Published 12 February 2015

Key points

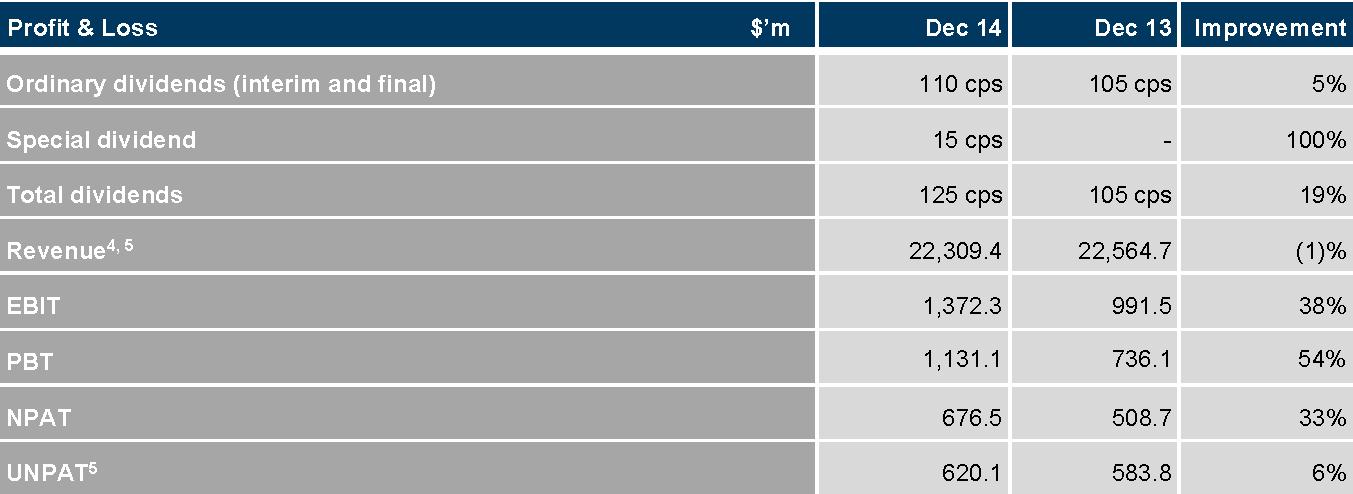

- Leighton Holdings (Leighton) reported underlying NPAT increased 6% to $620m. The results were driven by stable revenues ($22.3bn), strong operating cash flows (up 26% to A$1.6bn) and assets sales, which were used to sharply reduce net gearing to around zero (from 37% in June 2014)

- Significant derisking of the balance sheet including, for the first time, making a $675m provision relating to debts on problem projects

- Solid liquidity was reported with cash from operations up 26% to $1.4bn and cash on balance sheet of around $2.0bn

- The company forecasts FY15 NPAT of $450-520m, expects to sell its property business and continue to reduce mining assets

- Management reiterated their intention to continue restructuring efforts including continued delivering and derisking of the balance sheet and expect further improvement in margins

- Overall positive results, solid credit profile and reliable FY15 guidance

Details

Source: FIIG Securities, Company presentation

Summary

- Untidy FY14 results which included gains from asset sales ($973m), a provision for bad debtors ($675m) and restructuring costs

- Top line NPAT rose 33% to $676.5m and revenue was $24.1bn (down slightly on FY13 $24.4bn)

- Revenue from continuing operations was up 4% to $18bn, underpinned by a 10% increase in construction. Underlying NPAT was up 6% to $620m

- Work in hand declined to $37bn ($30bn from continuing operations) which is a 13% decrease from YE13. Management attributed the decline to a more disciplined approach to pre-contract risk assessment and the impact of macro-economic conditions. Management indicated the current 12 month tender pipeline is above the equivalent pipeline (from a risk perspective) at the time of the FY13 result

Source: FIIG Securities, Company presentation

- Gearing has reduced from 37% at Jun 14 to 30% at Dec 14, but after including the proceeds from asset sales (due to be received in 1H15), the company would be in a pro forma net cash position of $20m at YE14 and therefore negative net gearing

- For the first time, LEI has made a $675m provision relating to debts on problem projects. This has put some “conservatism” in the balance sheet

Efficiency and streamlining the business

- Costs were down 3%

- Reduced a shortfall in contract payments by clients by $2bn (last year the company radically changed the way it collected billions of dollars owed by its customers, including standardising processes across the group, when the level of debts swelled to $5bn)

- Trade receivables stood at $3.4bn compared to $5.4bn six months earlier and working capital has significantly improved by $1.4bn over the same 6 months

Outlook

- The company forecasts $450-520m FY15 NPAT, reflecting a significant reduction in revenue (30-40% mainly from divestments), which should be partially offset by a material improvement in net margins (30-40%). The company needs to achieve $50m of cost savings to meet the low end of the FY15 guidance range which appears achievable given it only represents 0.3% of costs from the company’s continuing operations

Ownership background

- Leighton is currently 69.62% owned by HOCHTIEF AG, which is in turn 50.35% owned by ACS. Both entities have financial profiles that are significantly weaker than Leighton

- There is limited risk however of financial support being provided to the parent by Leighton, in the short to medium term, other than normal dividend distributions

- Provisions in HOCHTIEF’s debt and bond facilities prohibit almost all transactions with ACS, including upstream guarantees and loans, profit transfers, and non-arms-length transactions. In relation to dividends, HOCHTIEF has undertaken that it will not propose to pay a dividend of 75% or more. The same level of protection does not, at this stage, apply between HOCHTIEF as parent and Leighton

Bondholder protections: Change of control/downgrade

- The bond indenture (Leighton Finance USA 2022s) provides bondholders the right to put the bonds back to the company at a purchase price equal to 101% of the principal plus any accrued and unpaid interest if any single party appoints more than 50% of seats on the board, which results in Leighton being downgraded to sub-investment grade shortly after the event (by two rating agencies)

- Therefore, bondholders have the right (not obligation) to put the bonds back at $101. This effectively provides a base at which they can sell their bonds if a change of control drives a downgrade to sub-investment, noting this is however significantly lower than the current circa $110 pricing

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.