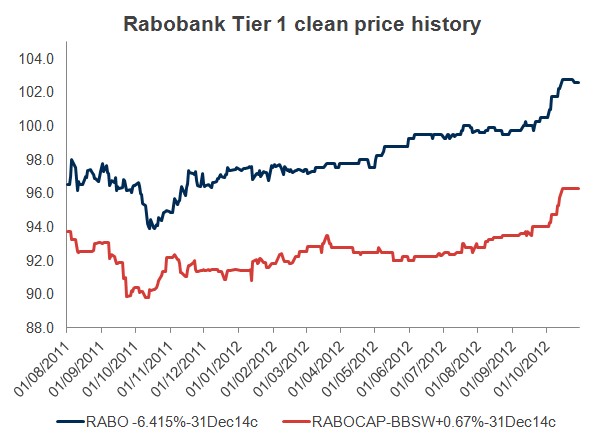

The last 12 months has seen Rabobank Tier 1 hybrids rally strongly with the fixed rate surpassing its par value of $100 (Figure 1). This may present a good opportunity for investors to switch, locking in profit and possibly removing call risk. In other words an investor can sell this security now above par, generating a higher capital gain than would be returned if held to maturity.

However, we have not changed our credit view of these securities and an investor may also choose to hold until maturity and continue to benefit from the high running yield. While we still believe this security will be called in December 2014, subject to regulatory approval and market conditions at that time, this cannot be guaranteed. See this week’s article “Everything you wanted to know about call risk – Part 3” for what might happen to the price in the event these securities are not called.

Source: FIIG Securities

Figure 1

Background

A sharp rally has seen credit spreads contract and bond prices increase for bank debt globally since June 2012. These spreads generally have been contracting since their wide points in late November 2011. Last November the average credit spread over the benchmark for European financial institutions reached 290bps. Improvement in the banks’ fundamentals and progress on several economic fronts then drove average credit spreads to 182bps by March 2012. However, concerns over the weakening European economy and exposures to PIIGS resulted in a reversal of the tightening trend in late May and early June, as European banks spread over the benchmark worsened to 217bps.

As investors began to view bank credit spreads as cheap versus the broad market in June, spreads tightened in both the US and European banking sectors. Investors were also encouraged by second-quarter 2012 results that showed continued asset quality recovery and that banks’ troubled legacy asset portfolios had greatly improved. Average European bank credit spreads over the benchmark have now contracted to 160bps at the end of September. These broader market conditions have benefited most bank debt, including the Rabobank Tier 1 hybrid securities.

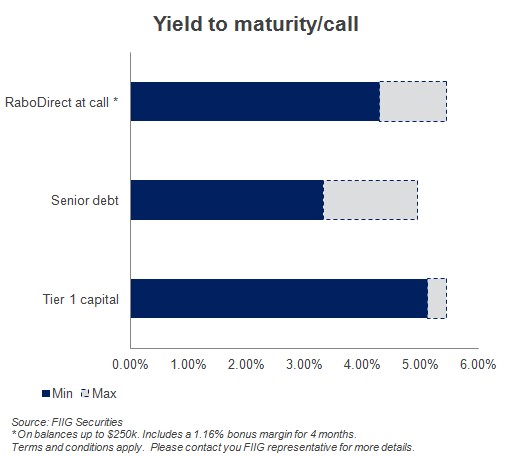

Relative value

Figure 2 illustrates the current yield of Rabobank’s Tier 1 hybrids in comparison to an At-call Rabodirect deposit account we can offer clients, as well as senior debt, albeit issued by different entities within the Rabobank Group. What this demonstrates is given the rally in the price of the Tier 1’s the yield on these securities is now very comparable to other Rabobank offerings. Investors therefore are arguably not being paid adequately for the additional risk taken on – noting that Tier 1s sit at the bottom of the capital structure just above equity (and have call risk), compared to deposits (including the Rabobank At call account which is also covered by the government guarantee up to $250k) at the top, then senior debt just one rank lower.

Figure 2

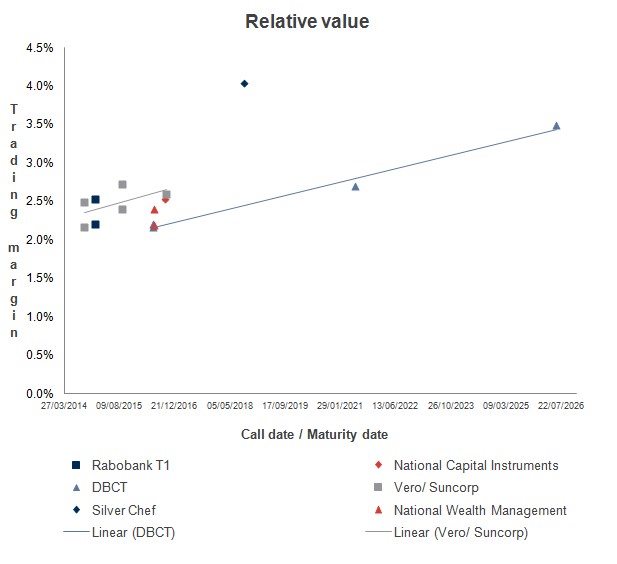

Figure 3 presents the current trading margin for a variety of possible switches. You can see how much Rabobank Tier 1s have rallied (reducing the trading margin) as they now trade at similar levels as Vero (Suncorp) subordinated debt or National Capital Instruments Tier 1 securities/National Wealth Management subordinated debt. They also offer less yield that senior ranking securities such as DBCT Finance (Dalrymple Bay) or Silver Chef.

Source: FIIG Securities

Figure 3

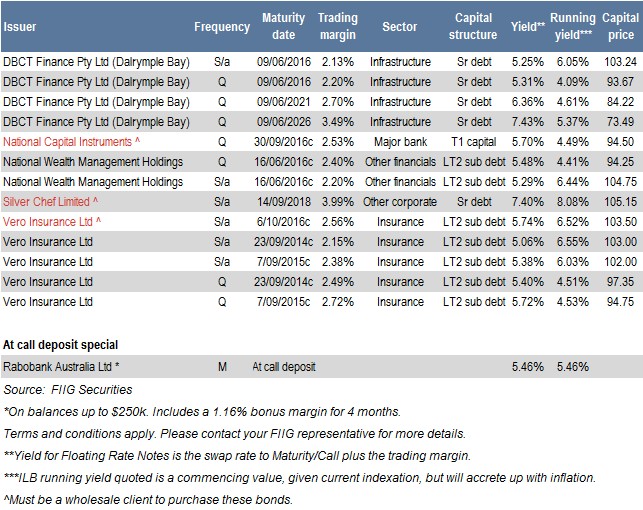

Switch ideas

Below is a list of possible switch ideas (Table 1). There are both fixed and floating options which present a variety of risk profiles. Investors also have the opportunity to reduce risk, by moving up the capital structure and/or exiting Europe and/or removing call risk. We note the inclusion of the Rabobank Australia Ltd At-call deposit account which we can currently offer to clients at 5.46%*.

Table 1

Options for clients:

- If you are comfortable with the situation in Europe and the call risk of Rabobank, do nothing and enjoy the solid running yield and return until maturity

- If however you would like to lock in a capital gain and switch to another solid yielding security you may consider the following:

- If you want to reduce European exposure, maybe consider an Aussie such as NAB’s National Capital Instruments/National Wealth Management, Suncorp owned Vero Insurance or the high yielding senior unsecured Silver Chef fixed rate bond

- If you would like to sit in a very low risk option perhaps consider Rabobank’s Australian subsidiary with an At-call 5.46%* investment (Australian domiciled, highest ranking, term deposit and covered by government guarantee up to $250k).

- Or maybe consider an Aussie infrastructure deal (DBCT) well removed from the impact of Europe, with the security of senior debt, no call risk and cash flows backed by top mining companies through take or pay contracts – and an attractive yield of up to 7.43%

Diversification and risk appetite are key when assessing investment strategies. Where investors are overweight in investment structure, type, or industry there may be various switching opportunities available to improve diversification or targeted risk/ reward profile.

If you’d like to discuss diversification strategies relevant to your portfolio please call your local FIIG dealer. They can use our portfolio construction switching tool and send you a range of options to consider.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.