by

Justin McCarthy | Jun 24, 2014

We have initiated coverage of Newcrest Mining Limited with a positive credit view. The executive summary of the research report is reproduced below (and wholesale clients can access the full report by following the link and using their login and password).

Executive summary

- Newcrest Mining Limited (ASX:NCM) is Australia’s largest ASX listed gold producer and ranked in the top five global producers by output. With a current market capitalisation of $8.3bn it is ranked as one of the top 20 companies on the ASX by market capitalisation

- The company owns six operations across four countries in the Asia Pacific and Africa. Almost 50% of revenue is generated from its Australian operations

- Gold accounts for ~84% of revenue followed by copper ~15% while silver accounts for just over 1% (based on FY13 actual results)

- Current gold reserves are approx. 80Moz and resources 148Moz which ranks it in the top three in the world and based on current production levels has a reserve life of 33 years

- Newcrest is on track to provide full year gold production for FY14 around the top end of their guidance at 2.3Moz

- All-in sustaining costs (YTD to Mar 14) have reduced 22.2% year on year from A$1,283/oz to A$998/oz. A key contributor to keeping these costs low and possibly lower is the Cadia Valley mine which has an all in cost of A$325 YTD

- Newcrest have recently undertaken substantial capital expenditure at two of its primary operations which has been funded by bank debt. Debt levels are currently at peak levels with the impact from this capital expenditure now expected to flow through to the cash flow position with improvement in both production output as well as a lower overall all-in cost of gold

Wholesale clients can access the full research report at the following link (using their login and password).

USD DirectBonds

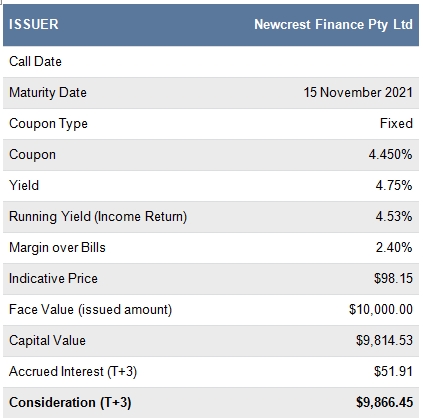

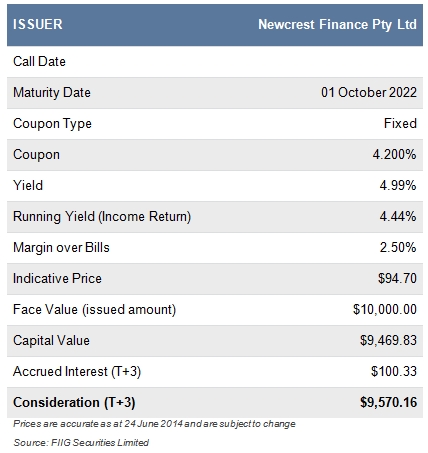

FIIG Securities has two high yielding investment grade USD Newcrest DirectBonds available to wholesale clients in minimum (face value) parcel sizes of USD $10,000. Both bonds are issued by Newcrest Finance Pty Ltd but are guaranteed by Newcrest Mining Limited (and other subsidiaries).

Details of the two bonds, including indicative pricing, are in the following tables. Given the positive credit view and significant size and stature of the Newcrest Mining Group on a global scale, we consider the bonds to offer attractive USD returns for the risk involved. Further, investment parcels are as little as USD $10,000.

Please speak to your FIIG representative if you are interested in the USD Newcrest Finance Pty Ltd bonds.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

The Newcrest Finance Pty Ltd USD bonds are only available to wholesale investors and in minimum parcel sizes from USD $10,000.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.