Key points:

- Conditions remain difficult in the airline sector.

- Headline loss of $254m for the half.

- Job losses of 5,000 announced as the company seeks to bring down costs.

- Question remains over the form of government support – an opportunity to take profits for those recently trading the bond.

Last week Qantas Airways Limited (Qantas) announced a $254m loss for the first half. This loss was foreshadowed by CEO Alan Joyce in December when he provided a guidance update (guidance for the first half of a loss of between $250m to $300m) which we covered in the article “Qantas balance sheet strength offers an opportunity” here.

A number of industry fundamentals affected Qantas’ performance for the half (which also affected its competitor Virgin, which announced its own loss later in the week) including increased capacity in the domestic market placing pressure on pricing; uncompetitive cost base and work practices; high AUD and fuel costs and a distorted market place (that is Virgin’s foreign government ownership structure).

In response Qantas announced it was accelerating its business transformation including staff cuts of up to 5,000 full time equivalents, adjusting its existing fleet including removal of older, less efficient aircraft and removal of unprofitable routes and a reduction in capital expenditure by delaying new aircraft acquisitions. The company is also exploring/undertaking a number of other options including the sale and lease back of terminal space.

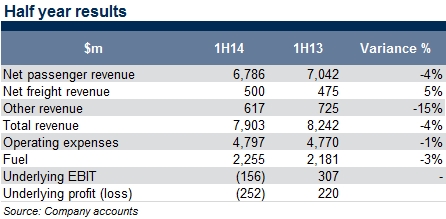

Revenue for the half was 4% down on the prior comparable period as continued competition and increased fleet capacity in the market led to subdued passenger yields for the half.

Should I stay or should I go?

For clients, who are content to earn a solid yield and are happy holding the bonds until maturity, we believe they should continue to do so. This remains a very asset rich company with a significant market capitalisation, despite the recent sell off. Selling off just the frequent flyer business pays out bond holders, and while the return of an investment grade rating would be dependent on some government invention, we fundamentally do not believe Qantas is going anywhere soon.

For those clients that bought Qantas in the period December through February, where spreads moved wider on the back of Alan Joyce’s earlier announcement, this may be a good time to book some profits (either all or some of your holdings) – given price movements, you should have achieved a very strong annualised return – always a good thing. With the government hamstrung on its desire to change the Qantas Sale Act, and the Prime Minister questioning the merits of a government guaranteed debt facility, holding out for a rating upgrade (and further spread contraction) may take some time.