Key points:

- Pricing has settled at a level which assumes no government debt backing.

- The spread looks good compared to investment grade credits.

- Qantas now offers a strong high yield opportunity for investors.

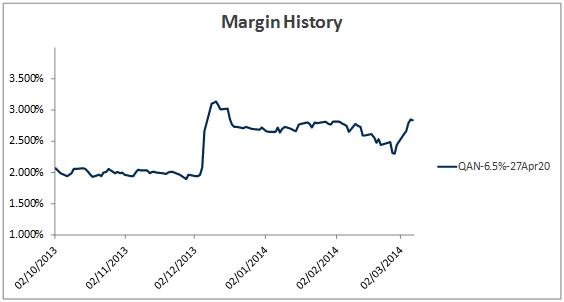

As expected we have again seen Qantas’ spreads (and CDS) drift out this week following my note last week suggesting ‘trading’ clients to take profits. We now see the Qantas bonds spreads back beyond where they traded through December/January (ignoring the overshoot on the announcement date of the downgrade) as can be seen on the margin history graph shown in Figure 1.

Source: FIIG Securities

Figure 1

The spread is now getting to where we expect it to trade sans government support, and reflecting its sub-investment grade rating (and negative outlook on the issuer). As we have noted previously, we remain comfortable with Qantas as a high yielding credit story. The company still has a market cap of $2.5bn, it still has many, many assets to sell if needed (frequent flyers, aircraft, etc) and it is still central to Australia’s tourism industry. While it may be a political football for the next few months, it remains a sound credit. To wit, Qantas should be considered for any high yield portfolio.

The Qantas 2020 bond is offering a significant yield opportunity for buy and hold clients. Please note, I am not suggesting that we are about to see the spread rip in as I suggested a month ago, that opportunity has passed (for the time being at least) without some real government action (which appears some way off) the spread will likely remain around this level, but this level is wide.

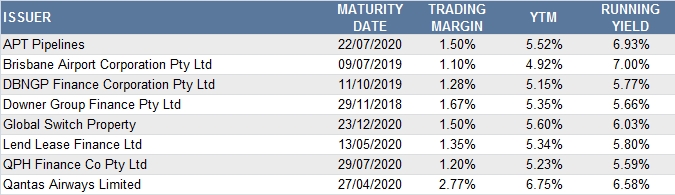

Comparing Qantas to BBB-/BBB credits, the next closest trading margin is Downer (which has always been a bit of an outlier since their poor results two years ago) at 167bps; 110bps narrower than Qantas’ trading position (see Table 1). The average of these credits is 137 basis points (bps) meaning Qantas is 140bps wide of the average. Qantas is paying enough premium to justify stepping below the IG threshold for the added yield. On a relative value basis, compared to investment grade, Qantas is offering value.

Source: FIIG Securities

Table 1

Note: Prices are accurate as at 10 March 2014 but subject to change

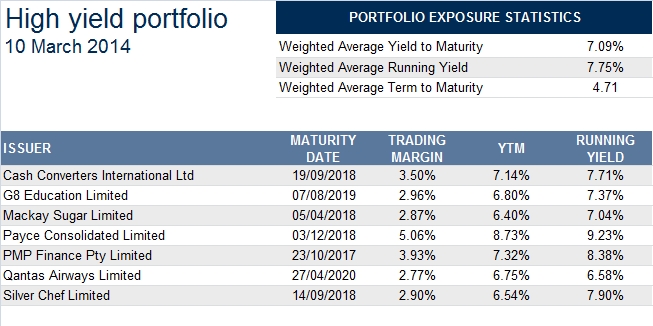

A portfolio of high yield bonds including all FIIG (fixed) originated deals and Qantas as shown below offers investors a yield to maturity (YTM) of over 7% and a running yield of 7.75% (see Table 2). This is a compelling yield story for investors.

Source: FIIG Securities

Table 2

Note: Prices are accurate as at 10 March 2014 but subject to change

For more information please call your local dealer.

Common terms

Yield to maturity - the return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.

Running yield - uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.