by

Elizabeth Moran | Dec 05, 2012

Travelling around and meeting investors, I’m continually bombarded with questions about where to find the best yield. It’s a loaded question though because just searching for the best yield doesn’t take into account the risk involved and if you are being appropriately paid for that risk. That’s the crux really, are you getting value for your investment?

It seems those investors who invested mostly in cash are now concerned about how they are going to pay the bills (I note that 80% of Bloomberg economists expect an interest rate cut tomorrow). Yet those of you that invested in fixed rate bonds should be sitting pretty with high coupon payments (interest) providing high ongoing income and significant capital gains on those bonds. Many are now trading at substantial premiums, giving investors the choice of realising gains if they chose to sell or holding the bonds for the valuable high cashflows that they provide. If you’re in that position, remember if you own more than the minimum parcel size, you could choose to sell part of your holding to take some of the capital gain and keep the rest – that would be a good Christmas present!

But is it too late to catch the fixed income boat? I think not. This article explains where to look for the best returns without taking on the much higher risk and volatility of the share market.

In this low interest rate environment, what does high yield mean? I always took high yield to mean above a 10% return, but that was when the cash rate was higher. I think we all need to appreciate that lower interest rates mean “high” yields are less than a few years ago. So if 10% meant a high yield a few years ago, that was when the cash rate and the bank bill swap rate (BBSW) were higher, around 5%. So to my mind the cash rate or the bank bill swap rate + 500bps (basis points 100bps = 1.00%) means high yield. That would mean high yield in today’s terms would be anything providing a return over approximately 8.25%. But I took a small sample of what my colleagues thought what a high yield was in this market and it varied greatly. Here are some of the responses:

- 7.5% is a high yield but a year ago that figure was higher. It’s a moving target, spreads (the rate over and above a benchmark, in Australia this is the relevant swap rate) move with market sentiment

- 250bps over swap (forward interest rates where banks are indifferent between receiving a fixed or a floating set of cashflows)

- Towards 400bps over swap

- There is significant risk associated with it. Prudent exposure in your portfolio. Investors can afford to risk 10% of their portfolio if they are in retirement but not 50%. High yield = high risk = lower exposure. Anything above 6.5% is high yield

- The cash rate is 3.25%

- Term deposits are around 4.50%

- Add 1% to 2% for bonds, meaning 5.50% to 6.50%

- Investments over 6.5% mean you need to ask yourself what are the extra risks I’m taking and what am I giving up for this higher return?

- There isn’t an established high yield market in Australia. High yield in the US means anything rated sub-investment grade. So anything rated BB+ or below

- To me high yield means anything sub-investment grade but as Australia doesn’t have an established sub- investment grade market like the US, I’d start by assessing what BBB- credits are paying over swap and add a margin. Also high yield to me means the 7% full franked dividends banks are paying on their equities/ shares. Small caps are the equivalent of high risk equity

- There’s a range to what high yield means. In this environment it’s 200bps to 300bps to 600bps+. The MYOB issue paying 675bps over is a good example of high yield. Also I think better credits paying lower yields should still be considered relatively high yield. The Sydney Airport inflation linked bonds come to mind (current spreads range from 400bps to 445bps)

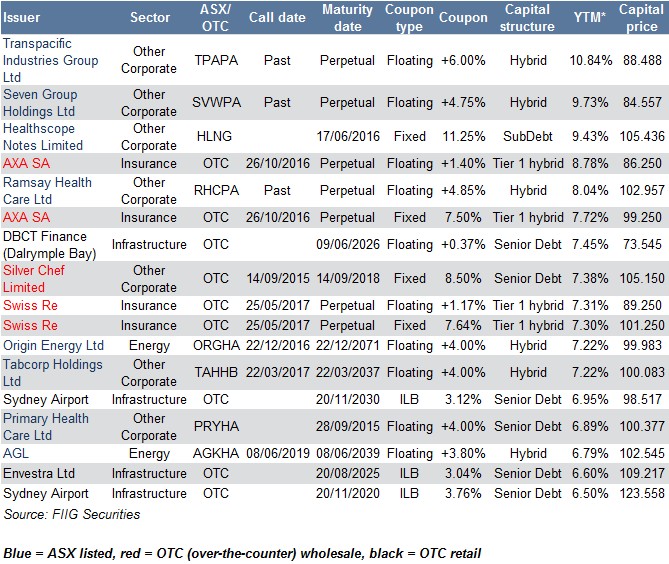

Table 1 shows some high yield fixed income corporate investments (with a yield to maturity of 6.5% +) from the over-the-counter (OTC) market and the ASX listed market. Sitting at the top of the Table, with the highest returns are some perpetual ASX listed hybrids that have passed their first call dates. That means that for investors to see a return of their capital they have to sell those securities, so they act much more like the underlying equities and we would expect price volatility in stressed markets and possible illiquidity. They’re paying those higher returns as compensation for those risks.

The call risk on most of the securities is significant and can be a difficult assessment. Essentially you need to assess the reasons the company would call versus the benefits of not calling and that really needs to be done closer to the call date. The risk of not being paid at the first opportunity (first call) is often why the yield to maturity is high. Should securities not be called you would expect the price of them to drop (thus providing a higher yield).

If you run your eye down the capital structure column you’ll see that many of the securities are ranked low in the capital structure, meaning they are higher risk. Senior debt issues are lower risk but there would be other risks associated with these securities. While all the yields to maturity look attractive, they’re high because there are associated risks. Note that all the following securities are priced to maturity or first call date, however, as detailed above, a number are unlikely to be called or may have gone past their call date already. TPAPA and SVWPA have passed their call dates and essentially regarded as perpetual however, are callable at each coupon payment date.

*YTM for TPAPA, SVWPA and RHCPA is calculated on assumed final maturity of 2050

*Yield for Floating Rate Notes is the swap rate to Maturity/Call plus the trading margin.

*Yield for ILB equals Real Yield plus a current inflation assumption of 2.5%.

Table 1

Comparing risks of the different issues between the ASX listed and OTC markets and individual securities is complex. However, I can say because the OTC market is more of a wholesale market, we tend to see a great flow of larger values of bonds changing hands on a regular basis. Whereas the ASX retail market has a much smaller turnover, which could mean it would be harder to sell large parcels in times of stress. So if you have larger sums to invest, the OTC market would be the better option.

I don’t have the word limit to describe each of the securities listed in any detail, but instead offer a few points to consider:

- Have a look at historic prices of the securities, what’s been the highest and the lowest prices, where does the current price sit in relation to historical pricing? Prices will be a past indicator of perception of risk in different markets

- What risks is the high yield compensating you for? Illiquidity, call risk, credit risk, term to maturity, non-cumulative coupons (meaning interest payments don’t have to be made up if missed) and the company’s history of making payments, cyclical earnings, possible default and possible loss given default are some of the key risks

- Finally, do you think that yield adequately compensates you for all the risks you’ve identified in that security?

Having watched the OTC market for years, I have a natural bias for OTC investment compared to ASX listed securities if you have the larger $50,000 needed to invest in this market. So, no surprise my preferred securities on this list come from that market. The inflation linked bonds remain a standout given their benchmark is to the Consumer Price Index, offering unique inflation protection. Also, they are all investment grade, so low relatively low risk but still paying “high” yields.

Note: All prices and yields are accurate as at 3 December 2012, are a guide only and subject to market availability. Minimum investment amounts differ. FIIG does not make a market in these securities.