by

Elizabeth Moran | Dec 19, 2012

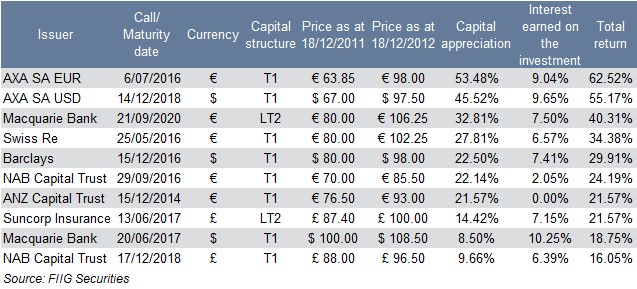

Last week, we published a list of our best performing AUD bonds which had annual returns between 17% and 38%. This week we publish our best performing foreign currency bonds which returned between 16.0% and a whopping 62.5% (not adjusted for currency movements).

Who would have imagined that you could earn over 60% from a defensive asset class investment in just one year? Topping our best performing foreign currency list was the AXA SA EUR security (see Table 1 below). Twelve months ago the security was priced at €63.85 and the price of the security at close of business yesterday was €98.00, providing a capital appreciation of 53.48% and coupled with interest earned of 9.04% provided an annual return of 62.52%, a truly outstanding return.

Three other foreign currency investments returned over 30% over the same period: an AXA SA USD issue (55.17%), a Swiss Re EUR issue (34.38%) and a Macquarie Bank subordinated debt issue (40.31%), which led the performance table for Australian names in both A$ and foreign currency securities.

Surprisingly three Tier 1 hybrids issued by “Big 4” Australian banks made it onto the list: the ANZ Capital Trust and two issues of the NAB Capital Trust. The performance of these securities helps explain why we thought major bank issuance into the domestic listed market was not offering sufficient returns for the risk involved earlier this year.

Both of the securities are step-up perpetuals, meaning there is a greater incentive for the banks to call (repay) at the first opportunity, unlike the new breed of listed bank hybrids where there is no step-up. If for any reason they are not called, the securities then become perpetual. These older style Tier 1 hybrids do not have an equity trigger, where the new Basel III hybrids do, so, if capital falls below a pre-determined level, the securities convert to equity. These foreign currency Tier 1 hybrids have no such clause, meaning they remain higher in the capital structure (in the event the new style are converted to equity) and hence are lower risk than the new ASX listed securities. We liked the wholesale foreign currency securities because they were trading at substantial discounts and we considered them lower risk.

Table 1

If you’d like to learn more about foreign currency investments, please call your local dealer.