by

Dr Stephen J Nash | Jan 22, 2013

This article highlights our economic expectations for 2013 and shows how these assumptions might impact asset markets broadly and the QTC 2033s in particular. Specifically, we argue that QTC 2033s can deliver a return of over 10% should our assumptions prove to be true. If conditions for bonds are better than expected the QTC can outperform delivering a return of around 15%.

Every year, optimism about economic growth and equity performance, tends to peak at the start of the year, with earnings gradually revised down as the year wears on. We may have already seen the peak of equities and yields.

In the enclosed note, we look at the following three scenarios, where firstly, we discuss the scenario and its implications for the broad asset classes, and then for the QTC 2033 and also the Sydney Airport 2030 inflation linked bond (ILB):

- Best case

- Worst case

- Expected case

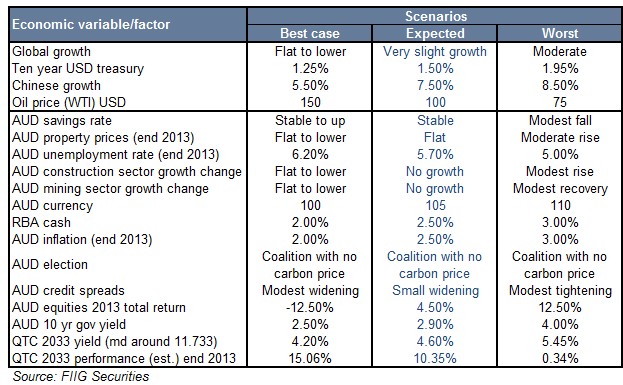

When we specify scenarios, we specify them from a bond perspective, so that the “best” scenario is when growth is lower and yields are lower, and the opposite is also the case. In all scenarios, the coalition is expected to win the federal election and eliminate the carbon price, so that a slight easing in inflation may emerge from this change. However the growth variations in each scenario are the major drivers of inflation, with higher growth driving up inflation (see Figure 1 detailing our economic assumptions for the three scenarios). Recent fiscal negotiations in the US have already excited markets and buoyed growth expectations for 2013 and 2014, and have buoyed the typical bias in earnings estimates at the start of the year. What happens next is of more interest to investors, and that is the basis for our discussion.

Economic assumptions for 2013

A summary of the key scenarios is provided in Figure 1 below.

Figure 1

Best case scenario

In the best case scenario, we are looking to a situation where growth dramatically underperforms expectations, and where interest rates in Australia are set even lower than we expect. In this scenario, there would be no lowering of the savings rate (of around 10%), no increased borrowing, and a very rough transition from mining led growth to other sectors, like construction, as banks continue to ration credit to property developers. A lower AUD would ease the plight of the RBA, since lower global growth should move the currency lower, while an unemployment rate of around 6% would be of concern to the RBA. Generally, the AUD tends to follow perceptions of global growth, and in this lower growth scenario the AUD should be a little lower, not collapse, just a little lower. Also, the tensions in the Middle East may well boil over, especially the tensions between Israel and Iran, where the Israelis remain concerned about the nuclear capabilities of the Iranians. Heightened tension in the Middle East would raise oil prices dramatically, towards USD 150 (WTI). Such an oil price would combine with extra fiscal drag from further spending cuts in the US to force a new recession, and with that even lower than expected yields. If this scenario occurs, then the QTC 2033 would rally substantially, meaning that yields would fall and prices would rise by near 15% over 2013.

Broad asset class implications

Under this scenario total return from equities is poor, as specified in Figure 1 above, yet the volatility of equities will continue to be large, with then rolling one year volatility of equities around 17%, as at December 31 2012, that means that investors can expect equities to be looking great at some times in 2013, and then looking not so good, with the net result being a reasonable loss. In contrast, the UBS Corporate Bond 3 to 5 year Index should return around 6.50% with a rough rally of around 66 basis points, with a modified duration of around 3.5 years. All this can be expected with a much lower volatility than equities, with the one year volatility at around 3.5%, so investors can expect the range of return outcomes to be around that central estimate of 6.50%, plus or minus 3.50%, most of the time.

Implications for QTC 2033

What is good for bonds is not good for equities, so do not expect positive returns from equities in this scenario, with the QTC falling from around 5%, at the time of writing to the level specified in Figure 1. Since ILBs generally tend to be less volatile than the QTC 2033, the fall in the ILB will be less than the nominal, yet one could expect a 50 basis point rally in the Sydney Airport 2030 ILB, leading to a rough total return of over 12% over 2013.

Expected scenario

In the expected scenario, we are looking at a further modest rally in government and semi government yields, with no major change in the behaviour of the Australian consumer, (savings rate continues at circa 10%), nor property prices. Lack of growth in either the construction sector or the mining sector, would lead the RBA to ease towards the end of 2013, to around 2.50%. Ongoing strength in the Australian currency will continue to hurt the Australian export sector, emphasising the need to ease monetary policy, during 2013 under this scenario. A slow global growth picture, combined with expected growth from China of around 7.50% would allow further easing to proceed, as tensions in the Middle-East escalate, yet not break out, causing the oil price to rise somewhat.

Broad asset class implications

Under this scenario total return from equities is somewhat small, as specified in Figure 1 above, yet the volatility of equities will continue to be large, with then rolling one year volatility of equities around 17%, as at 31 December 2012, that means that investors can expect equities to be looking great at some times in 2013, and then looking not so good, with the net result being not a lot of gain. In contrast, the UBS Corporate Bond 3 to 5 year Index should return around 5.70% with a rough rally of around 33 basis points, with a modified duration of around 3.5 years. All this can be expected with a much lower volatility than equities, with the one year volatility at around 3.5%, so investors can expect the range of return outcomes to be around that central estimate of 5.70%, plus or minus 3.50%, most of the time.

Implications for QTC 2033

Here, ten year Commonwealth treasury bonds would fall towards the new cash rate and break 3%, while the QTC 2033 would rally slightly less, yet still enough to record a return of over 10% for 2013, based on a yield specified in Figure 1. Since ILBs generally tend to be less volatile than the QTC 2033, the fall in the ILB will be less than the nominal, yet one could expect a 25 point rally in the Sydney Airport 2030 ILB, leading to a rough total return of around 9% over 2013.

Worst case scenario

In the worst case scenario, we are looking to a situation where growth dramatically outperforms expectations, and where interest rates in Australia are not eased any further, even though higher growth forces the AUD even higher, thereby making it even more difficult for the export sector. Here, there is no major tension in the Middle East, so that oil prices remain low, while Chinese growth continues at a little above current estimates, around 8.50% for 2013. Current stimulation by the RBA would significantly change the outlook of Australians to borrowing, so that the savings rate would fall and borrowing would accelerate, along with prices for property. Such changes, along with higher global growth and a slight reduction in the rate of unemployment, would prevent the RBA from easing further as expected.

Broad asset class implications

Under this scenario total return from equities is somewhat attractive, as specified in Figure 1 above, yet the volatility of equities will continue to be large, with then rolling one year volatility of equities around 17%, as at December 31 2012, that means that investors can expect equities to be looking great at some times in 2013, and then looking not so good, with the net result being a reasonable gain over 2013. In contrast, the UBS Corporate Bond 3 to 5 year Index should return around 4.50% with a rough sell-off of around 33 basis points, with a modified duration of around 3.5 years. All this can be expected with a much lower volatility than equities, with the one year volatility at around 3.5%, so one can expect the range of return outcomes to be around that central estimate of 4.50%, plus or minus 3.50%, most of the time.

Implications for QTC 2033

What is bad for bonds is good for equities, so we would expect positive returns from equities in this scenario, and the capital loss would reduce total return to around 0% for 2013%, as specified in Figure 1. Since ILBs generally tend to be less volatile than the QTC 2033, the rise in the ILB will be less than the nominal, yet one could expect a 20 point rise in these, leading to a rough total return of around 4.4% over 2013.

Conclusion

As the holidays place investors in a relaxed mood, it seems logical to expect that such a mood might let optimism rise in strength. Moreover, analysts and market participants have some reason to be happy, with the recent passage of fiscal legislation in the United States has fuelled the typical bias for optimism that tends to exist each January. Yet, as the year wears on we are expecting global growth will vary around zero and will be close to recession most of 2013. Such an environment should wear away current optimism, and allow longer term fixed rate debt, like the QTC 2033, to provide around a 10% return for 2013. As cash falls lower, towards 2.50% at the end of 2013, such a return will look very handsome indeed. Moreover, such a long dated bond will come in very handy when current optimism fades, providing a very effective hedge, or form of portfolio insurance, which will provide excellent return to offset any possible loss from the equity market in a low growth environment.