by

Justin McCarthy | Sep 09, 2014

Key points:

- 360 Capital Investment Management Limited launched a $50m fixed rate bond issue yesterday with the ability to take oversubscriptions of up to $75m.

- The bonds are senior unsecured and will pay 6.90% p.a. with maturity in five years.

- The 360 Capital Group is an ASX listed (ASX: TGP) real estate investment and funds management group that concentrates on the strategic investment in, and active investment management of, real estate and real estate related assets.

Key Highlights

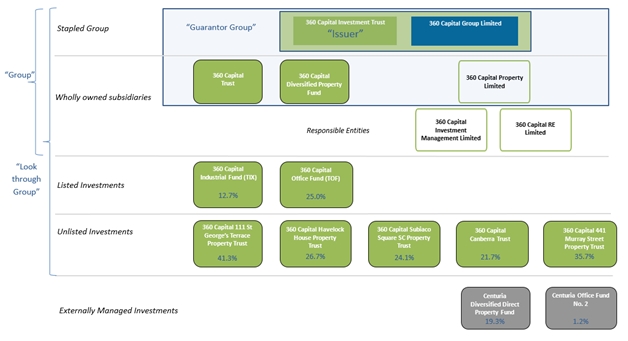

- The 360 Capital Group is an Australian property funds management group comprising 360 Capital Group Limited ("360 Capital") and 360 Capital Investment Management Limited as responsible entity of the 360 Capital Investment Trust (the "Issuer")

- 360 Capital and the Issuer of the Notes (together the "360 Capital Group") are listed on the ASX as a stapled security (ASX: TGP) with a current market cap of approx. AUD 240m

- 360 Capital manages nine investment vehicles holding 33 industrial, office and retail assets across Australia valued at more than AUD 1.0bn on behalf of over 10,800 investors and has over AUD 100m in co-investments in its managed funds and a direct asset valued at AUD 38.5m

- Total funds under management are well diversified across the 5 major Australian states, with high occupancy levels (99%) and long WALE (4.8 years)

- Co-investments align the interests of the 360 Capital Group with underlying fund investors and provide income through distributions and capital growth in property values

- The fixed rate notes are senior unsecured obligations of the Issuer, guaranteed by 360 Capital and certain controlled entities of both 360 Capital and the Issuer

The Notes

360 Capital Investment Management Limited (ABN 38 133 363 185) as responsible entity of the 360 Capital Investment Trust (ARSN 104 552 598) ("Issuer"), guaranteed by 360 Capital Group Limited (ABN 18 113 569 136) ("360 Capital") and certain controlled entities of 360 Capital and the Issuer, to issue AUD 50m senior unsecured and unsubordinated Australian Dollar Fixed Rate Notes ("Notes")

360 Capital Group (ASX: TGP) has today launched the issue of a five year, senior unsecured fixed rate note issue ("Notes") with an indicative interest rate of 6.90% per annum available exclusively through FIIG Securities Limited ("FIIG"). 360 Capital Group is seeking to raise AUD 50,000,000 to repay senior secured bank debt, acquire the remaining 41.1% of units in the 360 Capital Diversified Property Fund ("DPF") that it does not own and provide working capital. 360 Capital Group will accept a minimum of AUD 50m and will take over-subscriptions of up to AUD 75m.

FIIG is the Sole Lead Arranger for this transaction and the Notes are available to wholesale clients only (pursuant to the Corporations Act Cth 2001), with an initial minimum subscription of AUD 50,000 and in increments of AUD 10,000 thereafter.

The Issuer - 360 Capital Group

The Issuer and 360 Capital, and their controlled entities, are together the 360 Capital Group (see simplified group structure diagram* below). The 360 Capital Group is an ASX listed (ASX: TGP) real estate investment and funds management group that concentrates on the strategic investment in, and active investment management of, real estate and real estate related

For more information about the 360 Capital Group please visit their website or go to the ASX website and search TGP.

We also recommend reading the FIIG Research Report on 360 Capital Group.

*assumes 100% ownership of DPF after buyout of minority unitholders

The Preliminary Information Memorandum, which is subject to completion and amendment, dated 9 September 2014 includes the draft terms and conditions of the Notes. A summary of the Notes is included below in "Notes summary".

Who should consider this offer

The Notes are an attractive investment for wholesale clients looking to lock in a high fixed rate of return and/or are looking to diversify their fixed income exposure.

How to find out more and to apply

For more information talk to your FIIG Representative.

To provide your Firm Bid for Notes contact your FIIG Representative on 1800 01 01 81 or alternatively email newissue@fiig.com.au.

Important information

The information has not been lodged with Australian Securities and Investments Commission or any other authority. Any securities that may be offered by the Issuer in, or into, Australia are offered only as an offer that would not require disclosure to investors under Part 6D.2 or 7.9 of the Corporations Act. The information is a summary only and does not purport to be complete. It does not amount to an express or implied recommendation or a statement of opinion (or a report or either of those things) with respect to any investment in the Issuer nor does it constitute a financial product or financial advice. The information does not take into account the investment objectives, financial situation or needs of any particular investor. FIIG does not provide accounting, tax or legal advice. Prospective investors are required to make their own independent investigation and appraisal of the business and financial condition of the Issuer and the nature of any securities that may be issued by the Issuer. By accepting receipt of the information the recipient will be deemed to represent that they possess, either individually or through their advisers, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial securities discussed herein.

FIIG has been engaged by 360 Capital Group to arrange the issue and sale of the Notes by the company and will receive fees from the issuer of the Notes. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.

Disclaimer

FIIG Securities Limited ('FIIG') provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a 'wholesale client' as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG's current Financial Services Guide is available at www.fiig.com.au/fsg.