by

Dr. Stephen Nash | Mar 15, 2013

As expected, yesterday’s RBA statement left the cash rate unchanged at 3.00%. While the prospect of an imminent rate cut by some market participants was not realised, we would expect cash rates to be reduced over 2013, given the need to support the transition from mining led growth to construction sector led growth. By the end of 2013, we expect the cash rate to be 2.50%.

Business leaders on the RBA board are focussing attention on the high Australian dollar and the continuing negative impact on the export sector. Meanwhile, the consumer refuses to reduce saving and increase debt. In addition, scope for even further easing than currently expected might emanate from global developments, especially in Europe, where risks remain significant yet very difficult to predict.

Despite this failure to ease, rates remain low, and the yields on term deposits and longer term debt remain attractive, especially when corporate debt is returning more than double the government rate in most cases, and further easing is on the way.

Statement

The following points are evident from the statement:

- Global growth: Global growth comments were largely unchanged from the prior statement on 5 February 2012. Also, the RBA acknowledged that commodity prices have now firmed. Regional growth was noted to have been “dampened” by both developments in China and Europe. As the RBA indicates,

Global growth is forecast to be a little below average for a time, but the downside risks appear to have lessened over recent months. The United States is experiencing a moderate expansion and financial strains in Europe are considerably reduced compared with the situation through much of last year. Growth in China has stabilised at a fairly robust pace. Around Asia generally, growth was dampened by the earlier slowing in China and the weakness in Europe, but again there are signs of stabilisation. Commodity prices are little changed recently, at reasonably high levels.

- Financial market developments: In general, the assessment of financial market developments was largely unchanged from the prior statement, where a growing recovery in sentiment became apparent. However, risks remain as, “the task of putting private and public finances on sustainable paths in several major countries is far from complete. Accordingly, as seen most recently in Europe, financial markets remain vulnerable to occasional setbacks.”

- Domestic economic developments. In general, the RBA summarised domestic conditions by noting that growth was close to trend in 2012, yet as the resource investment peak approaches, “there will be more scope for some other areas of demand to strengthen”. Generally, the outlook for non-residential construction was seen as being “relatively subdued”, while dwelling investment appears to be “slowly increasing”. Fiscal stimulation was also forecast to be “constrained”, leading to a very much subdued outlook for the rest of the 2013 calendar year.

- Inflation: As the labour market weakens and the unemployment rate rises, general conditions are “working to contain pressure on labour costs”. Also, the RBA noted that “businesses are focussing on lifting efficiency under conditions of moderate demand”, which support the idea that the RBA sees inflation as being very much contained.

- Final paragraph: Here, the RBA noted that while the prior easing in 2012 was substantial, and that the current “accommodative” stance was appropriate, the current inflation outlook does afford scope to ease further, as the RBA noted,

The Board's view is that with inflation likely to be consistent with the target, and with growth likely to be a little below trend over the coming year, an accommodative stance of monetary policy is appropriate. The inflation outlook, as assessed at present, would afford scope to ease policy further, should that be necessary to support demand. At today's meeting, taking into account the flow of recent information and noting that there had been a substantial easing of policy as a result of previous decisions, the Board judged that it was prudent to leave the cash rate unchanged. The Board will continue to assess the outlook and adjust policy as needed to foster sustainable growth in demand and inflation outcomes consistent with the target over time.

Other factors

Markets are continuing to correct from somewhat exuberant expectations, which were supported by the delay, not solution of, fiscal negotiations in the US. While the market initially thought that the sequester, which began on 1 March, was a temporary problem, the reality is that ongoing fiscal drag in the US will be large and will constrain growth significantly. However, rising mortgage rates and rising fuel prices are moderating US growth, and when combined with continued wrangles in the US over fiscal issues, indicate that growth expectations need to become somewhat more realistic. Popular revolt against austerity in Europe is growing, as the recent Berlusconi vote indicated, and is beginning to concern financial markets which have recently become overly complacent on European problems.

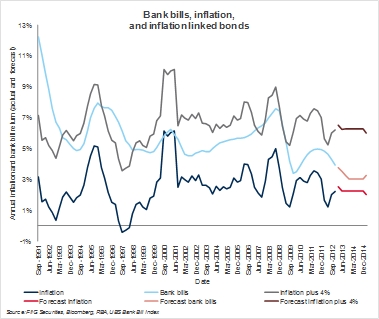

Taking all this into account, the outlook for cash rates is down, and this makes inflation linked bonds (ILBs) at 4% over inflation look increasingly attractive, as we show below in Figure 1.

Figure 1

As Figure 1 suggests, bank bill returns are set to shrink further and this makes the return on ILBs look even better than it is now, as we look out towards the end of 2013.

Conclusion

While financial market commentators are “jumping at shadows”, the fact remains that inflation remains very much contained, and that such containment affords scope for the RBA board to assist in the transition from mining related growth to non-mining related growth. A structurally more conservative consumer is preventing the typical transmission of lower rates to activity at this point, and this is what is making the prospect of further easing tantalisingly close. While many had rightly judged that the improvement in the global economy would allow the RBA some time to assess prior easing, the domestic economy still remains disappointing with the unemployment rate now set to rise, and the construction sector still showing relatively weak growth; certainly not enough to offset the fading impact of the mining boom. Further RBA easing will be needed to encourage borrowing, and thus non-mining growth, from a now timid and very conservative consumer.