by

Dr Stephen J Nash | Oct 02, 2012

As expected by FIIG, the RBA statement yesterday indicated that the cash rate was to be cut 25 bps to 3.25%, based on a change of heart in the recent RBA minutes, dated 4 September. Also, the market was very interested to gauge RBA reaction to recent declines in the resource sector, as indicated by declining commodity prices. Expectations of an imminent rate cut were realised, and we probably expect one further rate cut by the end of the calendar year, as the business leaders on the RBA board force attention to be paid to the higher Australian dollar, and as the RBA typically moves more than once, when it begins to move. Scope for further easing could also emanate from global developments, especially in Europe, where risks remain significant yet very difficult to predict.

Despite this current easing, the yields on term deposits and longer term debt remain attractive, especially that corporate debt is returning more than double the government rate in most cases.

Statement

The following points are evident from the statement:

- Global growth comments were substantially moderated from the prior statement on 4 September 2012, with the RBA arguing that commodity prices are now “significantly” lower than earlier in the year. Regional growth was noted to have “slowed” with increased uncertainty about the outlook. As the RBA indicates

The outlook for growth in the world economy has softened over recent months, with estimates for global GDP being edged down, and risks to the outlook still seen to be on the downside. Economic activity in Europe is contracting, while growth in the United States remains modest. Growth in China has also slowed, and uncertainty about near-term prospects is greater than it was some months ago. Around Asia generally, growth is being dampened by the more moderate Chinese expansion and the weakness in Europe.

- In general, the assessment of financial market developments was largely unchanged from the prior statement. As the RBA indicated, “Financial markets have responded positively over the past couple of months to signs of progress in addressing Europe's financial problems, but expectations for further progress are high”

- In general, the RBA summarised domestic conditions by noting that growth “has been running close to trend”. However, two new aspects were evident in the statement of today. First, dwelling investment was seen as “subdued”, while non-residential building investment “remained weak”. Second, the assessment of labour market conditions had changed dramatically, from a largely unconcerned assessment last month, to a much more sobering one. As the RBA indicated, “The Bank's assessment, though, is that the labour market has generally softened somewhat in recent months”. This “softening” is seen by the RBA to help to contain labour cost pressures, going forward

- On inflation, the RBA repeated most of what it said last month, yet the softening in the labour market was seen to help contain the inflationary impact of the carbon price. However, the RBA continue to emphasise that even further improvements in productivity are needed, so as to offset the “waning” impact of the higher currency on inflation

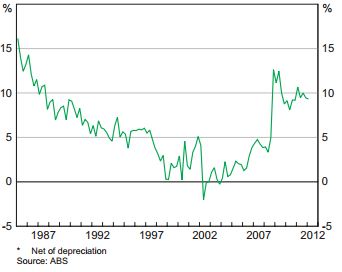

- While the RBA repeated the observation that interest rates are below their medium-term averages, they noted that “credit growth has softened of late”. This softening in credit growth is consistent with the increasingly conservative consumer, who does not want credit, even at historically low rates of interest. Apart from other things, this means the easing of today will not force the consumer to “change his spots”; borrowing will not explode and property prices will improve, yet the improvement will be moderate. This characterisation of the consumer was highlighted in the recent RBA Financial Stability Review, and is evident in the savings rate shown in Figure 1 below

Source: RBA, Financial Stability Review, September 2012, p. 37

Figure 1

- Once again, the RBA noted that the currency remains “higher than might have been expected, given the observed decline in export prices and the weaker global outlook”. While the RBA has expected a fall in the terms of trade, it has been repeatedly acknowledging how it did not expect the stubbornly high level for the Australian dollar. It is this factor that is driving the business leaders on the RBA to force an easing, probably against internal RBA advice.

Other factors

Markets are still pricing in QE3 with elevated, although gradually weakening, equity pricing. A “dazed and confused” US bond market is now reluctantly following what the Fed wants; lower long rates, and more of this can be expected. A target of 1.25% on the US 10 year is feasible, and with a possible spread of 1.25 to the AUD 10 year, there is still plenty of room for the Australian 10 year bond to rally from 3%. Recent declines in commodity prices, and cancellation of mining expansion projects have already partly enabled a rate cut, and one more rate cut is possible this calendar year. Recent improvements in major bank funding should see a full pass-through of the rate cut to the variable housing rate.

Conclusion

As we observed with the recent RBA minutes, financial market commentators are quick to overstate changes in RBA rhetoric; they have a habit of “jumping at shadows”. What drove our assessment towards an easing today, as published in the recent Bloomberg survey, was something quite simple; an unbiased reading of the recent minutes. A November easing now remains a possibility, yet developments in many variables will need careful monitoring before that would occur, as then RBA typically moves more than once when it does move. Specifically, while Europe remains the key risk for RBA expectations of growth, the high currency and the fall in commodity prices are now shifting RBA thinking. Even though rates were not going anywhere in August, given borrowing rates are lower than average and low unemployment, recent developments have transformed the RBA assessments of domestic growth. Even though the RBA sees risks in easing, with comments about possible future inflation, as noted above, the business leaders are forcing attention to be paid to the plight of the Australian manufacturing sector with a high Australian dollar. Accordingly, one senses that the decision of today was not fully embraced by, or supported by, internal RBA advice. Rather, the decision reflects growing despair expressed by business leaders about an economy that faces the tightening impact of a high currency at a time where the government has no adequate policy response. As the Federal election draws nearer, the possibility of an adequate policy response from the Federal government moves farther away, as no-one wants to be risk making a mistake before the all important poll.