by

Dr Stephen J Nash | Dec 12, 2012

This article is an executive summary of a more detailed article that explains how annuity prices and returns are calculated.

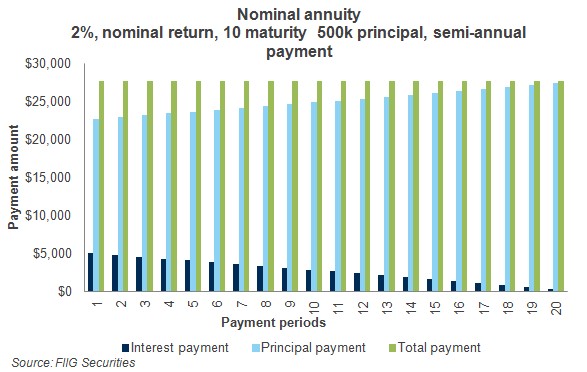

Annuities are very simple; they are an equal repayment over the life of a loan, comprised of increasing principal payments and decreasing interest payments. The present value of an annuity is the value of a series of payments, discounted by the interest rate to account for the payments that are being made at various specified points of time in the future. In many ways, annuities look just like your typical home mortgage payment stream. Such an annuity is also known as a “nominal” annuity, which does not keep pace with inflation.

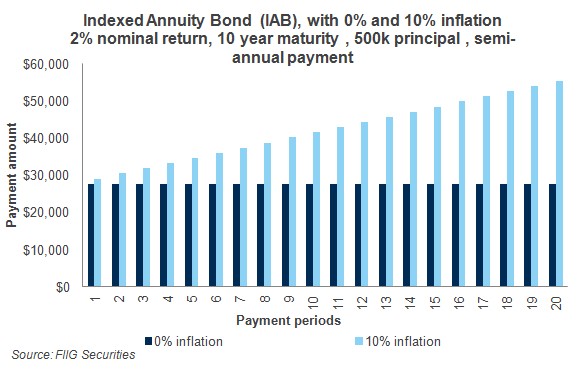

Inflation indexed annuity bonds (IABs) have the annuity payments, which are indexed to inflation. Here, the equal re-payment amount, (known as the “base payment”) is indexed to inflation, so that the value of the base payment remains constant in “real” terms, or after inflation.

We show how to derive an indexed annuity payment stream in four steps. Specifically, when we follow these steps we can derive Figure 1, which shows a nominal annuity payment schedule. Notice how the green bars which represent the total semi-annual repayment are always constant, and the dark blue bars, or the interest payments gradually decline, while the principal payments, shown by the light blue columns, gradually increase.

Figure 1

In order to demonstrate how the IABs protect against inflation, we have graphed an example showing the IAB semi-annual total payments assuming 0% and 10% inflation respectively. The dark blue column in Figure 2 shows the 0% inflation assumption while the light blue columns show the extreme 10% inflation assumption. Notice how the repayments with 10% inflation grow over time, protecting the purchasing power of your capital.

Figure 2

Index annuity bonds provide a real return of 3% over inflation and present a compelling case for investment. Protection against inflation should be an important consideration for all portfolios, and the IAB, which releases principal over the life of the security, allows investors to re-invest in other opportunities as they arise.

Click here to see the full technical article.