by

Dr Stephen J Nash | Oct 17, 2012

In October, the RBA chose to do what the market did not entirely expect; it cut rates by 25bps. In the Minutes issued yesterday, the RBA developed the more dovish tone that began in the September minutes. While markets want more easing than the RBA will deliver in the short term, the RBA appears set to ease once more before the end of the calendar year, as it aligns monetary policy to lower forecasts of global growth.

In interpreting the Minutes we need to assess what is said and what is not said. While the minutes followed the typical format, they were largely silent on inflation, with inflation being mentioned only twice in the last paragraph. While that silence is important by itself, to maintain such silence just before the release of the quarterly CPI later this month, seems even more significant. In some ways, this silence may indicate a switch in the balancing of policy targets; away from inflation targeting, and more towards supporting growth.

This note provides a summary and comments on considerations for monetary policy and finally, some brief conclusions. The pertinent details from each section of the Minutes are provided below.

Global assessment

While expansion in growth was apparent in the US, European growth “was continuing to contract”. Of most interest, however was the acknowledgement of a broadening contraction in Chinese growth. Initially, the declines were driven by Euro area growth declines, however more recently the US and Japan had driven declines, as the RBA note below,

Members noted that the gradual slowing of Chinese economic growth had been accompanied by declining exports to Europe for some time and, more recently, falls in exports to the United States and Japan. The slowing of growth in China had resulted in weaker demand for steel, which was evident in the falls in steel and iron ore prices in August and had resulted in lower steel production. The Chinese authorities had announced a number of infrastructure projects, although the additional stimulus that this imparted was likely to be modest in the near term. The housing market appeared to have turned but, with prices picking up in recent months, controls on the property market that sought to improve affordability were likely to remain in place, at least in the near term.

Domestic assessment

Significantly, the RBA emphasised how recent commodity price volatility was impacting the current level of investment in the mining sector, while the discussion of inflation was somewhat limited. In particular, what seemed to be “solid” commitments some time ago, are now much less “solid”, and delays in mining investment became increasingly apparent. As the RBA note below, these developments impacted expectations of the strength of resource investment,

These developments suggested that the forecast profile for mining investment might not be quite as strong as previously expected. Overall, resource investment could peak earlier, and at a lower level, than had previously been forecast. While there remained considerable uncertainty about the outlook, the lower resource investment profile suggested growth in demand and output over the coming year could be below previous forecasts. Members discussed the implications of the revised outlook for the labour market and tax receipts.

Larger than expected declines in mining investment, combined with expected declines in non-mining investment had then forced a general decline in labour market conditions, as flagged last month and by Deputy Governor Lowe, in a recent speech. As the RBA note,

Labour market conditions appeared to have eased in recent months, even though the unemployment rate had remained broadly unchanged at a little above 5 per cent. After picking up in the first half of the year, the ratio of employment to population had fallen back over recent months. Softer demand for labour had been particularly pronounced in the construction industry, with employment there falling from relatively high levels. In addition, mining employment had recorded a modest decline in recent months for the first time since the middle of 2009. Labour productivity across the economy as a whole had increased at an above-average pace over the past year.

Even though the labour market is always an important theme for the RBA, the lack of a detailed discussion on inflation is significant. Usually, the RBA devotes at least a paragraph to the discussion of inflation, and developments therein. While the discussion of inflation is usually important in the minutes, the focus of the RBA now appears to be shifting; from inflation to growth, as it has in the US. We assess the lack of the discussion on inflation as all the more breathtaking, given the proximity of an important inflation release, by the Australian Bureau of Statistics, later in October. In all likelihood, this release will indicate higher headline inflation, given the impact of the carbon price.

Financial markets

A discussion of the significant developments in the Euro area and the US was evident in the Minutes, where the reaction of financial markets was seen as generally positive, as evidenced by share market pricing and declines in peripheral European bond yields. Declines in credit spreads were seen as broadly positive for corporations, who have been able to source funding at better levels, and for longer maturities, than had previously been available. Yet, despite the positive developments, the RBA highlighted the significant uncertainties that permeated financial markets, especially with regard to “unconventional monetary policy”. As the RBA note,

Members discussed the significant uncertainties that remained about the effectiveness of the various unconventional monetary policy actions that had been taken, including in the Euro area. One element was whether Spain would apply for support from the ECB and, if it did, how long it would take for any program to be ratified by various European parliaments. In addition, the troika of official agencies reviewing Greece had not released its appraisal and there were indications that Greece was falling well short of its targets. As markets had re-focused on these issues in recent days, some of the initial positive reaction had reversed.

Considerations for monetary policy

Generally, the RBA indicated the global growth forecast had been lowered somewhat, and that this lower global growth outlook had supported the lowering of commodity prices. In turn, these developments had softened the outlook for the Australian mining sector. This is not to imply that the contribution to growth, from the mining sector, is now ended, as forward contributions will continue. However, the revision in the global growth forecast was generally seen as being supportive of a lower cash rate.

At its previous meeting, the Board had observed that the effects of earlier reductions in the cash rate were still working through the domestic economy, and that the outlook for inflation was consistent with the target over the next one to two years. Members concluded that the current assessment of the inflation outlook provided scope to adjust policy in response to the softer growth outlook. Therefore, at this meeting the Board judged that it was appropriate for the stance of monetary policy to be a little more accommodative, thereby providing some additional support to demand over the period ahead.

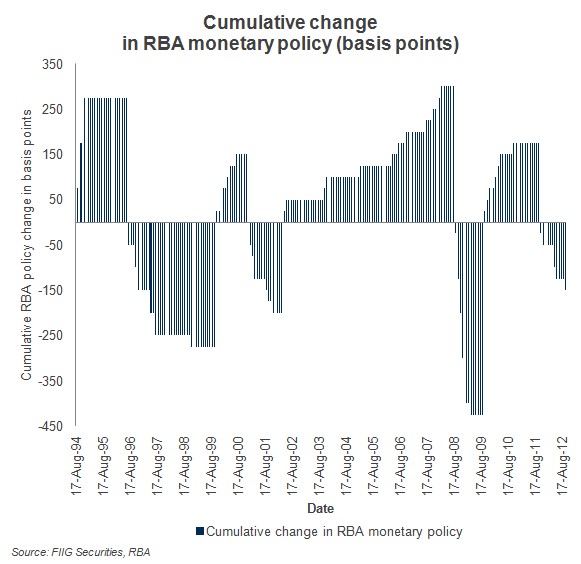

As Figure 1 indicates, the current cumulative amount of easing looks moderate, in relation to the historical record, and a further adjustment to the cash rate should be expected, before the end of the calendar year.

Figure 1

Conclusion

Financial market commentators are quick to overstate changes in RBA rhetoric; they have a habit of “jumping at shadows”. However, when the RBA moves it usually moves more than once, and the decline in global growth, as extensively elaborated by the RBA, combined with the gradual softening in the labour market, has given the RBA further scope to align the cash rate to lower global growth. A focus on inflation now appears to be largely absent from RBA discussion, although inflation remains a consistent background theme for the RBA at all times.

A further rate cut by the end of the calendar year is now expected, to be followed by a period of additional assessment over 2013. After that period, a further round of easing should be delivered after mid 2013, as continued global weakness allows further rate reductions to proceed.