Morgan Stanley (MS) reported an NPAT loss of US$1.0bn for 3Q12 compared US$2.1bn the prior year on revenues of US$5.3bn compared with US$9.8bn a year ago. Results were impacted by negative revenue of US$2.3bn (compared with positive revenue of US$3.4bn a year ago) relating to changes in MS’s debt-related credit spreads and other credit factors such as debt valuation adjustments (DVA). Excluding DVA, net revenues for the current quarter were US$7.6bn compared with US$6.4bn.

Investment banking revenue was 12% higher than the prior year due to stronger fixed income underwriting fees. Equity underwriting and advisory fees declined as the global outlook remains subdued. Lower market volume also hurt equity trading results, down 8% year over year. Fixed income, currency, and commodity trading results increased 33% over the same period, reflecting the improved market conditions.

Wealth management revenues improved slightly however were impacted by one-time costs associated with MS’s purchase of a larger stake in its wealth management joint venture and integration costs.

MS’s Tier 1 capital ratio was 16.7% and Tier 1 common ratio was 13.7% 3Q11. MS’s current projected Basel III Tier 1 common ratio was more than 9% as at 3Q12. Subject to regulatory approvals MS may seek to return more capital to shareholders in 2013.

Source: FIIG Securities, company report

Figure 1

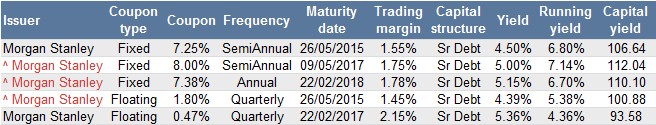

Morgan Stanley has a range of A$ DirectBonds in both fixed and floating offering attractive yields, various maturities and the security of senior debt. See Figure 2 for full details.

Red = wholesale, black = retail

Figure 2

For more information please call your local dealer. All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.