by

Alen Golubovic | Dec 09, 2014

The high yield bond market, which represents bonds with sub-investment grade credit ratings, is an increasingly prominent sector for FIIG investors who are seeking high-yielding fixed income investments. The volatility in the high yield bond market has been pronounced in recent months, particularly for bonds in the mining sector.

Some of the US dollar high yield bonds available to FIIG investors are in the commodities/resources sector. Spreads on US dollar high yield bonds in this sector are very sensitive to movements in the price of the commodities underpinning the operations of the companies that issued the bonds. A very recent and notable example of this has been the impact on credit spreads on US dollar bonds in the energy sector as a result of the fall in oil price. Since the fall in the oil price began in June 2014, the US high yield energy bond index, which represents the average credit spread of high yield bonds in the energy sector, has doubled (from about 400 basis points to 800 basis points), which is an almost ‘equity like’ movement in value in response to the commodity price falls.

One way to combat volatility is to think about investing in companies that benefit from falling commodity prices. For example, investing in a combination of airline bonds, such as Qantas and Virgin, and resources bonds. The airlines’ earnings and credit profile improve with the weaker oil price, offsetting the impact on the resources bonds from a falling iron ore and gold price.

Overall when considering an allocation to high yield bonds we recommend that high yield bond exposure is diversified across different sectors, which will go some way to ‘smoothing out’ the unwanted capital price fluctuations, while still providing the high running yield which investors are seeking.

Recent performance in Emeco and Ausdrill

High risk Ausdrill and Emeco bonds have recently suffered price falls. The observed price falls have been large in the context of what might be considered typical for a bond, and have been driven by a variety of factors:

- Falling commodity prices impacting the creditworthiness and investor sentiment in the mining services sector

- Poor earnings results, earnings downgrades and loss of contracts for both of these companies

- More active trading in the US dollar bond market as well as block sale trades from large institutional bondholders

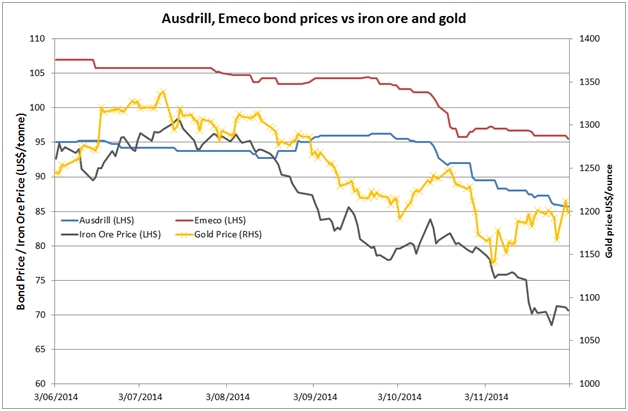

The chart below shows that the declines in the price of these companies’ bonds have been driven to some extent by the falls in the price of the key commodities underpinning these companies’ operations – iron ore and gold.

However, despite the capital price falls in Ausdrill and Emeco, bondholders’ total returns have been buffered by the high coupons and the currency devaluation over this period.

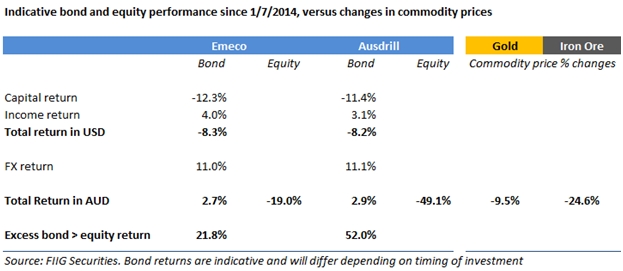

Since the beginning of September, the Australian dollar has weakened by over 10% which has gone a long way to offsetting the impacts of the falls in bond prices. In addition, when allowing for the high running yield on the bonds, many investors would have an overall positive return on the bond investment when expressed in Australian dollars. The table below looks at indicative total bond versus equity performance based on a 1 July investment date. The total bond performance on both of these names has actually been positive after adjusting for currency, and in both cases the bonds have significantly outperformed the equity return over the same period. Notably in the case of Ausdrill, the bonds have returned 2.9% overall in Australian dollars over this period versus a 49.1% drop in the equity price over the same period.

Emeco and Ausdrill are both considered to be at the ‘very high risk’ end of the credit spectrum, suiting investors who are comfortable with high risk in return for the high yield on offer, which has been a consistent message in relation to these credits. The falls in their bond prices have been related to the falls in the value of the underlying commodities in which they operate – iron ore and gold.

We continue to believe that Ausdrill is a stronger credit than Emeco. However, both companies are experiencing the impacts of a downturn in the mining cycle, which have had a negative impact on the earnings and creditworthiness of these names. Conditions in the mining services sector are expected to remain tough for at least the next 12-18 months. In addition to its weak domestic business, Emeco’s Canadian business, in particular, is exposed to the weakening in the oil price.

In relation to these bonds, you need to decide whether you are in for the long haul, or prepare to exit if you believe the probability of default has become too high given the conditions facing the sector. Emeco is currently rated B+/B2 with a stable outlook and Ausdrill is rated BB-/Ba3 with a negative outlook. Based on historical default rates, a B+ rating implies a 16% probability of default over the next five years, while a BB- rating implies a 10.3% probability of default. Note that these default probabilities are based on historical data across a range of sectors, and future outcomes may differ from historical data.

Note that in continuing to hold either Emeco or Ausdrill, you are being paid a high running yield as compensation for the weak credit rating, as well as having exposure to currency fluctuations. If the Australian dollar continues to weaken, this will also improve the future income returns on these bonds. In the event of a default and wind up scenario, it is expected that Emeco would have a higher recovery percentage than Ausdrill. This is because the Emeco bond is senior secured while the Ausdrill bond is senior unsecured. Recovery rates, however, are likely to be impacted by the low point in the mining cycle.

In continuing to maintain exposure to the mining services sector, one additional mitigating factor to note is the possibility of external capital support should either company face severe financial distress. We have seen this in the case of Boart Longyear, another Australian mining services company. Boart Longyear was recently recapitalised through a combination of debt and equity from a private equity firm. While shareholder returns were heavily impacted by the private equity deal, existing bondholders benefited from the additional liquidity injected into the company. This shows that there is the possibility of external support for companies that are facing financial distress in a downturn in the cycle, and Emeco and Ausdrill are both businesses with a relatively long operating history.

If you choose to sell the bonds at this point in time, note that increased illiquidity may mean it takes some time to liquidate your position. During that period of time the actual sale price may fall further and there may be a resultant loss on the bonds.

The risks in the mining services sector are currently skewed to the downside given the recent spate of earnings downgrades and falling commodity prices, and we remain cautious on the outlook for this sector. We will continue to monitor these credits closely, particularly if continued ‘bad news’ such as earnings downgrades, weaker than expected earnings results, further commodity price falls or loss of contracts emerges. In the absence of any earlier updates, the next announcements from both companies will be their half yearly results for 1H15, which are due to be released in February.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.