In our Smart Income series we look not just at FIIG’s fixed income area of expertise but also other asset classes that produce income. Investors typically care less about what ‘asset class’ our industry defines different investments as, and more about how much income they will get and how much risk they have to take. In this article we review the income options for Australian investors.

On 5 May, the RBA cut the official cash rate by 25 basis points to 2.0%. Given the cash rate is now at an all time low, it’s a timely reminder to recap on some of the options available for Australian income-seeking investors. We discuss this below and also highlight other relevant material written over the past few months.

But it is first worth recapping the scenario we face today. The global context is as follows:

- The US economy is the most positive contributor globally, but still isn’t out of the woods.

- The EU and Japan are embarking on the largest monetary policy experiment in history, eclipsing the Quantitative Easing by the US in 2009-2014.

- This has created negative yields for more than A$5 trillion worth of government bonds in Europe and Japan, for example: investors are effectively paying for the privilege of holding low risk government debt.

- Switzerland became the first government in history to issue bonds at negative interest rates.

- These low yields in Europe and Japan have put upward pressure on the USD, which rose rapidly against all currencies in the first 3 months of the year, with most forecasters expecting this to continue for some time.

- The US Fed has responded by pushing out the decision to raise its rates.

- All of that has frustrated the RBA’s desire to see the AUD fall, with the RBA Governor all but stating that they will lower rates if the AUD doesn’t fall to 75c against the USD.

- Further prompting the RBA to cut rates, China, the world’s second largest economy and the most important driver of Australia’s economic future, is almost certainly heading for a major slowdown.

- The Australian domestic economy is struggling to replace the momentum lost from the mining boom. Construction is helping, thanks largely to inbound Chinese investment in the office and apartment sector, but there is a time limit on this phase and that’s approaching. The RBA knows that, has acted, and will continue to act.

While we talk about “lower for longer” with regard to Australian interest rates staying at the current very low levels for longer than the market expects, the scenario for European and Japanese investors is even worse. Goldman Sachs referred to this trend being “the new normal”. Warren Buffett, while not quite as pessimistic, reinforced the view that rates will not return to previous levels any time soon (see more on Buffett’s views here).

This is not just a problem for investors in those countries. As long as Europe and Japan keep interest rates at near zero levels, other countries will not raise interest rates. They will hold rates as low as they can in order to keep their currencies from rapidly rising against the Euro and Yen. The US Fed and Australia’s RBA have specifically pointed to this issue in each of their recent meetings and the RBA has acted in this regard with the recent cut in official rates to 2.0%.

Investors need to adjust their expectations for returns from cash and government bonds. Yields will rise and fall as markets change their short-term views, but unless inflation comes back to life, anyone managing their portfolios to produce income they can live off in retirement needs to consider their options, particularly with respect to cash and government bonds, with other asset classes offering higher yields.

So what are the choices for Australian investors?

Our 2015 Smart Income Report issued at the start of the year outlined options for Australian investors to earn investment income including cash, bonds, equities, infrastructure, property and foreign currency. A few of these strategies most relevant to today’s markets are:

Earn cash plus the inflation rate using a portfolio of infrastructure bonds

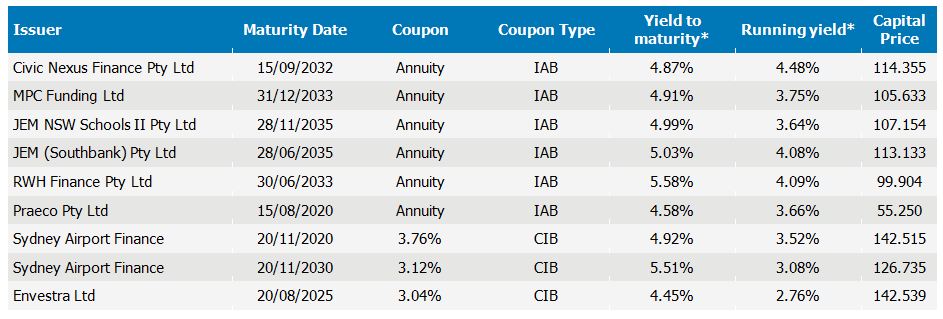

A well constructed portfolio of inflation linked infrastructure bonds can pay investors significantly above the current cash rate in real terms (see example portfolio below). That is, you get the more than cash rate as income plus additional returns hedged to the inflation rate. At the moment, the expected total return (yield to maturity) is around 5% p.a. with income (running yield) of around 3.6% p.a.. These bonds are linked to major infrastructure assets such as Sydney Airport, Melbourne’s Royal Women’s Hospital or the Commonwealth Government Defence Headquarters property (Praeco Pty Ltd).

Portfolio of inflation linked infrastructure bonds

Source: FIIG Securities

*Assumes 2.5% inflation rate

Further reading: Comparing the relative value of indexed annuity bonds

Australian companies, using both equities and bonds

By definition, bonds are less risky than equities in the same company. That is, Qantas bonds are less risky than Qantas shares, simply because Qantas is legally obliged to pay income and repay capital to bondholders, but not to shareholders. The trade off is that you don’t get any of the upside from bonds, whereas the upside is unlimited on shares.

In the past Australian investors have chosen between owning a company’s shares, or waiting in cash. But there is a middle ground: if you like the company, but think the shares are overvalued, own the bonds. Or you like the company, but it doesn’t pay a dividend and you need more income, own the bonds.

As discussed in the 2015 Smart Income Report (pages 26 – 28), this is also applicable to shares versus bonds (and other securities) issued by banks. The recent downward price movements in bank shares in response to speculation that APRA will require higher bank capital levels and then this week’s poor results from Westpac (that raise the proposition of dilutive share issues or dividend reinvestment plans and low or no dividend growth) are important considerations in this regard.

Further reading: Investing for yield: Part 1 - Comparing bonds and equities ; Are equities and bonds in a ‘bubble’? or download the February update of the 2015 Smart Income Report.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.