by

Alen Golubovic | Sep 02, 2014

Despite a weak FY14 result, with the general media attention focussing on the large headline losses, there were still a number of positives for Qantas’ bondholders to take away from the FY14 results. Of particular note were the better than expected underlying earnings, an increase in group liquidity of $600m to $3.6bn, positive management comments on market conditions, progress on the cost reduction initiatives and confirmation that Qantas Loyalty (Frequent Flyer) will not be sold.

Qantas was also able to generate large positive operating cash flows of $1.1bn in FY14 despite being engaged in a price war with arch rival Virgin Australia. In addition, whilst Virgin has declined to provide any guidance to the market, Qantas has forecast it will return to profitability in 1H15. In a further boost for bond holders, management stated that it was focused on regaining the company’s investment grade credit rating.

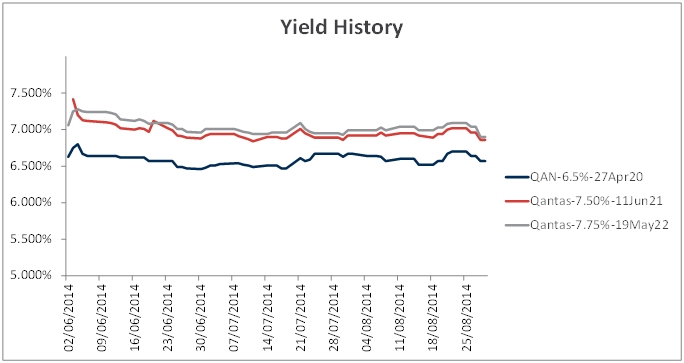

Offering high yields to maturity of between 6.5% to 6.9%, we believe the Qantas bonds represent good value for a premium brand with a stated intention to improve its credit position.

Key points

- The FY14 results have been generally well received by the market. Analysts had expected the airline to report an underlying pre-tax loss of around $750 million, so the underlying result is better than expected, however the market had not expected the airline would take such heavy write-downs on its fleet. In particular, profitability is better than expected in 2H14

- As a result of the weak earnings result, credit metrics such as gearing have increased. However, in the results briefing, Qantas management stated its intention to return to investment grade credit metrics over the medium term. In particular, Qantas is targeting an improvement in its Debt / EBITDA ratio to 4.0x by FY 17. The Debt / EBITDA ratio is a key credit metric reflecting the ratio of debt in the business to earnings

- Following the results announcement, the rating agencies have maintained their negative outlook on Qantas, but have chosen not to downgrade its credit rating. While the outlook remains negative, S&P has in particular noted there are early indications that some key drivers are moving in Qantas' favour: revenue yields are expected to improve through more manageable capacity additions in both domestic and international markets, and the improved unit costs provide evidence of progress with Qantas' transformation program

Summary of FY14 Results

- Group revenue down 3% from $15.9bn to $15.3bn

- $646m underlying loss after tax and $2.8bn statutory loss after tax

- The statutory loss includes a non-cash writedown of international fleet of $2.6bn - bringing the carrying value of the international fleet to be more reflective of the current market value

- Operating cash flow of $1.1bn, leading to a neutral free cash flow result

- EBIT down $806m from $366m in FY13 to an EBIT loss of ($440m) in FY14

- Qantas Domestic reported underlying EBIT of $30m, down from $365m a year earlier, as a result of the damaging capacity war with Virgin Australia Holdings

- Qantas International reported an EBIT loss of $497m, compared with a loss of $246m in the prior year

- The Jetstar Group reported an EBIT loss of $116m, down from a profit of $138m in FY13, but the Australian domestic portion of the business remain profitable

- Qantas Loyalty division reported EBIT of $286m, up from $260m on the prior year. Qantas Loyalty to be retained within the existing group structure

- EBITDA down 46% from $1.8bn to $982m

- Following the partial repeal of the Qantas Sale Act, the group will establish a new holding structure and corporate entity for Qantas International

- On balance sheet debt ratio up from 36% to 54%. Total gearing ratio (which includes obligations under operating leases) up from 46% to 62%

- Group liquidity is up to $3.6bn, comprising $3bn in cash (up $600m from last year) and ~$600m in undrawn facilities

- No major unsecured debt maturity until April 2016

- Qantas expects a return to underlying profits in 1H15, “subject to factors outside of its control”

- Non-core assets identified and valued, including terminals, land and property holdings – Qantas will continue to assess opportunities to sell, with proceeds to repay debt

Despite the headline losses, Qantas’ FY14 results have been received well by the market, with Qantas flagging a return to profitability in 1H15. However, there continues to be a lot of near term uncertainty in terms of competitive factors, fuel costs and the results of the business transformation. The large fleet writedown is not considered to be a major issue for bondholders at it is a non-cash writedown and relates to operational fleet which will continue to be used by Qantas.

Following the FY14 result, bond yields have moderately fallen by between 10-15 basis points, as highlighted in the chart below.

The high yields on the Qantas bonds reflect the near-term uncertainties and credit pressures associated with the business. However, should the company be able to return to profitability in 1H15 as stated, we should see some of the negative rating pressure come off and a continued reduction in yields and corresponding increase in bond prices. With an improved outlook on profitability, high liquidity levels and managements’ stated intention to return the business back to investment grade credit metrics, we continue to believe that the Qantas bonds represent good value even with the moderate fall in yields following the results announcement.

FIIG has good supply in each of the Qantas 2020, ’21 and ’22 maturing bonds. With the downgrade protection offered in terms of step-up margins, we continue to prefer the Qantas ‘21s and ‘22s. Please contact your FIIG representative if you are interested in investing in Qantas’ bonds.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.