Published 20 February 2015

Half year results to December 2015

Source: FIIG Securities, Company presentation

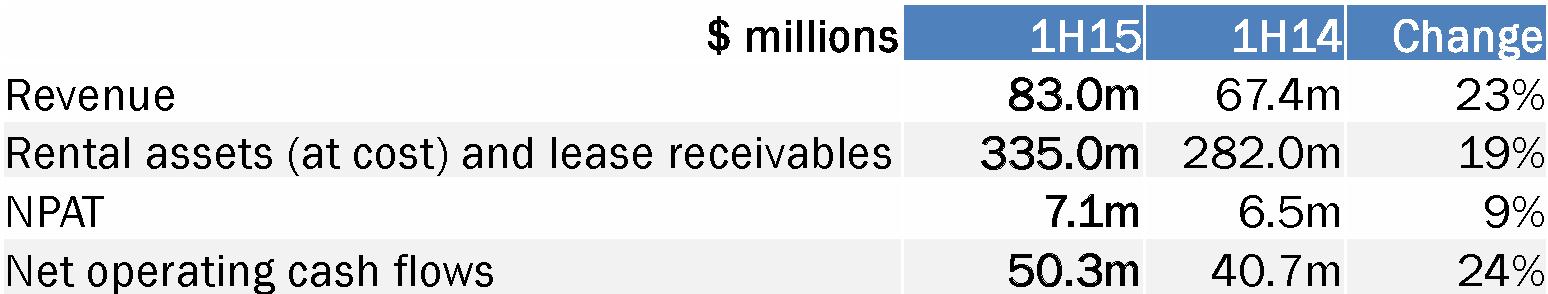

SIV reported strong 1H15 results with revenue increasing 23% to $82.9m, underlying EBITDA increasing 20% to $52.7m and NPAT increasing 9% to $7.1m driven by a faster than expected turnaround in the GoGetta business. Interest cover continues to grow at around 14x (up from around 13x 1H14) and net debt/EBITDA is 2.7x (up from 2.4x 1H14). FY15 guidance has been revised upward to a range of $15.2 to $15.7m (from $13.75 to $14.25m). Overall, good results and importantly for bondholder’s credit metrics continue to strengthen.

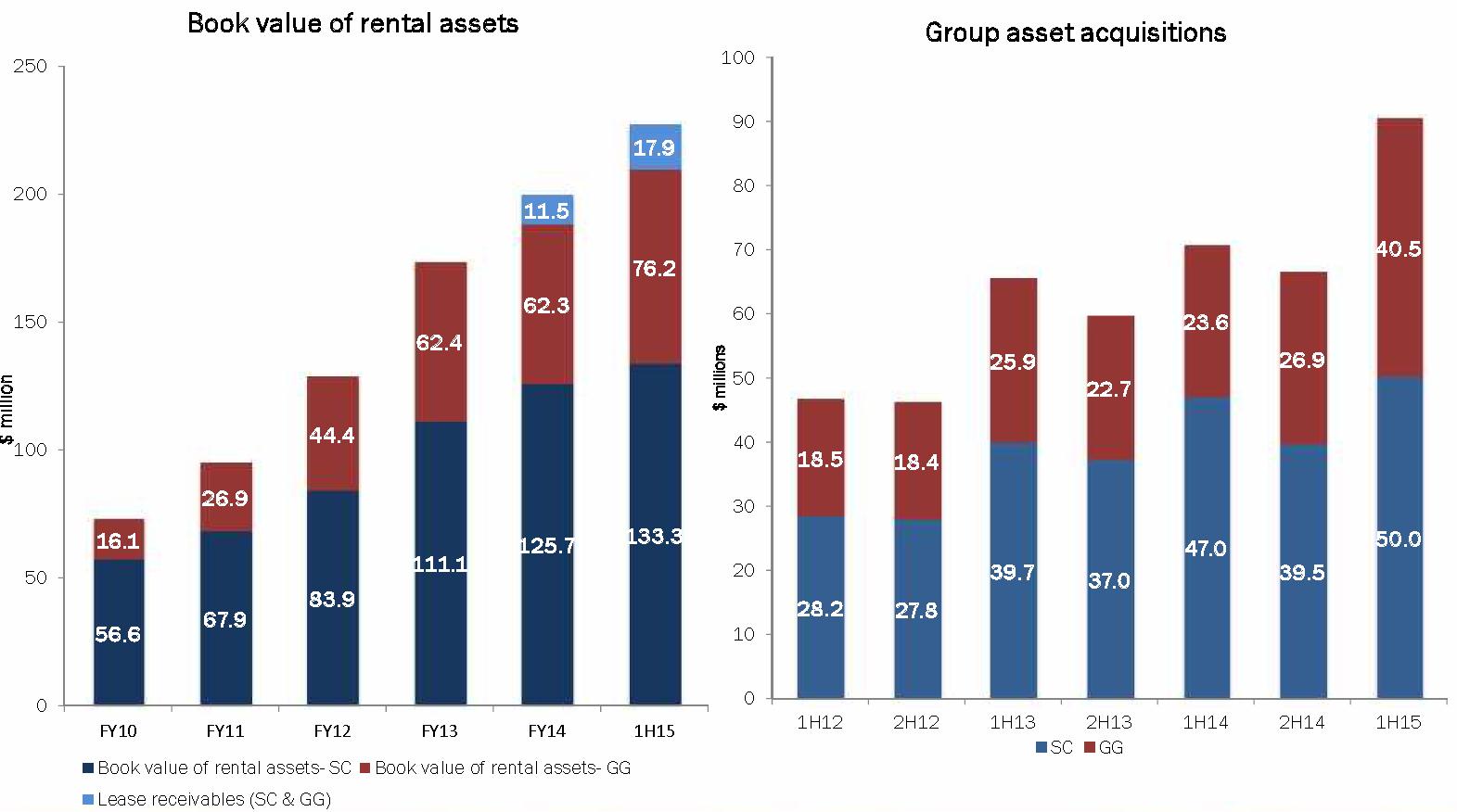

Hospitality: Revenue was up 23% to $83.0m. The hospitality division performed in line with expectations during the first half with acquisitions of $50.0m. The hospitality rental asset base including lease receivables are now $221.1m, up 9.0% from 2H14.

GoGetta: Revenue was up 27% to $27.4m. With prior periods of poor performance, the GoGetta division reviewed its strategy and began focus toward better performing sectors namely business critical assets in the light commercial vehicle and construction areas. This has paid off driving record growth in asset acquisition up 72% up on the previous corresponding period and up 51% on the second half of FY14.

Canada: During the period the Canadian operations passed the cash profit break even position and recorded an accounting loss of $0.4m. The business is now well established and it is expected to record an accounting profit early in calendar year 2016.

Source: FIIG Securities, Company presentation

Source: FIIG Securities, Company presentation

Funding: SIV continues to receive good support from its primary bank with its debt facility increased from $120m to $140 m and renewed to December 2016. It is likely the company will consider calling the FIIG originated bond at first call opportunity in September 2015. The bond is expensive compared to where rates are now and there are restrictions in the terms which the company would prefer to eliminate.

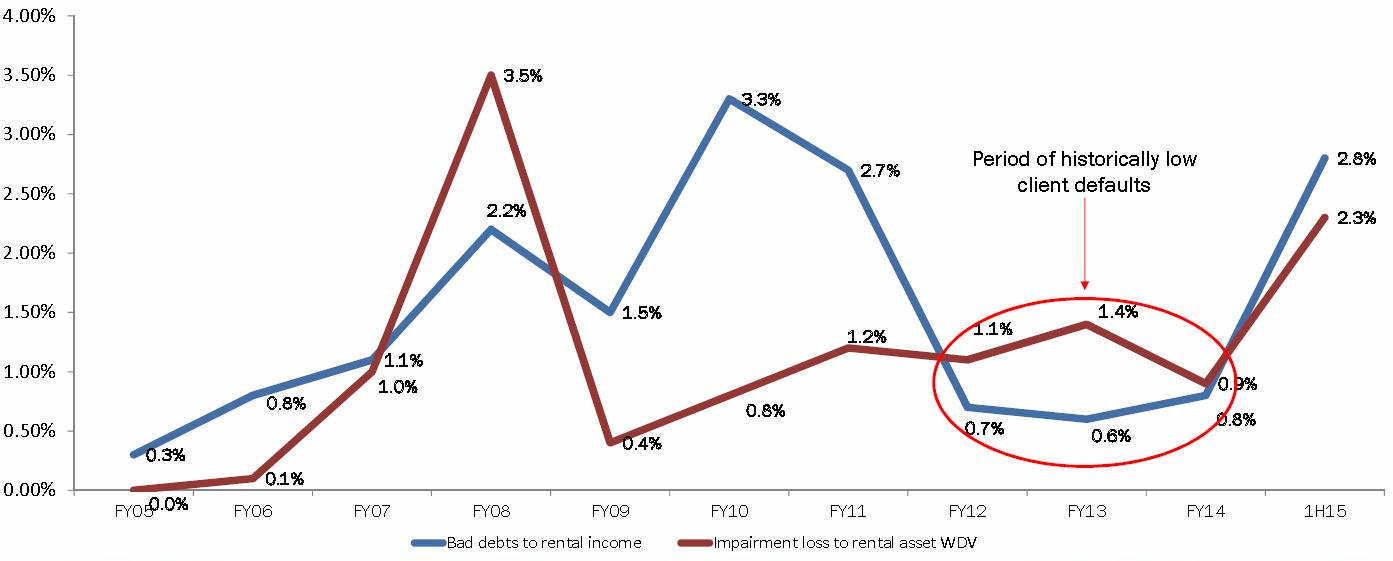

Credit and residual asset risk:

Source: FIIG Securities, Company presentation

The appointment of new senior financial management during the period has led to the discovery of some lapses in the business’ debt collection process. In a number of cases, arrears were allowed to accumulate beyond the equivalent of the client’s 13 week deposit before appropriate action was taken, thereby exposing the business to loss. SIV highlight that the failure in systems and processes has been addressed however a one off impairment expense of $4.1m was recorded this period. Impairment loss to rental assets has therefore risen to 2.3% (from 0.9%), however this is still within longer term averages (2-3%), and these losses should probably have been recorded against the prior periods of historic lows. Regardless these bad debt figures are still considered low for this type of business.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.