by

Dr. Stephen Nash | Mar 20, 2013

One typically thinks of a pilgrimage in terms of a journey of moral or spiritual significance. While Obama is not in the Middle East for spiritual renewal, he may need help from the many religions that call Jerusalem home, in order to execute his mission in the Middle East; to placate an angry Israel. As you hear repeated references to the Obama journey to Israel and Jordan this week, we encourage you to think about why Obama is in the Middle East, and what risks are evident at this time, especially risks of elevated inflation.

While many investors are now concerned about inflation emerging from excessive quantitative easing in the developed world, we think the more urgent risk to inflation might come from a more traditional source; the oil price. In elaborating this risk, we do the following:

- reflect on the history of prior oil shocks,

- consider recent political developments, especially the forthcoming visit by Obama to the Middle East,

- refer to some of the theoretical work on the translation of oil price rises to domestic inflation, and

- review some of the work from last week on inflation insurance from different asset classes.

History of oil shocks

Generally, the oil crisis in the 1970s came in three main “waves” of concern, which can be described as follows:

- Wave one, supply constraints: Initially, the rise in the oil prices was created by an imbalance of demand and supply, when financial markets sensed that production of oil, in the developed world, had begun to peak. While demand was perceived to be constant, the sudden realization of supply constraints led oil prices higher; much higher than any historical precedent,

- Wave two, Yom Kippur war and embargo: if you need a precedent for an unprovoked strike on Israel by Arab nations, then this is it. Specifically, the war began on October 6 1973, when a coalition of Arab nations executed a surprise attack upon Israel on the holiest day in Judaism; Yom Kippur, which also happened to coincide with the Muslim holy month of Ramadan. Arab forces crossed ceasefire lines, by entering the Israeli-held Sinai Peninsula and Golan Heights respectively. Here, a U.S. decision to supply Israeli military during the Yom Kippur war led Arab nations to place an embargo on exports of oil to the U.S. As a result, the U.S. engineered a peace deal that led to a withdrawal of the embargo around March 1974, and

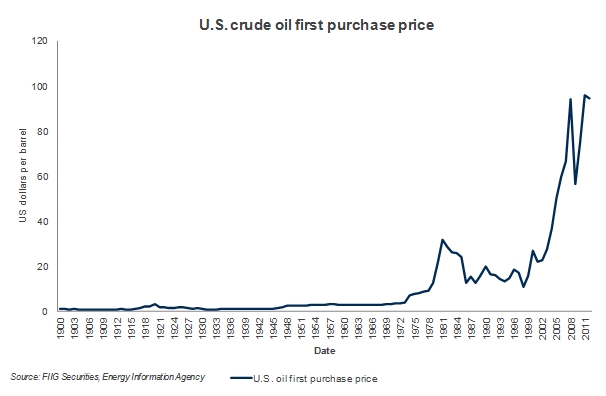

- Wave three, Iranian revolution: Once again politics intervened in the oil market, and departure of the Shah of Iran, allowed the ascent of Ayatollah Khomeini to power. Protests were rampant and led to many diplomatic clashes with the U.S., and others. For example, many U.S. citizens were held hostage for 444 days, from November 4 1979 to January 1981. Such clashes interrupted oil supply, and while Saudi Arabia tried to increase production, oil prices rose dramatically, as the below Figure indicates.

Figure 1

As the above account indicates, the oil price has been impacted in the past from both imbalances in demand and supply, yet politics has played a very large part as well. In particular, the division between the US and Israel, on the one hand, and the Arab countries on the other hand, has remained a crucial factor.

Recent political developments

Given the above history, and the breakout in inflation that ensued in the 1970’s, investors should now focus on more recent political developments, and the prospects for higher oil prices. Here, one can note that President Obama has recently indicated that Iran will have nuclear capabilities in around one year, in comments that precede the first visit by Obama as president to Israel. While this time line towards nuclear weapon capability appears to delay ideas of an immediate strike on Iran, Obama pledged support for Israel.

Taking these considerations together, it seems that the US is about to try and diffuse the concerns of the Israeli administration regarding Iranian nuclear capabilities. Specifically, the Israeli administration has aired a willingness to strike Iran in the spring or summer of 2013. All these issues were summed up by Dan Shapiro, US Ambassador to Israel in a recent joint press briefing with the Deputy National Security Advisor for Strategic Communications, Ben Rhodes,

I think part of the excitement stems from seeing very much in the same terms that we do; it's a manifestation of the close, enduring and warm ties between our two democracies, countries that share common interests and common values. And it's a reaffirmation of our commitments to each other, including the United States' strong, really unbreakable commitment to Israel's security. So I think Israelis feel good about that. But they also realize that at a time of a lot of uncertainty and change in the region, there’s great importance to our leaders getting together and engaging in some very intensive consultations on the critical issues that are really in their neck of the woods, in their backyard -- Iran, and preventing Iran from acquiring a nuclear weapon; obviously the dangerous situation in Syria; the constant importance of trying to make progress toward two states with two people -- with the Palestinian people through direct negotiations (Ambassador Shapiro, Press Briefing by Deputy National Security Advisor for Strategic Communications Ben Rhodes and U.S. Ambassador to Israel Dan Shapiro, 14 March 2013).

All this suggests, among other things, that the U.S. has Israel under control, and that it will succeed in diffusing current tension, so that a strike by Israel, on Iran, does not occur and cause concern in oil markets.

And this is the point of all the diplomacy; oil.

Crucially, if financial markets sense an escalation of the current Syrian conflict, especially a strike by Israel on Iran, then oil prices could well break upwards, towards US $150 per barrel.

Theoretical work: oil and inflation

As we argued last week, commodity prices do not necessarily translate directly into inflation, as inflation is not simply the composite of commodity prices. Rather inflation represents a complex mixture of labour costs, technological innovation, and commodity prices, among other things. Relationships between these various aspects of inflation also change over time. As one might expect, the translation of oil prices into inflation is part of a burgeoning literature, especially by central banks. Some argue that the rise in inflation experienced in the 1970’s was partly to do with disagreement with the promotion of price stability as a policy goal, and a lack of credibility with regard to the pursuit of that goal (Barsky and Kilian 2002). Given that price stability is now widely accepted as a goal of central banks, and that credibility in pursuing that goal has now been established, some have argued that rises in oil prices should not impact inflation going forward.

However, we would agree that elevated oil prices will translate to some elevation inflation, although less inflation than was experienced in the 1970s, as Hamilton 2009, has argued (see also Bernanke, Gertler and Watson 1997). Countering this expectation of some increase in inflation due to sustained elevations in the oil price is the idea that inflation fighting credibility will constrain growth in inflation

To the extent that the public views the central bank’s commitment to price stability as credible, the pass-through from oil price shocks to the domestic price level is not associated with sustained inflation (Kilian, 2009, p.2).

While we agree that central bank credibility will remain important to any possible translation of oil prices to domestic inflation, that credibility remains just one of many factors that will operate if oil prices become elevated. Factors that may lead to an elevation of domestic inflation are as follows:

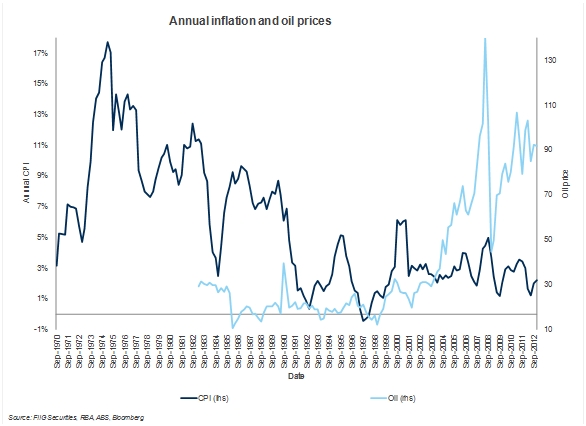

- the period over which the oil price is elevated, since the 2008 experience was one where the oil price elevation was only quite short, as shown below,

Figure 2

- the extent of the oil price rise, as the 2008 experience led to oil prices of around USD 140, and the recent elevations have centred around USD 90 dollars. Elevations in the oil price, towards the USD 150 area are more than feasible if a conflict in the Middle East erupts,

- the longer any potential conflict lasts, the larger the potential impact on domestic wage claims, as the effects of higher oil prices become part of the general price level, or as higher oil prices increase transport costs, and then elevate most prices for finished goods, and

- the trajectory of the domestic economy would also be important, as if growth remains around trend, with an elevated oil price, the potential for wage claims to elevate is higher, than in the situation where the economy is experiencing significant sub-trend growth.

There is some good news since some factors that will moderate rises in inflation due to an elevated oil price will be:

- continued labour substitution, from high cost countries, like Australia, to low cost countries, like China, yet at a reduced pace than of late,

- increased use of technology and the decline in manufactured goods prices, due to more effective production techniques,

- continued consumer confidence in the RBA’s inflation fighting credibility, and

- declines in manufactured electronics continues as technology improves.

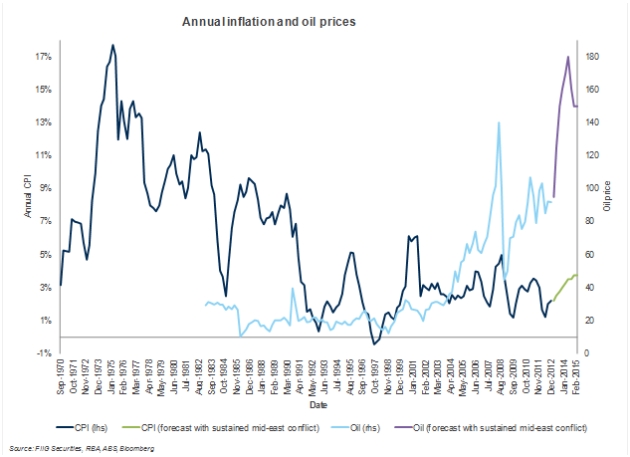

These factors, among many others, may well be represented in the below forecasts for inflation with a sustained high oil price, due to a conflict in the Middle East; between Israel and Iran.

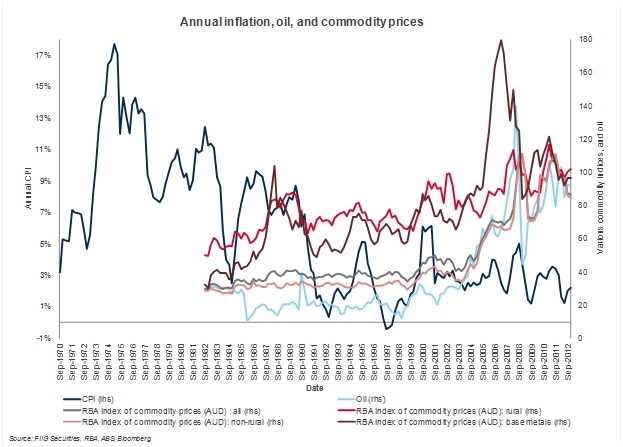

However, the additional issue may be that a rise in oil may well be associated with elevations in other commodity prices. As the below Figure indicates, most commodity prices have already risen and this will provide a floor for inflation, going forward.

Asset class insurance against inflation

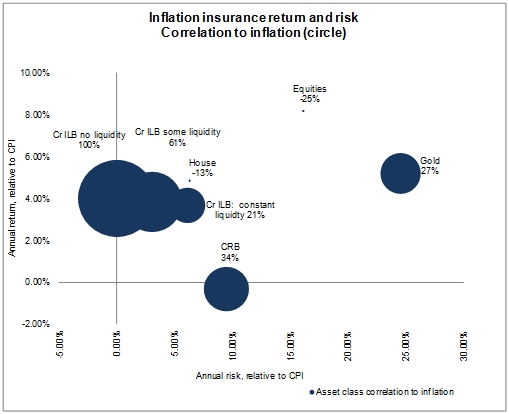

As we saw last week, many asset classes have been mistakenly seen as good forms of insurance against inflation. And we dismissed them as being poor forms of insurance. While these other assets perform other important portfolio roles, like return diversity, and exposure to underlying economic growth, they do not, and cannot, insure against inflation. We can represent the findings from last week, in a new way, where the return and risk of each asset class is shown, relative to inflation. However, in addition, we show the correlation of each asset class as an increasingly large circle. Hence, large correlations have large circles. However, there is a problem, as some asset classes have negative correlations, and it is difficult to represent a negative value as an area, so we place the negative correlation asset classes as small dots.

Of most importance is the size of the circles for inflation linked bonds, and how correlation improves as the need for liquidity is reduced. Solid investment grade ILBs offer low risk to inflation, and relatively high returns.

Figure 5

Conclusion

As we indicated last week, inflation needs to be taken seriously in the construction of portfolios, especially unexpected inflation, and ILBs have a crucial role to play in this portfolio insurance. Many possible scenarios support elevated inflation at this time. However, we think that the real and present danger for inflation lies is not in quantitative easing, but in the Middle East. It is no accident that President Obama is embarking on a journey to the Middle East; a journey that we think is designed to comfort and re-assure an understandably paranoid Israeli administration. Having the Syrian conflict on your doorstep, with ongoing weapon transfers to hostile parties, represents just part of the context for the current Israelis discomfort, along with instability in Egypt, ongoing frustrations with Gaza, and the sanctions against Iran galvanizing hatred against Israel. Obama will have a lot of soothing to do in Israel, a country that cannot forget prior Arab aggression, as experienced in the Yom Kippur war of 1973, and elsewhere, as the U.S. cannot afford an elevation in the oil price with an economy about to feel the chill of a large fiscal drag over summer.

Regardless of the political intrigue, the threat to inflation from a sustained elevation in the oil price, remains evident. While moderating factors will work against a dramatic elevation in the domestic rate of inflation, a rise in inflation, possibly above the RBA band may well occur if a sustained conflict in the Middle East occurs, and oil prices remain elevated for an extended period.

Such a scenario just serves to underline the already strong case for allocating to insurance from inflation, in the form of inflation linked bonds, while they are still reasonably inexpensive.

List of References

- Ahmed S. and Cardinale M., 2005,‘Does inflation matter for equity returns?', Journal of Asset Management, 6, 259-73.

- Ang, A. Wei, M. and Bekaert, G., 2008, The Term Structure of Real Rates and Expected Inflation, 63(2) Journal of Finance, 797-849.

- Australian Bureau of Statistics, 2011, Information Paper: Introduction of the 16th Series Australian Consumer Price Index, Australia, September (cat. no. 6470.0).

- Australian Bureau of Statistics, 2005, Information Paper: The Introduction of Hedonic Price Indices for personal Computers, (cat. 6458.0).

- Alquist R and L Kilian (forthcoming), ‘What Do We Learn from the Price of Crude Oil Futures?’, Journal of Applied Econometrics.

- Balke NS, SPA Brown and MK Yücel (2009), ‘Oil Price Shocks and U.S. Economic Activity: An International Perspective’, mimeo, Federal Reserve Bank of Dallas.

- Barsky RB and L Kilian (2002), ‘Do We Really Know that Oil Caused the Great Stagflation? A Monetary Alternative’, in BS Bernanke and KS Rogoff (eds), NBER Macroeconomics Annual 2001, 16, MIT Press, Cambridge, pp 137–183.

- Barsky RB and L Kilian (2004), ‘Oil and the Macroeconomy since the 1970s’, Journal of Economic Perspectives, 18(4), pp 115–134.

- Bernanke BS, M Gertler and M Watson (1997), ‘Systematic Monetary Policy and the Effects of Oil Price Shocks’, Brookings Papers on Economic Activity, 1, pp 91–142.

- Blanchard OJ and J Galí (2010), ‘The Macroeconomic Effects of Oil Price Shocks: Why Are the 2000s So Different from the 1970s?’, in J Galí and M Gertler (eds), International Dimensions of Monetary Policy, University of Chicago Press, Chicago, pp 373–421.

- Bodenstein M, Erceg CJ and L Guerrieri (2007), ‘Oil Shocks and External Adjustment’, Board of Governors of the Federal Reserve System International Finance Discussion Paper No 897.

- Bohi DR (1989), Energy Price Shocks and Macroeconomic Performance, Resources for the Future, Washington DC.

- Bruno M and J Sachs (1982), ‘Input Price Shocks and the Slowdown in Economic Growth: The Case of U.K. Manufacturing’, Review of Economic Studies, 49(5), pp 679–705.

- den Haan WJ (2000), ‘The Comovement between Output and Prices’, Journal of Monetary Economics, 46(1), pp 3–30.

- den Haan WJ and SW Sumner (2004), ‘The Comovement between Real Activity and Prices in the G7’, European Economic Review, 48(6), pp 1333–1347.

- Dvir E and KS Rogoff (2009), ‘The Three Epochs of Oil’, Boston College Working Paper in Economics No 706.

- Edelstein P and L Kilian (2007), ‘The Response of Business Fixed Investment to Changes in Energy Prices: A Test of Some Hypotheses about the Transmission of Energy Price Shocks’, B.E. Journal of Macroeconomics, 7(1) (Contributions), Article 35.

- Edelstein P and L Kilian (2009), ‘How Sensitive Are Consumer Expenditures to Retail Energy Prices?’, Journal of Monetary Economics, 56(6), pp 766–779.

- Hamilton JD (2009), ‘Causes and Consequences of the Oil Shock of 2007–08’, Brookings Papers on Economic Activity, 1, pp 215–261.

- Kilian L (2008a), ‘A Comparison of the Effects of Exogenous Oil Supply Shocks on Output and Inflation in the G7 Countries’, Journal of the European Economic Association, 6(1), pp 78–121.

- Kilian L (2008b), ‘The Economic Effects of Energy Price Shocks’, Journal of Economic Literature, 46(4), pp 871–909. 84 Lutz Kilian

- Kilian L (2008c), ‘Exogenous Oil Supply Shocks: How Big Are They and How Much Do They Matter for the U.S. Economy?’, Review of Economics and Statistics, 90(2), pp 216–240.

- Kilian L (2009a), ‘Comment on “Causes and Consequences of the Oil Shock of 2007–08” by JD Hamilton’, Brookings Papers on Economic Activity, 1, pp 267–278.

- Kilian L (2009b), ‘Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market’, American Economic Review, 99(3), pp 1053–1069.

- Kilian L (2010), ‘Explaining Fluctuations in Gasoline Prices: A Joint Model of the Global Crude Oil Market and the U.S. Retail Gasoline Market’, Energy Journal, 31(2), pp 103–128.

- Kilian L and B Hicks (2009), ‘Did Unexpectedly Strong Economic Growth Cause the Oil Price Shock of 2003–2008?’, CEPR Discussion Paper No 7265.

- Kilian L and LT Lewis (2009), ‘Does the Fed Respond to Oil Price Shocks?’, mimeo, Department of Economics, University of Michigan.

- Kilian L and C Park (2009), ‘The Impact of Oil Price Shocks on the U.S. Stock Market’, International Economic Review, 50(4), pp 1267–1287.

- Kilian L, A Rebucci and N Spatafora (2009), ‘Oil Shocks and External Balances’, Journal of International Economics, 77(2), pp 181–194.

- Kilian L and C Vega (2008), ‘Do Energy Prices Respond to U.S. Macroeconomic News? A Test of the Hypothesis of Predetermined Energy Prices’, CEPR Discussion Paper No 7015.

- Kilian, L (2009), ‘Oil Price Shocks, Monetary Policy and Stagflation’, Conference paper, Inflation in an Era of Relative Price Shocks 17–18 August 2009, jointly hosted by the Reserve Bank of Australia and the Centre for Applied Macroeconomic Analysis.

- Kilian L and RJ Vigfusson (2009), ‘Pitfalls in Estimating Asymmetric Effects of Energy Price Shocks’, Board of Governors of the Federal Reserve System International Finance Discussion Paper No 970.

- Nakov A and A Pescatori (2010), ‘Monetary Policy Trade-Offs with a Dominant Oil Producer’, Journal of Money, Credit and Banking, 42(1), pp 1–32.

- Rotemberg JJ and M Woodford (1996), ‘Imperfect Competition and the Effects of Energy Price Increases on Economic Activity’, Journal of Money, Credit and Banking, 28(4), pp 549–577.