A number of changes over recent years have caused the Authorised Deposit taking Institution (ADI) market to change their focus. Changes in the application of APS210 restricted the use of High Quality Liquid Assets (HQLA) term deposits which in turn resulted in an upsurge in demand for Negotiable Certificates of Deposit (NCDs). However, the NCD market also had limitations in particular around the rating limits and weighting of lower rated issuers.

In the search for higher returns ADIs have had to adjust, taking a broader view of the HQLA landscape. ADIs which have moved allocations to bonds within their HQLA portfolio have been able to achieve higher returns whilst also increasing diversity within the portfolio.

Whilst most ADIs when taking this approach have focussed on senior bank bonds, there is another alternative. To classify as HQLA, a bond must appear on the RBA’s list of repo eligible securities. This list, which is on the RBA website, also includes a number of highly rated Residential Mortgage Backed Securities (RMBS).

With credit spreads compressing over recent months, and in particular in highly rated Australian senior bank paper, ADIs seeking better returns from their HQLA book would do well to consider the top tranches of Australian RMBS.

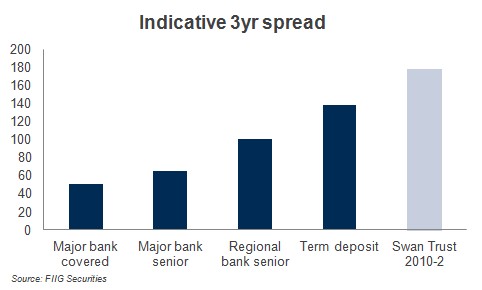

As a result of the movement in credit spreads over recent months, bank bonds yields have decreased considerably. With major bank senior bonds offering indicative spreads of around BBSW +65bps, covered bonds offering BBSW +50bps and regional banks only offering BBSW +100bps, investors may look to consider other alternatives.

Compared to the pricing of senior bank paper, AAA rated RMBS which is included on the RBA’s repo eligible list, and thus is available as a HQLA investment option, is offering BBSW +178bps as seen in Figure 1 below. This is based on a Weighted Average Life for the security of 2.89 years.

Figure 1

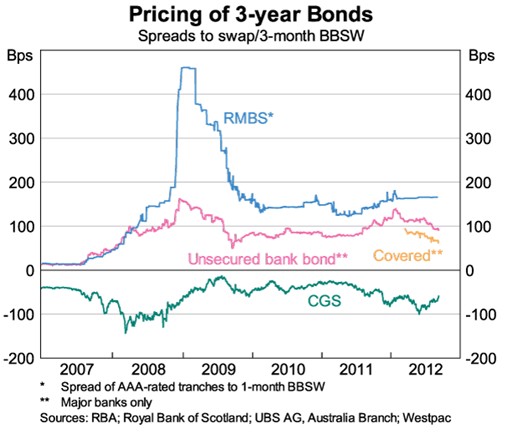

This change in spreads in the HQLA bond market was highlighted in the RBA in its recent address ‘Regulatory Reforms and their Implications for Financial Markets, Funding Costs and Monetary Policy’ by Assistant Governor Guy Debelle on the 18th of September. Focussing on the right of the graph in Figure 2, we can see a contraction in the spreads of both the bank senior and bank covered bond pricing of three year bonds (the pink and yellow lines respectively), however, the pricing for three year RMBS(the blue line) has remained stable.

Figure 2

While it is not guaranteed, we anticipate repo-eligible RMBS spreads to contract, similar to those of the senior and covered bonds, offering even better return opportunities for ADIs who add RMBS to their HQLA book.

Risk weighting

When investing their HQLA book, ADIs need to remain cognisant of the relative risk ratings of investments, however here again, Australian highly rated RMBS wins out. AAA rated RMBS has the same risk weighting as AA- rated senior bank paper offering ADIs a realistic alternative for consideration.

Whilst the introduction of repo-eligible RMBS to an investors’ HQLA portfolio may be a new strategy for some ADIs, we see the return on offer as a compelling reason to consider this alternative.

Australian RMBS

The Australian RMBS market has continued to perform well despite the effects of the GFC, and whilst the Australian real estate market has seen some softness over the last couple of years, we have not suffered a ‘crash’ as was the case in the US and many European markets.

S&P, in their recent paper ‘An Overview of Australia’s Housing Market and Residential Mortgage Backed Securities’, noted that this recent softening in the markets has eased concerns of a major price contraction. Further, the rating agency noted a number of key reasons behind their continued confidence in the performance of the Australian residential mortgage market including:

- Continuing low rates of unemployment

- More strenuous personal bankruptcy laws, in particular compared to the US, which provides a significant incentive to borrowers not to default on mortgages

- Historic low interest rates (with scope for further decreases should the market begin to stall)

- Continued population growth

- High and steady levels of salaried employees at around 80% of Australians (salaried employees have less volatile cash flows driving more consistent repayment)

- Whilst overall indebtedness is quite high across Australia, there remains only a small share of very highly geared borrowers

- Lack of tax deductions on interest for owner-occupiers incentivises borrowers to repay ahead of schedule.

The highly rated tranches of Australian RMBS, which have been well-seasoned (that is they have been issued for a number of years, and thus have historic repayment data), represent a relatively predictable low risk investment for ADIs looking to increase their returns from the HQLA book.

What’s on offer?

The RMBS market is both broad and deep, and as such there are numerous issues available which would provide similar returns and/or meet specific ADI requirements.

One such offer, which we currently have access to, is a 2010 issue from Bank West. Rated AAA, the Swan Trust 2010-2 ‘AB notes’ are offering ~BBSW +178bps currently. With two years seasoning the current Weighted Average Life remaining for this issue is 2.89 years and it enjoys the benefits of structurally subordinated ‘B notes’, providing $10.6m (or 3.3557%) of structural protection for investors in the ‘AB notes’.

Investors interested in adding some high return, AAA-rated RMBS to their investment portfolio should call their FIIG dealer.

All prices and yields are accurate as at 25 September 2012 and are a guide only and subject to market availability. FIIG does not make a market in these securities.