, demand is high.

One reason is that corporate bonds, particularly those of inter- national corporations not listed on the ASX, provide fantastic diversification.

The bond was issued in the over-the-counter market, unfortunately not giving SMSFs an opportunity to invest.

Interestingly there were only around 90 investors in the final book, meaning they invested an average of $5.55m each.

According to a report by KangaNews, the banks that managed the trans-action said demand was 67 per cent domestic with the rest split between European and Asian ac- counts.

The oversubscription and the high domestic interest shows how willing institutions are to invest in investment grade fixed rate bonds, despite the relatively low returns.

It highlights the view that larger investors also think interest rates will be lower longer.

Not all investors will hold the bonds to maturity but if they had serious concerns of imminent and steep rises in interest rates, they would have demanded a higher fixed rate of return to investor declined to invest in the issue. Even if Glencore wasn’t accessible to many, there are other bonds with similar credit quality worth considering.

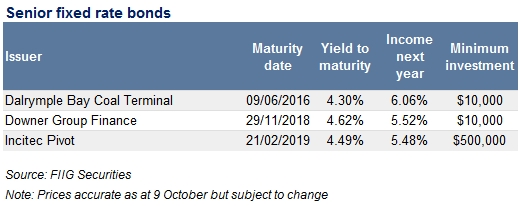

There are three senior, fixed rate bonds on the market that have shorter terms. Theoretically, they should offer lower returns than the Glencore bond.

The Dalrymple Bay Coal Terminal bond is perhaps the most comparable, and not ASX listed, so good for the diversity of your portfolio. But, with less than two years to run it is substantially shorter dated. The bond offers a relatively good 4.3 per cent until maturity.

The Downer Finance bond is closest in terms of return but with only three years to run I think it is a better proposition.

The 4.49 per cent return on the Incitec Pivot bond, with over four years to run, is a good option if you can invest $500,000 in a single asset.

If you are seeking to diversify your investments, bonds offers a range of risk and return options — many not listed on the ASX.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.