by

Elizabeth Moran | Apr 29, 2014

Key points:

- Investors in shares can access the whole of the ASX listed market. No matter the risk of the company, or the volatility of the share, or the lack of dividend, there are no restrictions on retail investors.

- A better knowledge based approach to allow investors to invest in over-the-counter bonds might be to allow any investor the opportunity to be classified “wholesale” if they can learn about the asset class.

- The weighted average yield to maturity of the suggested wholesale portfolio is 5.70 per cent and the weighted average credit rating is single A on the Standard and Poor’s scale (excluding the non rated G8 Education bond).

Investors in shares can access the whole of the ASX listed market. No matter the risk of the company, or the volatility of the share, or the lack of dividend, there are no restrictions on retail investors. Investors can invest all of their funds in a single, very risky ASX listed investment and while it’s not a sound investment decision, it is possible. Yet when it comes to unlisted bonds there are restrictions in place particularly for retail investors.

All investors are deemed retail investors unless they can establish that they are wholesale investors. One of the hurdles to be a wholesale investor is the value of net assets or gross annual income. If they meet these restrictions, they are then able to invest in a much broader range of securities including bonds in the wholesale over-the-counter market. Bonds and hybrids listed on the ASX retail market do not have these restrictions.

Investors that understand the key concept of where an investment sits in the capital structure (which outlines the priority of payments in liquidation) will appreciate that bonds sit higher in the capital structure than shares in the same company, meaning in liquidation they are repaid before shares and are thus lower risk. However, lower risk bonds are not so freely available.

So a better knowledge based approach to allow investors to invest in over-the-counter bonds might be to allow any investor the opportunity to be classified “wholesale” if they can learn about the asset class, take an approved test and then be assessed as “wholesale” given they can demonstrate an understanding of key concepts and risks involved.

Another option might be to allow investors access to over-the-counter bonds if shares in the same company are available on the ASX or the bonds meet a certain minimum credit rating. Another possibility might be to limit non rated bonds to a certain percentage for retail investors but this still seems unreasonable given the broad availability of non rated shares.

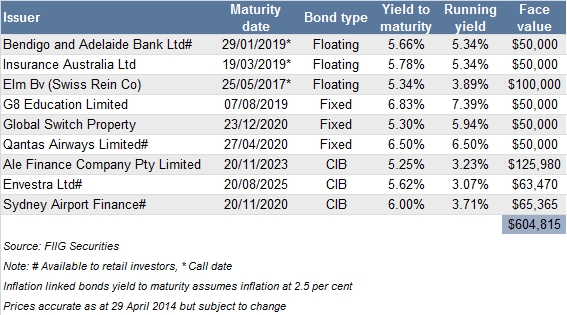

Constructing a model wholesale bond portfolio is still about finding investments that have the best returns given the risk involved. The table shows a model wholesale bond portfolio which also contains some retail bonds.

The bond portfolio invests in three fixed rate, three floating rate and three inflation linked bonds for a total face value investment of $604,815. The weighted average yield to maturity of the portfolio is 5.70 per cent and the weighted average credit rating is single A on the Standard and Poor’s scale (excluding the non rated G8 Education bond). This is a low risk portfolio.

Projected income for the next 12 months is $29,418 and this is expected to rise gradually with increasing inflation. Investors wanting higher returns can reduce the allocation to inflation linked bonds and increase the weighting to non rated, fixed rate bonds where returns can be significantly higher.

Investors may prefer a weighting to one of the three types of bonds given their expectations about the direction of interest rates and economic conditions. They may have foreign currency earning very low rates of return in a cash account in the UK or US, so want bonds in that currency for higher returns.

Bonds are the next best investment to term deposits in terms of risk but are still very difficult for retail investors including some SMSFs to access. Investors that are prepared to learn about the asset class and be accredited by an approved course should be able to be categorised as wholesale investors and invest in the over-the-counter market which constitutes approximately 95 per cent of the total Australian bond market.