Like many other European banks, ING’s main story is its balance sheet restructuring. The bank is currently selling assets and repaying government capital. While the bank contends with the backdrop of a weakening environment, it still achieves sound underlying profitability. The Group also benefits from good diversification, a history of solid asset quality in its loan portfolios and a good capital position at ING Bank.

ING highlighted the following:

- A potential €1.1bn reserve shortfall on the closed Japanese variable annuities book, offset by surpluses elsewhere in Asia. Some or all of this may need to be recognised in future, depending on the order of disposals of other Asian Insurance operations

- The possible need for the US business to issue primary capital in the IPO to replace capital support from the group (in the form of a $1.5bn letter of credit) on a standalone basis

- €200m of new cost saves in Insurance and €260m in the Bank.

Divestment update

- As part of the approval conditions for the aid, ING entered into an agreement with the European Commission (EC) to separate ING’s banking and Insurance/Investment Management (IM) operations and exit Insurance/IM by 2013

- Following the announced divestments of ING Direct Canada and ING Direct UK in August and October, these units were transferred to ‘held for sale’ in 3Q12. These two divestments are expected to yield net transaction gains totalling €0.8bn in 4Q12

- ING continues to discuss various options for ING Life Japan.

Profitability

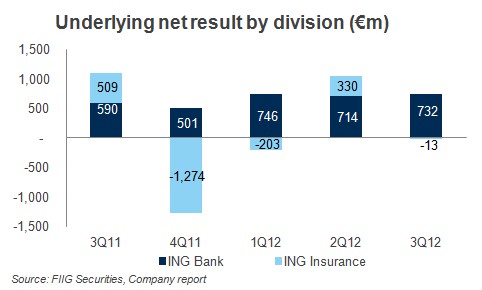

ING Group posted 3Q12 underlying result of €719m a 34% decrease to 3Q11. The banking divisions recorded a solid quarter, with underlying pre-tax results up both year-on-year and sequentially. The underlying result before tax of ING Insurance declined on both quarters, primarily due to negative results on hedges to protect regulatory capital and as Benelux investment margins declining faster than expected.

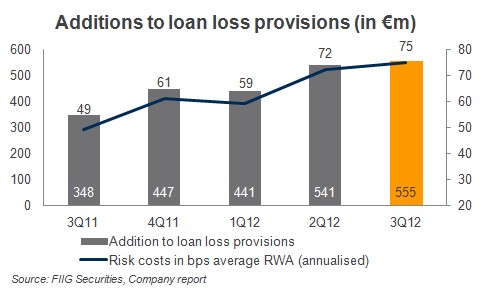

ING Bank - 3Q12 underlying result before tax of ING Bank rose 16.3% from a year ago to €1.02bn. 3Q12 include a €323m gain on the sale of ING’s equity stake in Capital One, which largely offset the €258m impact of losses from de-risking as well as a €173m negative impact of credit valuation and debt valuation adjustments. Underlying interest margin increased to 1.33% from 1.26% in 2Q12, driven by higher interest results and a lower average balance sheet level. Expenses were stable YoY affected by various ongoing cost containment initiatives. Risk costs increased 2.6% from the second quarter, but were 59.5% higher than a year ago, reflecting the weakening macroeconomic environment.

The modest increase compared with 2Q12 was mainly due to Retail Benelux, particularly the mid-corporate and SME segments, and by Retail International due to further provisioning for a CMBS position. Risk costs for the Dutch mortgage portfolio were modestly lower QoQ, despite a slight increase of non-performing loans to 1.3%. Commercial Banking’s risk costs declined QoQ, but remained elevated, notably in Real Estate Finance.

Non-performing loans increased by €0.2bn to €14.5b equating to a stable NPL ratio of 2.3%. The coverage ratio of provisions to NPL was also stable at 38%. Which while appearing low overall, it is high for unsecured lending while lower against lending secured by higher quality collateral.

ING Insurance - Results before tax at ING Insurance decreased 90% to €44m YoY, reflecting losses on hedges as insurance continued to focus on protecting regulatory capital. Results also included a €104m charge for US Closed Block variable annuity related to lapse rate assumption refinements following an annual review of policyholder behaviour assumptions. Results were also impacted by pressure on the investment margin from de-risking measures and low interest rates, as well as from lower Non-Life results in the Benelux, due to higher disability claims.

Capital

ING Bank’s core Tier 1 ratio strengthened to 12.1% from 11.1% 2Q12 due to a €17bn reduction in risk-weighted assets (RWA), of which €7bn was related to the sale of ING’s equity stake in Capital One and €5bn to de-risking.

The sale of ING Direct Canada, announced in August, is expected to have a positive impact on the core Tier 1 ratio of approximately a 0.5% percentage points (expected in 4Q12). The sale of ING Direct UK, announced in October, is expected to have a neutral capital impact when it closes in 2Q13.

Funding

ING state they have completed their 2012 funding programme and have now prefunded into 2013. ING has adequate liquidity with a Liquidity Coverage Ratio under Basel III of above 100% at 3Q12.

Deposits and bonds

At ING Australia, deposits under $250,000 qualify for the Australian Government’s deposit guarantee while their bonds are guaranteed by ING Bank N.V., and offer a higher yield than the ‘big four’ domestic banks.

ING Bank A$ senior bonds are available through FIIG’s DirectBond service in minimum face value parcels of $50,000.

For more information on the bonds and prices, please contact your local dealer.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.