by

Elizabeth Moran | Nov 07, 2012

Lloyds reported 3Q12 and nine months to 30 September 2012 results last week. Once again the progress in balance sheet restructuring, risk weighted asset run-down and reduction in impairments was overshadowed by more provisions for mis-selling payment protection insurance (PPI).

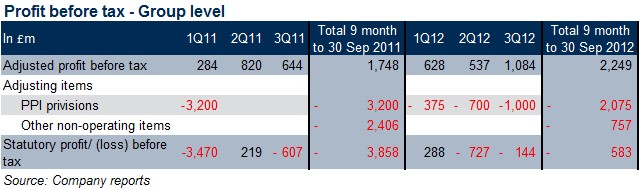

Like Barclays, Lloyds reports its profits on a statutory and adjusted basis. On a statutory basis, the bank reported a statutory pre-tax loss of £144m in 3Q12, and £583m loss for the nine months to 30 September 2012 (9M12); however it was an 85% improvement compared to a £3.9bn statutory loss for nine months to 30 September 2011 (9M11).

On an underlying basis, stripping all one-off charges, Lloyds reported a profit of £1.1bn in 3Q12, and £2.2bn for 9M12, up 29% compared to £1.7bn for 9M11 (see Table 1 for more details). Lloyds took another charge of £1.0bn for PPI provisions in 3Q12, taking the total to £2.1bn in 2012 and £5.3bn overall. Lloyds’ provisions are much higher than its UK peers as the bank had the biggest share of the PPI market, and it is likely to affect bank’s profitability for a few more quarters.

Table 1

Other key points to note:

- Impairment charges continued to drop, reflecting further improvement in the quality of assets and the Bank’s portfolio. Lloyds reported charges of £1.3bn in 3Q12, down 16% and 24% compared to £1.5bn in 2Q12 and £1.7bn in 1Q12 respectively. In 9M12, the charges dropped 40% to £4.4bn from £7.4bn, driven by reduction in Retail Irish and Australasian portfolios

- Lloyds showed progress in cost reduction driven by its Simplification program (reshaping and simplifying the business to achieve a target run-rate cost saving of £1.9bn). Total costs decreased 5% in 9M12 to £7.5bn, compared to £7.9bn in 9M11. The run-rate totalled £660m, with the program contributing cost saving of £483m in 9M12

- In line with the balance sheet strengthening program, deposits grew 5% to £421.bn (£419.1bn 2Q12). As a result, the loan to deposit ratio reduced to 124% (126% 2Q12). The need for wholesale funding reduced by 13% to £186.2bn in 3Q12 (£213.8bn 2Q12), of which £61.6bn or 33% matures in the next 12 months. Total liquidity stands at £210.6bn and is 3.4x the short term funding requirement

- During 9M12, Lloyds bought over £10bn of its own debt (in various currencies). The bank had total liquid assets of £211bn, and had completed its 2012 funding requirement in 1Q12

- The sale and wind down of non-core assets was slower, but still ahead of schedule, decreasing a further 7% in 3Q12 to £110bn, now representing less than 12% of total assets. In turn, risk weighted assets in the Non-core division also reduced by 9% (to £84.6bn from £93.4bn) over the quarter and 22% (from £108.8bn) over 9M12, reflecting a substantial reduction of risk achieved over the period

- Core Tier 1 ratio was 11.5%, up 0.2% and 0.7% from 11.3% in 2Q12 and 10.8% in 4Q11. Lloyds calculated its fully-loaded Basel III Common Equity Tier 1 ratio of 7.7%

- Banking net interest margin was down 8bps to 1.93% and in line with expectations as funding costs increased

- Total direct exposure to PIIGS stands at £20.1bn, or around 2% of total assets, the lion’s share (67% or £13.5bn) of that exposure is attributable to Ireland

- Lloyds has €, £ and $ callable securities with a first call date in 2012. However, the Bank is unlikely to call these securities at the first opportunity (at least in 2012), as they need approval from the Financial Services Authority (FSA) (UK regulator), and the bank has yet to repay the UK government, which we expect before any subordinated debts holders are redeemed at first call

- Like other British banks, Lloyds is likely to be impacted by the retail bank ring fencing legislation, although to a lesser extent given most of its business will sit within the ring fence

Lloyds’ bonds

Lloyds has A$ senior debt that matures in November 2013, October 2014 and October 2015 with yields to maturity ranging from 3.5% to 4.1%.

Lloyds’ senior debt ranks the same as its deposits in the capital structure and I think it very unlikely the UK government would allow deposit holders to incur any loss. In that instance, part government ownership, while negative also has positive implications. The UK government is already committed to supporting the bank despite moves by credit rating agencies, suggesting reduced support. The enormous loss of standing in global financial markets of allowing Lloyds ranked in the top three banks in the UK to fail cannot be underestimated.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.